- | 9:00 am

The Middle East is quietly strengthening its manufacturing capabilities. How and why?

Governments across the region are rolling out strategies to diversify their economies through advanced manufacturing in particular, but several challenges remain to be addressed

The maxim that necessity reveals innovation has found resonance in the GCC. When the pandemic disrupted business operations – and supply chains in particular – companies across the Middle East and Africa stepped forward to source and manufacture essential products.

Last year, the UAE became the first country in the Arab world to manufacture coronavirus vaccines. Hayat Biotech, a joint venture between the Abu Dhabi technology company G42 and Chinese state-owned healthcare corporation Sinopharm, began locally producing the Hayat-Vax vaccine in partnership with the Ras Al Khaimah-based Emirati pharmaceutical manufacturer Julphar.

The agreement covered an initial capacity of two million doses per month. Hayat Biotech has since announced a purpose-built R&D facility at Abu Dhabi’s Kizad industrial zone, with three filling lines and five automated packaging lines.

“Our plant is expected to commence operation by the end of this year with a final capacity of over 200 million vials per annum and promises to be an epicenter for R&D in the region, challenging the barriers of science through human-centric solutions and innovation in health and diagnostics,” says Naser Al Yammahi, Deputy CEO, Hayat Biotech.

“With the country being four hours from two-thirds of the world, we knew the purpose-built scientific hub and vaccine manufacturing plant would create a significant impact across the region because of its strategic location in the Emirates,” he adds.

The company already has deals to support a global distribution network, including with AD Ports Group, which operates free zones and industrial sites in Abu Dhabi.

Hayat Biotech is one of several new and established players hoping to establish manufacturing and industrial leadership as an unprecedented supply chain crisis reshapes the global economic order.

The companies are supported by governments eager to diversify their economies as hydrocarbon revenue streams are threatened by a global push towards clean energy sources. Along the way, the countries hope to create jobs in a region where more than half the population is under 30.

UNLOCKING ECONOMIC DIVIDENDS

Manufacturing is important to countries’ economic development and sustainability. Besides its role in building export strengths, manufacturing has a knock-on effect on other sectors, including driving technological progress and productivity gains.

“Setting a manufacturing base can stimulate different parts of the economy, including creating demand for skills, inputs, manufacturing components, storage, and more. Most importantly, the innovation and technological advances that manufacturing allows can feed into other economic sectors, increasing their overall productivity,” says Paul J. Hopkinson, Head of the School of Social Sciences and Edinburgh Business School Dubai, at Heriot-Watt University Dubai and Academic Director, Heriot Watt Online.

“There is clear evidence that proves the potential of manufacturing to revolutionize the local economy. This is because it stimulates mass production, which increases the value of outputs per input,” he adds.

World Bank data shows that the sector is a major contributor to the global economy, amounting to 17% of global GDP in 2021. In the MENA region, however, manufacturing comprises about 12% of total value added to GDP in 2020 – although the number is slightly higher (14%) when high-income countries are excluded.

CREATING LOCAL VALUE

Now that contribution is growing. This year alone, announcements have come thick and fast, both in new and established sectors.

In January, Saudi Aramco announced 50 preliminary agreements with local and international companies, including Honeywell, Larsen and Toubro, and Sutherland Global Services, as part of its In-Kingdom Total Value Add (IKTVA) drive to increase the volume of goods and services produced in Saudi Arabia.

More recently, it announced Arabian Rig Manufacturing, a joint venture with Houston, Texas-based NOV (formerly National Oilwell Varco) to manufacture drilling equipment locally for the first time, and the launch of new offshore fabrication yards in Ras Al Khair to build and assemble offshore platforms, jackets, and structures for subsea pipelines in collaboration National Petroleum Construction Company (NPCC) and McDermott International.

Likewise, ADNOC is leading the charge in the UAE. In November, the oil company announced agreements worth over $9.5 billion with 25 companies, including Schneider Electric, Emerson, and Siemens, to manufacture critical industrial products such as compressors, specialist valves, industrial pumps, and flame and gas detectors.

