- | 9:00 am

Is Industry 4.0 transforming the Middle East region’s manufacturing sector?

How the industry is using big data, IoT sensors, and other digital tools to future-proof their processes and operations.

To help understand where digitalization is going, I’ll steal a line from All the President’s Men: Follow the money.

And this is not bad. While profit motives don’t explain everything, they are a useful lens to see where digitalization is headed and why.

It’s about improving efficiency, level of productivity, and innovation.

IDC figures reveal that digital transformation investments in the Middle East, Turkey, and Africa are set to more than double across the 2021-2026 period – accelerating at a CAGR of 16% over the five years and topping $74 billion in 2026.

Manufacturing is on its way to becoming one of the more high-tech industries in the region and the key to diversifying oil-dependent economies. And the backbone of this is digital capabilities.

It’s one reason companies can wade into a gazillion manufacturing businesses — from vaccines to electric vehicles to plant-based meat.

And over the last several years, manufacturing companies in the region have adopted cloud-based technologies in addition to robotics, artificial intelligence, and big data.

Big tech companies like Siemens, Bosch, Cisco, Ericsson, Honeywell, SAP, Schneider Electric, Siemens, Microsoft, and Unilever are partnering with governments across the region to digitally transform and automate key business functions such as human capital management, customer relationship management, finance, procurement, warehouse, and supply chain management.

“The major industrial players have industry 4.0 or smart manufacturing strategies at their core. The objective is to utilize digital technologies to leapfrog legacy or traditional processes while localizing industry,” says Nadim Haddad, a partner in the energy practice at Oliver Wyman.

DIVERSIFY INDUSTRIAL ECONOMY

For example, Saudi Arabia is looking to quintuple the industrial sector’s contribution to its GDP. A large part of this requires state-of-the-art technologies and digital solutions to complement the development of human capabilities.

Recently, it launched the Saudi Advanced Manufacturing Hub strategy in partnership with the World Economic Forum; it has identified more than 800 investment opportunities totaling $273 billion to diversify the industrial economy, and by 2035, it aims to increase the number of factories to 36,000. Nearly 4000 factories in the KSA will be heavily reliant on automated equipment and technologies.

In the neighboring UAE, through the Make it in the Emirates campaign, the country is attracting some of the world’s leading technology and industrial companies to work within its manufacturing ecosystem.

The Ministry of Industry and Advanced Technology (MoIAT) prioritizes smart manufacturing as part of the national industrial strategy.

Two years ago, MoIAT launched an Industry 4.0 program to help accelerate digital transformation in local manufacturing, increase productivity, and develop innovative products. All this aims to increase manufacturing productivity by 30% and add $6.8 billion to the economy by 2031.

Analysts say digitalization is about creating more resilient businesses— companies that can adapt to change, innovate easily, and more.

In recent years, various countries in the region have implemented economic policies to increase industrial productivity, including constructing special economic zones, incentives for foreign investment, and support for SMEs.

GREATER EFFICIENCY, PRODUCTIVITY

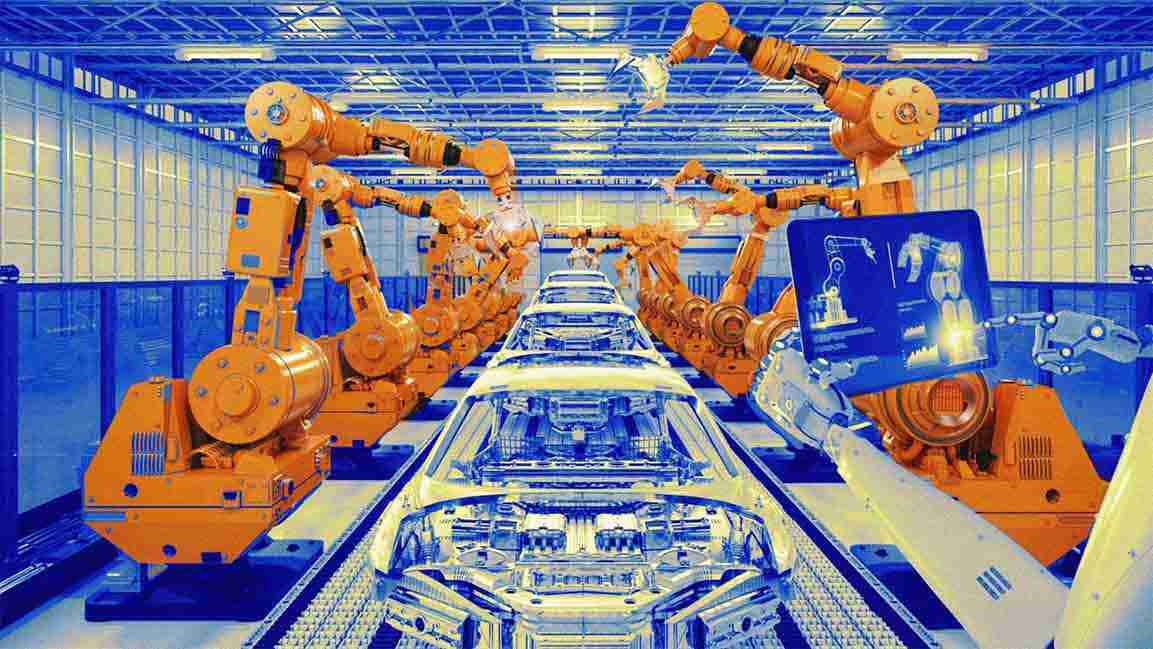

“Digital technologies such as automation, AI, and the IoT are streamlining production processes, reducing waste, and enhancing quality control,” says Mohamed Mousa, Vice President of Go-To-Market Kyndryl MEA.

