- | 8:00 am

These people got the biggest payouts when Elon Musk bought Twitter

Several insiders received big windfalls. Here’s what they are doing with the money.

Elon Musk made a lot of people very rich when he pulled the trigger on his takeover of Twitter last week.

Institutional investors, which held more than two-thirds of Twitter’s stock, saw the biggest windfalls. Vanguard Group was the company’s largest shareholder, with a 10.3% stake, giving that investment advisor a payout of roughly $4.5 billion. BlackRock pocketed roughly $2.8 billion for its 52 million-plus shares. Morgan Stanley saw a $3.6 billion payday. And State Street walked away with just under $2 billion.

And a lot of insiders and retail investors also got payouts.

Insiders held a little more than 20% of the company, while retail investors held the other 10%. Not everyone made money. As early as last April, Twitter shares were trading well over what Musk paid. But there were plenty of opportunities to buy low—and insiders had their own discounts available to them.

Here’s a look at how some of Twitter’s biggest non-institutional stockholders fared and, where information was available, what they plan to do with the cash.

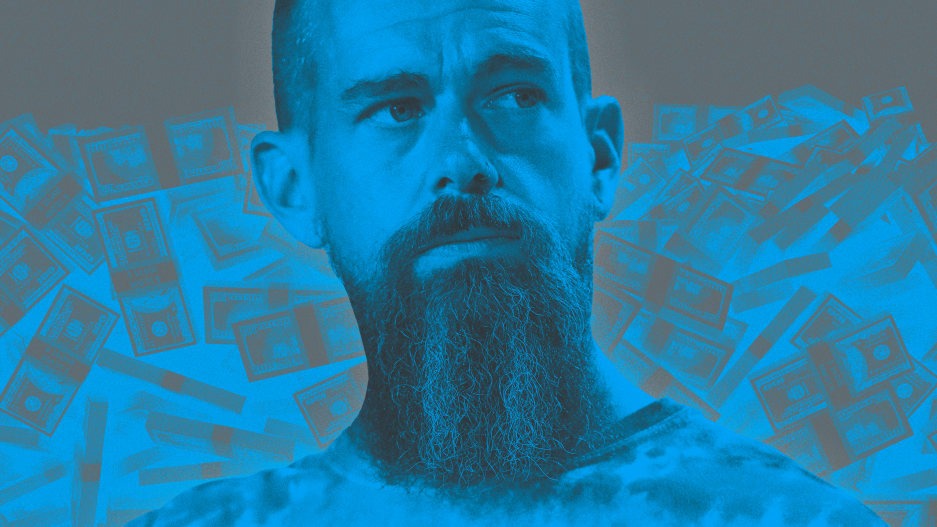

JACK DORSEY

The Twitter cofounder’s shares were worth roughly $1 billion after Musk closed the deal. But instead of hanging onto that or sinking it into Block (formerly Square), Dorsey opted to put the entire stake right back into Twitter, rolling the shares into the newly private company and instantly becoming one of its largest shareholders. Dorsey and Musk have long been fans of each other, with Dorsey very publicly backing Musk’s plans to buy the platform, so the move isn’t entirely surprising, even though he is working on his own social media startup, called Bluesky.

OMID KORDESTANI

The former executive chairman of Twitter (and board member until the merger) held 934,247 shares, according to the company’s most recent Schedule 14A, making him the third-largest individual shareholder. That netted him $50.6 million. He has not indicated what he plans to do with the income.

PARAG AGRAWAL

Twitter’s former CEO could be in line for a $38.7 million severance package. Musk, however, has said he does not intend to pay it, that Agrawal was fired “for cause,” setting up what’s likely to be a legal battle. Agrawal owned 128,753 shares, though, giving him a nearly $7 million pool to fund that fight.

VIJAYA GADDE

Twitter’s former general counsel, who was in charge of efforts to ensure Musk went through with the deal (and who was criticized by Musk for her decision to block the New York Post over a story it wrote about Hunter Biden), was escorted out of the building after the deal was completed. She walked out with $32.8 million for her more than 605,000 shares. Like Agrawal, some of that might go to a fight for severance.

NED SEGAL

Twitter’s chief financial officer held just shy of 394,000 shares, which were worth $21.3 million when the deal closed.

SARAH PERSONETTE

Personette, Twitter’s chief customer officer, didn’t get fired, but she quit the company the day after the deal was done and one day after tweeting she’d had a “great discussion” with Musk. One of Twitter’s highest-ranking women, Personette had accrued 143,213 shares over four years, which cashed out for $7.7 million.

DAVID ROSENBLATT

The former Twitter board member and current CEO of online marketplace 1stDibs.com held 109,827 shares, which netted him nearly $6 million after Musk’s takeover.