- | 10:00 am

Get woke and go broke? New data suggests otherwise

New data from Myriant and USC Annenberg School of Communication and Journalism demonstrates that despite media headlines, consumers, employees, and (especially) investors value corporate leadership on environmental and social challenges.

In recent years, an attack on Environmental, Social, and Governance standards (ESG)—a framework for investors to measure corporate risk and growth opportunities—has been playing out in the media, with recent examples including analysts reactively linking ESG to business failure and leaders proactively pulling back on such efforts.

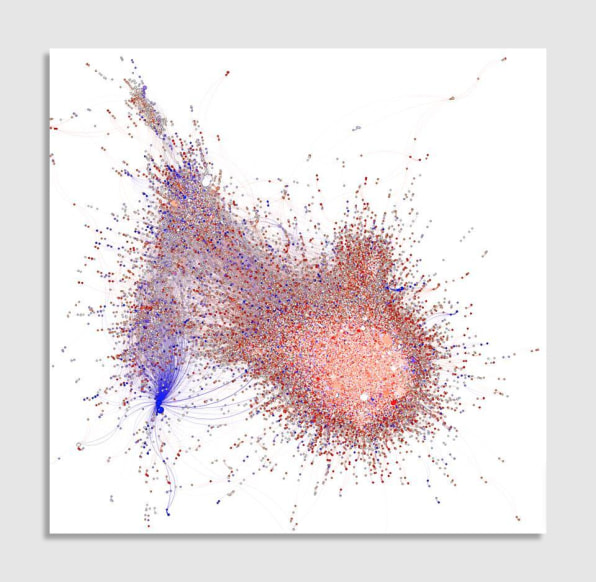

Leveraging AI-backed network analysis to better understand ESG conversations, Myriant identified several overwhelmingly negative media narratives, from linking ESG to a reduced ability to compete with China to identifying it as a tactic used by global elites to avoid regulation and maintain status quo to the most popular “Get woke, go broke” sentiment.

The social-network data in particular shows clearly what many can sense: ESG has become a political punching bag, with users across the spectrum (left, right, and center) engaging in battles of rhetoric about the meaning of the term and its impact on business and society.

The data also shows there is more than three times the engagement with the newest anti-ESG narratives that skew right wing (about 34%) versus left wing (about 10%). The right-wing engagement is also shown to be significantly more coordinated, demonstrating how the recent narratives questioning ESG are representative of one point of view versus a balanced dialogue.

Given the risk of negative media attention, it’s no surprise that business leaders might think twice about championing ESG. Perhaps this is a reason why a global public opinion poll of C-suite leaders completed in September by Myriant’s fellow advisory, KRC Research, found that while three in four (74%) are very focused on attracting and retaining talent, three in five (57%) on managing adoption of new technologies, and one in two (50%) on supply chain issues, less than one in four (23%) anticipated that ESG would be a major focus for their business in 2023. One in three (33%) anticipated giving it little if any focus.

RECENT DATA SHOWS NOT FOCUSING ON ESG WOULD BE A MISTAKE

As media reflects an increasingly polarized context, it’s more important than ever that leaders understand what their key stakeholders care about and to ensure these stakeholder opinions are adequately factored into business decisions. In fact, Myriant would argue that stakeholder input should be a primary consideration when building future business strategy.

To better understand the spectrum of key stakeholders, Myriant partnered with the USC Annenberg School on a survey that included questions on perceptions of ESG and influence on key decisions: for employees, satisfaction and retention; for consumers, brand loyalty and purchasing; for investors, overall confidence and investment. And the results show that, counter to the media commentary, the majority believe in the connection between business and society.

Across groups, nearly 100% believe corporate reputation to be somewhat, if not very, central to how they make decisions related to whether they stay with their organization, buy a product or service, or invest in a company. The top driver of reputation for all stakeholders looking at the next five years is also consistent: business performance.

STAKEHOLDERS SEE ADDRESSING SOCIAL ISSUES (AND ESG) AS A KEY BUSINESS DRIVER

The majority of employees, consumers, and investors believe that companies have a responsibility to play a role in addressing social issues. And surprisingly, it is investors who feel most strongly: 9 in 10 agree as compared to 7 in 10 consumers and employees.

However, the data also showed that, despite the recent uptick in media coverage, ESG is not a universally well-known term. While 100% of investors were at least somewhat familiar, less than half of employees and consumers could say the same. In fact, 44% of employees and 35% of consumers report having never heard of ESG; one out of five of these two stakeholder groups have heard the term but don’t know what it means.

But that doesn’t mean these stakeholders aren’t invested in ESG as a concept. When given a definition, the majority of stakeholders (more than 9 in 10 investors and 7 in 10 employees and consumers) agree that awareness of ESG performance is beneficial when making key decisions about a company. The implication is that the term ESG is essentially jargon that complicates the intended meaning.

Jargon or not, negative, politicized ESG narratives in the news and on social, especially, are reaching business leaders; yet, such narratives do not appear to be influencing or breaking through to other stakeholder groups.

WHAT THIS MEANS FOR LEADERS

It’s clear that there are disconnects between leaders and their stakeholders. Counter to what we found when asking them directly, the September poll shows that many C-suite leaders do not think their key stakeholders— employees, consumers, investors, and policymakers—expect the company to lead on issues related to ESG standards. What leaders think their stakeholders want is not what they appear to actually want.

Most starkly, 37% of C-suite leaders think investors expect their company to lead on at least one ESG-related topic (addressing social inequities and/or climate change; publicly engaging on geopolitical issues and/or domestic political and social issues), whereas direct polling showed that 91% of investors consider ESG rating when purchasing a position in the company. And while they are more likely to believe that employees and customers expect them to lead on these topics (64% and 50%, respectively), there is still a gap with actual impact in the context of retention and making purchasing decisions (74% and 62%, respectively).

And even if C-suite leaders were completely on the same page as their stakeholders, less than one in six feels very comfortable speaking to any one of these ESG-related topics.