According to a Deloitte report, there is an increase in demand for customization and personalization of technology for manufacturing processes, in parallel to a growing market need to meet sustainability goals, reduce costs, enhance quality and accelerate delivery times.

“Manufacturers are embracing digital solutions to simplify processes and collect valuable, actionable data and insights to improve efficiency and level of productivity in response to these rising customer expectations,” says Yarob Sakhnini, Vice President, Emerging Markets, EMEA, Juniper Networks.

Additionally, digitalization improves supply chain management and logistics, allowing companies to coordinate their operations better and adapt to changing market conditions. “Overall, digitization is driving innovation and competitiveness in the manufacturing industry throughout the region,” adds Mousa.

According to analysts, manufacturing companies are leveraging both physical and virtual assets. “The use cases typically revolve around commercial and market optimization – typically this is AI and machine-learning based; asset integrity and security – a mix of physical assets and IoT tech, or production optimization – digital twins, predictive maintenance, additive manufacturing, robotics,” says Haddad.

Additionally, 3D printing is helping manufacturers to improve their prototyping process and create more accurate and customized products.

“All these technologies are helping manufacturers to increase their productivity and efficiency, allowing them to stay competitive in today’s fast-paced business environment,” says Mousa.

Meanwhile, larger organizations are doubling down on AI and machine learning applications to drive optimization or production correlation while leveraging field data or big data.

“We have also started seeing the emergence of operational twins, and in certain instances, the use of VR to drive specific maintenance or simulations,” says Haddad.

This is what’s helpful to their bottom lines. Also, let’s not forget profit motives affect what technologies companies pursue vigorously or not.

DIGITAL MATURITY

Yet, according to analysts, on a digital maturity scale of 1 to 10, the sector is about a 6, which means it still has a lot of work to do before it realizes its full tech potential.

“There are many factors that determine the digital maturity score of the Middle East manufacturing industry, and there are various factors to consider, such as industry type, company size, and technology adoption,” says Mousa.

“I would expect the sector to score higher than five in digital maturity in the Middle East,” says Sakhnini, while adding that the region’s manufacturing ecosystem needs to step up its digital transformation efforts to stay competitive and be prompt in an environment where world-class quality products are more accessible than ever before.

While all this is good, there is a lack of proof of concept for Industry 4.0 production plants in the region. Some production facilities remain largely traditional for years, with owners resisting re-engineering processes or investing in more efficient tools to minimize costs.

“Many companies in the region are still using traditional methods in their manufacturing operations, which may hinder their competitiveness in the global market,” says Mousa.

Furthermore, although the UAE and Saudi Arabia have global recognition for being a leader in a number of commercial sectors, including freight and logistics, and real estate, its manufacturing sector attracts far less international attention.

For example, the World Investment Report 2022 ranks the UAE as the most attractive FDI destination in the Arab world, but investment in manufacturing remains limited.

PRIORITIZING TECHNOLOGY FOR LOCALIZATION

“But there are initiatives by governments and industry players that are helping accelerate the pace of digital transformation adoption, which shows potential for future growth and development,” says Mousa.

Countries are prioritizing technology for localization, competing to gain first-mover advantage. TONOMUS, the first subsidiary of Saudi Arabia’s NEOM city project, is building advanced digital infrastructure, such as metaverse and cognitive technologies. Similarly, Abu Dhabi’s Mubadala Investment Company focuses on localizing high-tech products.

Last year, Abu Dhabi’s Department of Economic Development (ADDED) launched a new index to help private sector industrial companies adopt smart manufacturing technologies to accelerate growth and boost competitiveness. The marker guides the private sector players’ transition to Industry 4.0 technologies and applications.

“It is paramount to equip manufacturers with vital, seamless, and effective mechanisms to transition to Industry 4.0 technologies and applications to drive future growth and pre-empt shifts in demand and supply,” said Mohamed Al Shorafa, chairman of ADDED.

Last June, the Abu Dhabi government pledged to invest $2.72 billion across six industrial programs to more than double the size of the emirate’s manufacturing sector to $46 billion by 2031.

Analysts say the infrastructure to develop appropriate digital use cases has progressed over the last few years. Both data collection and architecture are at a point that enables the implementation of digital use cases.

“In the next few years, we expect the penetration of digital assets in the manufacturing sector to grow exponentially,” says Haddad.

Some big players who launched digital transformations a couple of years ago are moving toward implementation.

FUTURE OF MANUFACTURING

“The manufacturing industry is expected to grow steadily in the coming years, driven by factors such as rising population, urbanization, infrastructure development, and increasing government initiatives to encourage industrial growth,” says Mousa.

A Strategy& report found that localizing the production of high-technology products could bring in an additional $125 billion in revenue for Middle Eastern countries. “By 2025, just three products – semiconductors, sensors, and general-purpose robots – could generate an estimated $25 billion in revenue. Moreover, because of their strategic locations, many countries are well-suited to serve as cutting-edge manufacturing hubs,” says Sakhnini.

The future of manufacturing has never been brighter. As more companies digitalize, more innovations—ones we can’t yet imagine—will be developed. That will only make the regional economy stronger.

“Their success will set the tone for the rest of the industry. It will be interesting to see how the next 12-18 months unfold and whether we will successfully get over the key inflection point towards digitization in that time,” says Haddad.