- | 9:00 am

Can Egyptian entrepreneurs shape the country’s new economy?

Government initiatives and VC firms are fueling entrepreneurship in the Middle East, but can it compete globally?

In the Middle East and North Africa (MENA), several regional governments have recognized entrepreneurship’s potential as an economic growth driver and have launched numerous initiatives to support startups. At the same time, the region has witnessed a surge in the number of incubators and accelerators providing financial support, mentorship, and funding.

While the UAE and Saudi Arabia have emerged as the most prominent entrepreneurial players in the MENA region, many other countries, including Egypt, are progressing in fostering a supportive environment for entrepreneurship.

According to the Global Entrepreneurship Monitor (GEM) Egypt National Report 2020/2021, the rate of early-stage entrepreneurship activity in Egypt increased from 7.8% in 2019 to 9.6% in 2020, indicating a growing interest in entrepreneurship among Egyptians.

THE FIVE WAVES OF ENTREPRENEURSHIP

“The growth has been fueled by social media penetration, development of mobile technologies, availability of funds, development of tech talents, and a rising culture of entrepreneurship that spreads virally,” says Hussein Mohieldin, CEO at Robusta, a tech consultancy in Egypt.

He believes Egypt has been through five waves of ecosystem development in the past decade. The first wave began in 2012 and 2013, with the emergence of mobile apps that provided convenience to consumers, such as Bey2ollak, an Egyptian crowdsourced traffic and navigation app that provided real-time traffic updates to users, and Circle Tie, a social networking app that leveraged location-based tech and included gaming features across multiple platforms.

However, the early ecosystem still lacked VCs and SMB funding was primarily sourced from family and friends and corporate sponsors and awards.

But, the second wave came with the rise of early VCs into the market and movements such as Rise Up that attracted founders with experience from corporate and consulting backgrounds to start their businesses. Sadly, they still suffered from weak funding, lack of regulatory environment and awareness, and most failed. Some joined other regional startups such as Careem and others relocated to US and Europe to join big-tech companies.

Mohieldin pointed out that the third wave was boosted by the international presence of businesses like Uber, prompting aspiring entrepreneurs to experiment and understand market dynamics.

The fourth wave, which resulted from the third wave’s ripple effect, gave birth to companies such as MaxAB, Brimore, Capiter, SWVL, Thndr, Breadfast, and others. While some companies have been perceived as great successes, others have failed, raising doubts about the ecosystem, founders, and investor’s acumen.

“We’re now living the fifth wave, which is special. On the one hand, the market is mature, understanding success and failure stories. But, it also comes during a global economic crisis and a local economic strain.”

He says his two standout features of the fifth wave are the entrepreneurs’ swift move from their businesses to join the VC seat. This move comes with a better understanding of the dynamics and support from more prominent startups, to grow and eventually exit, along with the regional fluidity of founders, talents, funds, and the growing bridges between the ecosystems in Egypt, Saudi, Jordan and UAE.

FUNDING IS FUEL TO STARTUPS

In recent years, the number of startups in Egypt has increased, and the quality of startups has significantly evolved.

“We are witnessing larger investments, and more global VCs invest in Egyptian startups, which is a testimonial to the potential of the ecosystem,” says Mai Medhat, Co-founder & CEO at Eventtus, an online platform for events planning, networking, and ticketing.

She adds, “A promising factor is that early entrepreneurs, who exited or left their companies, are now starting new companies, joining forces with other founders or investing and advising companies. This is very healthy for a growing ecosystem.”