TAPPING ADVANCED TECHNOLOGIES

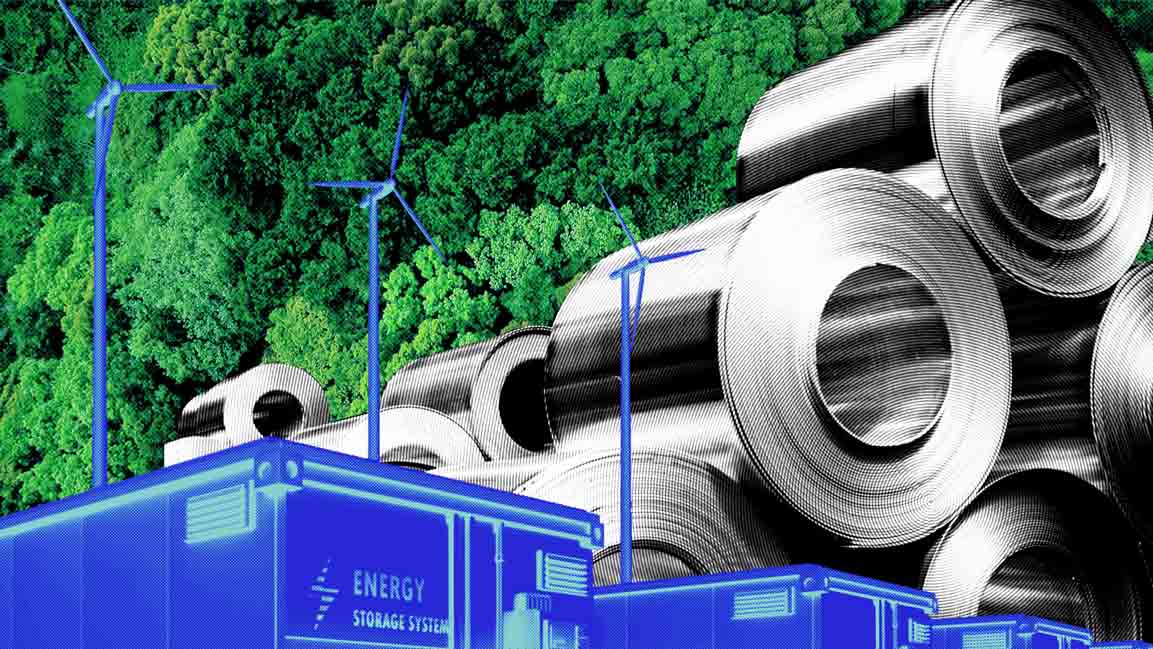

But while manufacturing components for the energy sector are a logical growth area for the region’s hydrocarbon economies, momentum has also spread to other sectors – particularly in areas requiring advanced and emerging technologies.

Saudi Arabia, for example, appears to be looking to establish dominance in the electric vehicles (EV) business. Last week, the kingdom announced Ceer, a homegrown EV, to be built in partnership with Taiwanese iPhone manufacturer Foxconn. Public Investment Fund, Saudi Arabia’s sovereign wealth fund, hopes Ceer will attract $150 million in foreign direct investment and create up to 30,000 direct and indirect jobs.

PIF also owns more than 60% of US-based EV maker Lucid Motors, which has announced plans to build its first overseas factory in the Kingdom, eventually assembling up to 150,000 vehicles a year.

Saudi Arabia’s manufacturing sector is now among the fastest growing in the world, growing at 7.5% annually.

Elsewhere, Qatar saw 60 new factories open in 2021, with the manufacturing industry contributing over $15 billion to GDP in 2021. The country’s National Manufacturing Strategy focuses on establishing advanced manufacturing value chains that use innovative technologies such as robotics, artificial intelligence, augmented reality, 3D printing, and the Internet of Things to boost manufacturing and production.

Bahrain and Oman also want to create industrial sectors that rely on technology and innovation. Bahrain aims to become a regional hub for Industry 4.0 – described as the fourth wave of the industrial revolution. The Bahrain Economic Development Board and labor fund Tamkeen have been working to implement pilot projects that generate near-term benefits and demonstrate investment opportunities.

