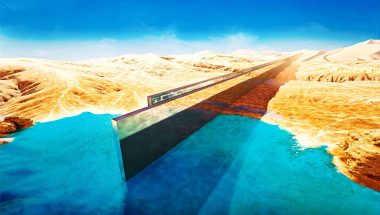

A vibrant, commercialized low Earth orbit (LEO) is coming. Looking back at the building of the transcontinental railway, the industrialization of the automobile, and the commercialization of the internet, the signs of the transformation to come were clear, but in that moment, the path forward was less certain. Today, many of the same early commercialization conditions are present in the commercial LEO economy, and looking towards tomorrow, these conditions could similarly evolve into a paradigm shift for the LEO economy.

The last decade alone has seen the space industry rapidly transform through the launch services evolution that has introduced reusable launch vehicles and the small sat revolution that has fundamentally transformed the commercial role of small satellites and satellite constellations. In December 2021, the 100th successful recovery of a commercial reusable launch vehicle occurred, a milestone that was achieved only six years (to the day) after the first successful recovery. By comparison, it took the Space Shuttle program 19 years to reach 100 successful missions.1 Not only are capabilities evolving, but the rate of technological innovation is clearly accelerating. Such trends necessitate a fresh look at market opportunities and a better understanding of how executives across the private and public sector can respond to enable the future LEO economy.

KEYS TO UNLOCK POTENTIAL, REDUCE BARRIERS

Since 2018, Deloitte has explored the outlook for a vibrant LEO economy. As we look towards the future of LEO, we recognize that the commercial potential of human spaceflight (HSF) and on-orbit servicing have yet to be realized. Unlocking this commercial potential requires concerted efforts to 1) deliver lower cost, higher cadence human-rated access to space; 2) significantly increase down-mass (mass brought back to earth) capacity; 3) establish multiple on-orbit destinations (human-rated, depot-centric, and otherwise); and 4) develop the ability to access LEO and execute missions and activities at the speed of business. For this to become a reality, we must avoid the “field of dreams” model and its pitfall of “if we build it, they will come.” Instead, we need to identify ways to break the cycle through the reduction of barriers, incentivization of sustainable commercialization outcomes, and continued investment in technology and capability development for key market and services gap areas.

Thankfully, breaking this cycle is possible—it has happened already in launch and commercial remote sensing—and is necessary if the National Aeronautics and Space Administration (NASA) and other U.S. Government agencies want to transition to be one of many customers for commercial human spaceflight and LEO destinations in the future. Below, we highlight seven challenges from our analysis that must be addressed:

- Market perception is one of the most pervasive barriers to commercial success in LEO. There are significant “blind spots” among industry-leading companies outside of aerospace about the potential value of on-orbit activities and pathways to achieve them.

- Market sizing remains challenging due to lack of a diverse set of demand forces because suppliers focus first and foremost on fulfilling public sector needs. The number and type of potential buyers have historically been served by niche suppliers, making the true market size difficult to ascertain.

- Capital constraints remain significant, primarily when compounded by the complex landscape of business, financial, and regulatory risks that often cause potential investors to prematurely dismiss LEO investment opportunities as capital intensive, high risk, and low ROI.

- Government procurement behaviors reinforce the status-quo and often limit the pioneering and scaling of new applications and game-changing technologies. Enabling government organizations to “take a knee” and embrace commercially derived, and often privately funded, efforts and innovations requires acquisition authorities and approaches that are more compatible with commercial markets.

- Physical infrastructure constraints impose hard limits on capacity, scalability, and ultimately, economic viability for various markets within the LEO human spaceflight industry. For example, because there is a limited supply of human habitats in LEO and a limited capacity for on-orbit activities like manufacturing and R&D on the ISS, only a select few companies can participate in the LEO human spaceflight market at any given time.

- Operational barriers imposed by current supply-side limitations, such as prohibitive launch operations and maintenance costs linked to “low run” production, are preventing companies from fully participating in the growth of the LEO human spaceflight market.

- Minimal commercial participation by the broader U.S. economy, such as the Fortune 500 members, potentially threatens the long-term viability of the LEO human spaceflight industry because startup companies backed by venture and angel investors do not have the economic buying power to drive the industry forward while simultaneously growing it on a sustained basis.

SUPPLY AND DEMAND

Despite these challenges, the market continues to move toward commercialization, particularly with respect to satellite remote sensing and launch services activity. These trends are demonstrated by several examples of recent announcements that are lowering key barriers on both the supply and demand side to enable increased market activity.

On the supply side, the LEO human spaceflight market has observed a significant increase in competition among service providers in recent years thanks in part to NASA’s Commercial Crew and Cargo Programs. Additionally, other competitors in launch services have established new unmanned capabilities, which is helping to further grow the LEO human spaceflight market. Fueling both manned and unmanned technologies are emerging companies that are developing large-scale additive manufacturing capabilities that will likely have significant implications for the advancement of manned as well as unmanned launch services.

On the demand side, space tourism providers are accelerating their efforts to bring consumer space access to market. For example, Blue Origin and Virgin Galactic have quickly taken space tourism from a niche ideal to an established concept, eliciting interest from consumers and providing an initial assessment of demand. The New York Times reports that as of July 2021, more than 600 people had reserved tickets priced up to $250,000 each to fly to the edge of space on Virgin Galactic, while nearly 7,600 people had registered to bid to fly alongside Jeff Bezos on the first commercial flight of Blue Origin’s New Shephard vehicle.2

With this industry momentum, and collaboration to address the identified challenges, by 2035, we can envision a vibrant LEO economy that includes multiple on-orbit destinations, regular human-rated access to space, the industrialization of on-orbit manufacturing, and robust on-orbit services. Like the railroad, automobile, and internet industries that came before it, infrastructure investment, demand incentivization, and additional intervention is still required to get us from today to a vibrant LEO economy.

The LEO economy has lifted off and is starting to ascend in the right trajectory, but more energy and effort needs to be applied to get into the correct orbit, so we believe the time and the opportunity to act is now.

—

Jeff Matthews is a specialist leader with Deloitte Consulting LLP’s Government and Public Services space practice focused on commercial space markets in the U.S. and globally. Lorien Bandhauer is a consultant with Deloitte Consulting LLP’s Government and Public Services practice. Andrew Stiles is a senior consultant with Deloitte Consulting LLP’s Government and Public Services practice. You can read more about Deloitte’s views on the space industry at Commercial Space Industry Services | Deloitte US.