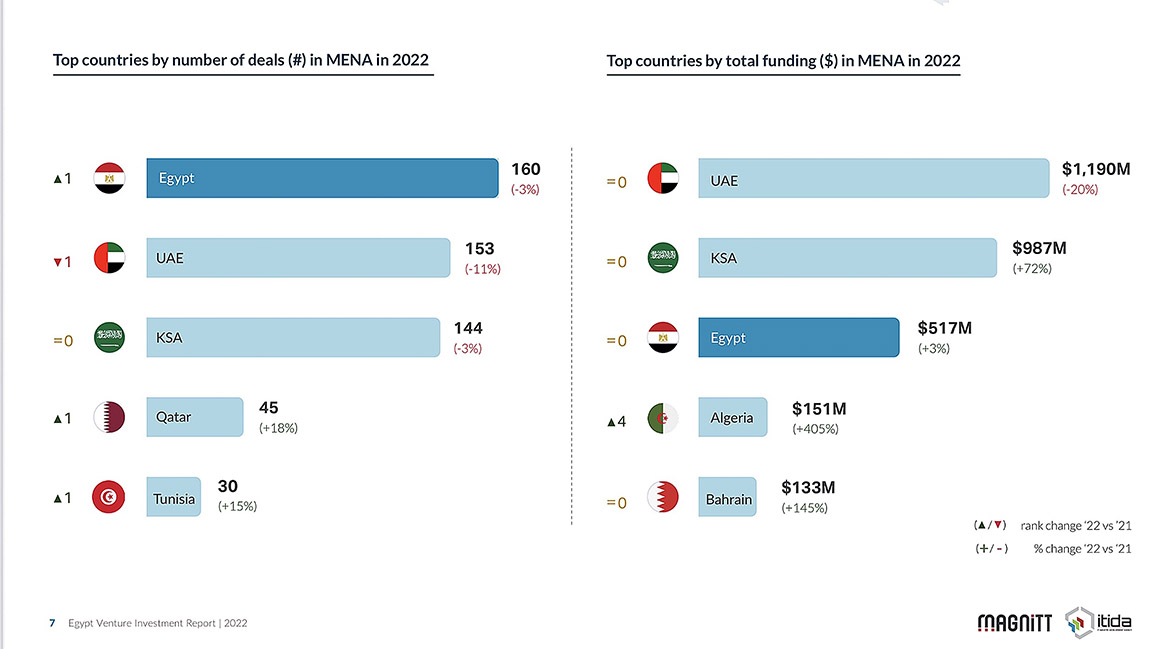

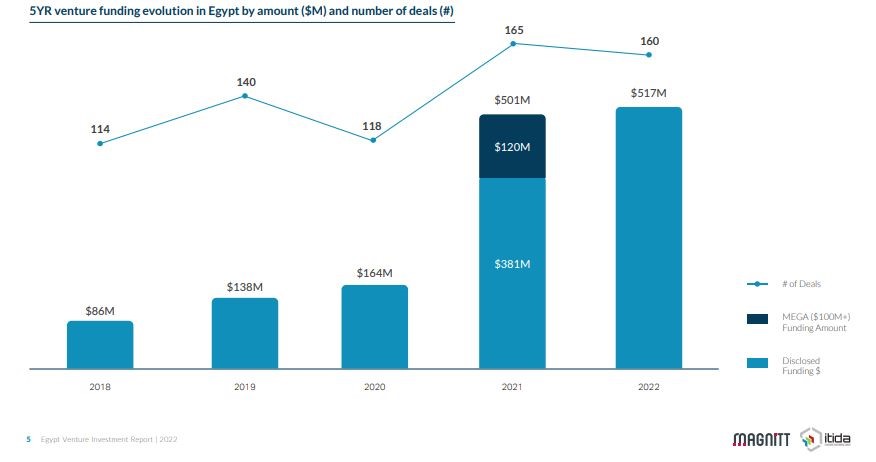

Startups in Egypt recorded $517 million in funding in 2022, up 3% from the previous year, according to Magnitt’s Emerging Ventures Market report. Egypt was the third most funded country in the MENA region, after Saudi Arabia and the UAE, which raised $987 million and $1.19 billion in 2022.

Yasmine El-Mehairy, Founder of SuperMama, a parenting platform, emphasizes, “In terms of support, there are several government-led and privately-led initiatives to support different business models and plans and help entrepreneurs and prepare them for seed-stage investments. However, beyond seed-stage funding, it’s mostly the entrepreneur’s network or their investors that open doors for securing Series A, B, or beyond.”

Medhat added that funding is crucial for startups, and Egypt is witnessing significant funding opportunities. However, it’s still not enough. “There’s still a gap in ticket sizes, specifically, Series A and B funding. Most startups tend to attract regional and global VCs, which is now easier, given their track record and recent success stories of Egyptian startups.”

Image Credit: MAGNiTT

Even so, Mohieldin stresses that not all entrepreneurs look for resources to help them secure funding. Rather, they require funds managed by general partners (GPs) who align with the dynamic nature of tech startups and have been a part of successful exits. They understand what makes and breaks startups, when to grow market share at all costs, and when to slightly press the breaks to avert a crash.

BOOSTING THE ECONOMY

The report added that the Egyptian ecosystem was an attractive investment destination in 2022, as the number of investors that funded local startups increased from 123 in the previous year to 160 in 2022.

Image Credit: MAGNiTT

Startups make a significant contribution to the country’s economy, creating jobs. Medhat believes startups promote innovation and creativity, which is critical for long-term economic development in Egypt.

Mehairy says, “Successful entrepreneurs are role models, job and learning opportunities providers. They generate wealth for their communities and solve problems that governments and large corporations are not equipped to handle.”

Encouraging youth entrepreneurship and the development of small businesses have to be central to any new growth strategy, eventually aiding economic growth.

Mohieldin says, “Egypt has to capitalize on its people, geography and history, and entrepreneurs are capable of visualizing the future.”.

TOWARDS A SUSTAINABLE ECONOMY

Medhat says many entrepreneurs are “taking steps to ensure that their businesses are environmentally friendly and socially responsible”, including reducing waste, using sustainable materials, and supporting local communities by hiring locals or using local products and vendors.

Entrepreneurship in Egypt is embedded in the social part of the UN Sustainable Development Goals, believes Mehairy. “Most entrepreneurs try to embed social responsibility in their work. It’s our duty as good citizens, before being entrepreneurs.”

However, “Egypt is still in its early stages of embracing sustainability in entrepreneurship. There will be a surge of environmentally-conscious Gen Z trailblazers who will lead the way in creating more sustainability-focused startups in the future.”