In Oman, besides new plants for resources such as calcined coke and blue ammonia company 44.01, the country’s Ministry of Commerce, Industry & Investment Promotion recently showed how a resurgence in micromanufacturing is catering to local demand for specialized products such as frankincense-infused chocolate and organic cosmetics at the grassroots level.

Meanwhile, the UAE has announced several new initiatives to transform its economic base. In tandem with complementary initiatives such as Make in the Emirates and the transformative Abu Dhabi Industrial Strategy, last year’s Operation 300bn aims to position the UAE as a global industrial hub by 2031, increasing the sector’s contribution to the country’s GDP from the current $36billion to over $81 billion.

“The transition to a paradigm where smart manufacturing is the norm will yield significant benefits which include increased productivity, supply chain resilience, new business models and opportunities, high skilled jobs and ultimately will contribute to our net-zero strategy,” said Sarah Al Amiri, UAE Minister of State for Public Education and Advanced Technology said at the Smart Manufacturing Strategic Conference.

Initiatives such as Operation 300bn also support existing manufacturers to build an innovation-driven culture while securing local supply chains and expanding the sector’s contribution to GDP, agrees Emmanuel De Smedt, managing director, Al Muqarram Industry, a UAE-based manufacturer of construction chemicals.

“A key benefit of this strategic move by the UAE is that it would encourage more and more industrialists to make their purchases locally, further boosting the country’s economy. In addition, this move would help the UAE stand as a distributor to foreign markets,” says De Smedt. “As an expanding organization, we plan on strengthening our locally made products to domestic and international markets aiming to increase our contribution towards the country’s revenue. Moreover, we also have plans to increase storage capabilities and warehousing by 2025.”

Regional food producer Iffco said it will commission its first 100% plant-based meat factory by early 2023 in response to the shift towards sustainable and healthy food sources.

GETTING A HEADSTART

Focusing on the Fourth Industrial Revolution sectors allows regional economies to build competencies in areas where leadership has not been firmly established.

“Local economies can benefit from the job creation and comparative advantage that comes from being an earlier mover in the 4IR. In terms of medium-term and long-term growth trajectories, not pursuing 4IR-tech integrations will ultimately render systems redundant due to inefficiencies and lack of customer satisfaction,” says Nancy W Gleason, Director of the Hilary Ballon Center for Teaching and Learning, and Associate Professor of Practice in Political Science at NYU Abu Dhabi.

“Job creation and economic development can come from early joiners, especially when this 4IR-related tech is related to environmental sustainability, where there is also great job-related momentum. But this benefit has to be unlocked with upskilling and training in new work areas,” she adds.

Nearly every GCC country has launched initiatives to enable and increase local talent in the job market and contribute to the wider economy, but more needs to be done.

The region’s economies do not yet have the necessary innovative capacity to absorb a highly skilled workforce into the growing future sectors, PwC said recently.

“While there may be an adequate supply of highly skilled individuals willing to work, skills gaps still arise, specifically when the skills of the available workforce do not match those needed for the roles that need to be filled. To attract, develop and retain appropriate skills and competencies vital to the growth of the manufacturing sector, key stakeholders need to work collaboratively to implement recommended initiatives,” said Randa Bahsoun, New World New Skills Leader at PwC Middle East.

Nevertheless, established players remain upbeat. Ahmed Ali Husain Nalwala, CEO and Managing Director, Anchor Allied, welcomes the new-found focus on manufacturing – despite the challenges.

The company is an established player in the sealants and coatings sector and is currently setting up two new manufacturing plants in the UAE’s northern emirates to cater to opportunities in Latin America and CIS countries.

He says that attracting talent will remain a significant challenge despite the demographic bulge, while pointing to the need for better infrastructure and government incentives for the sector across the region.

“GCC governments are diversifying their economies from oil and tourism into manufacturing as it is less cyclical and offers more long-term stability and resilience. The manufacturing sector will play a key role in sustainable employment, add value to the region’s petrochemical-based economies, and create new opportunities for their inhabitants,” he says.