- | 12:00 pm

ADQ invests $125 million in woman-backed Aliph Capital

The $250 million target private equity fund aims to invest in high-quality mid-sized companies in the UAE and across the GCC

Abu Dhabi-based holding company ADQ has invested $125 million in Aliph Capital, the first woman-founded private equity fund in the Middle East, for its maiden fund.

Based in Abu Dhabi Global Market (ADGM), Aliph Capital is founded by Huda Al-Lawati, a leading private equity professional.

According to a statement, Aliph Capital seeks to invest in high-caliber mid-sized businesses in the UAE and throughout the Gulf. This comes as the fund works to expedite its growth and expansion goals.

“Building a strategic partnership with an Abu Dhabi-based private equity fund dedicated to serving SMEs further supports our aim to accelerate sustainable economic development and growth within the UAE and the region. We will work in partnership to capture growth opportunities, which complement our core portfolio and enable us to generate attractive risk-adjusted returns,” said Murtaza Hussain, chief investment officer of Alternative Investments and M&A at ADQ.

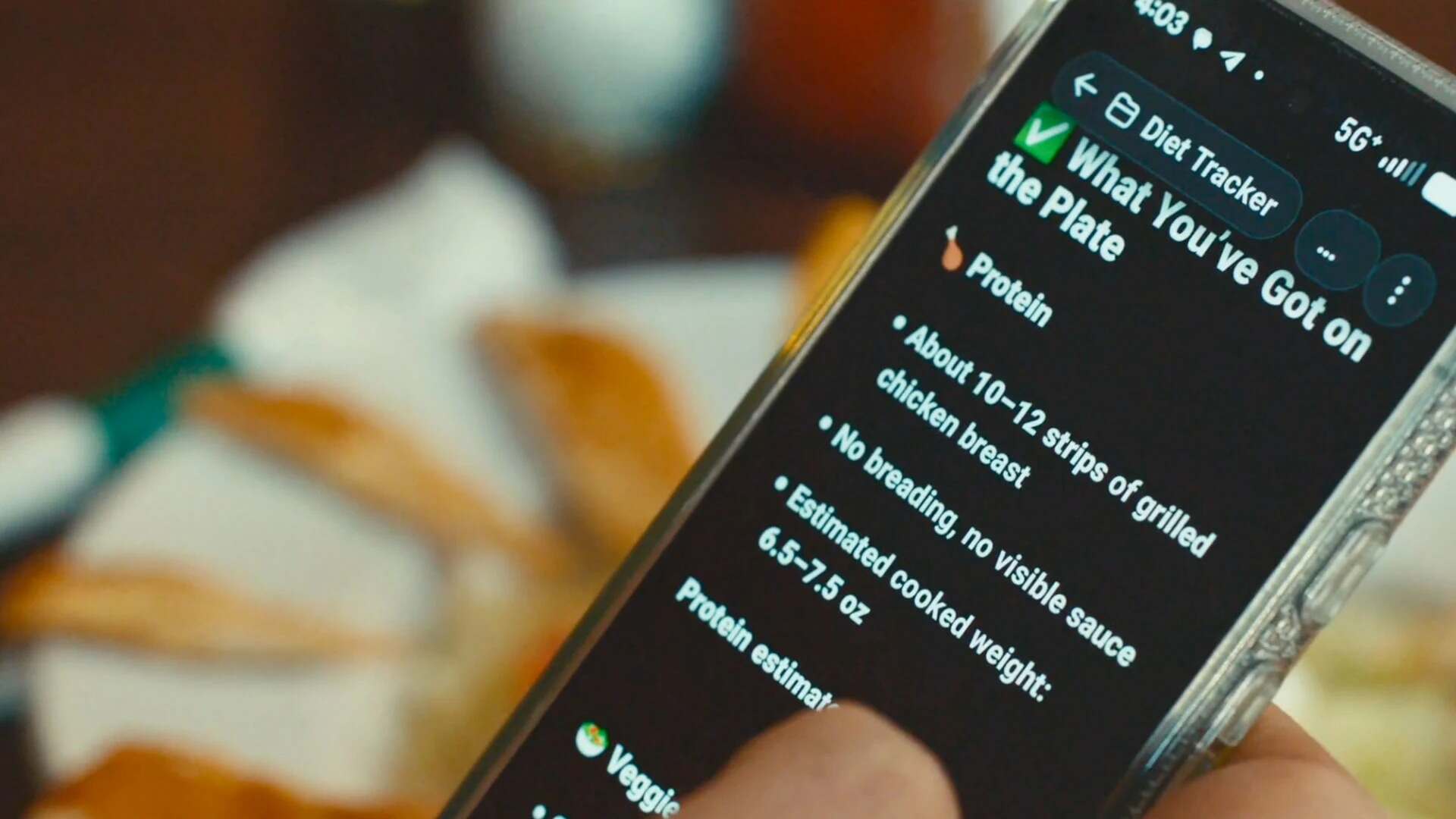

Aliph Capital plans to buy sizeable, active interests in privately held, mid-market businesses with sound financial foundations within the GCC nations. To secure the long-term viability of its portfolio firms and the ability to create lucrative returns, Aliph works with founders to embrace technological platforms and solutions that will increase revenues, optimize operations, and reduce costs.

“I am delighted and honored that ADQ has chosen Aliph Capital for this significant investment. The timing is perfect for GCC-based private equity to invest in the region’s midmarket growth stars. When fully equipped with digital and tech enablement levers, these will generate significant returns and power the ongoing diversification and transformation of the GCC economy,” said Al-Lawati.