- | 1:00 pm

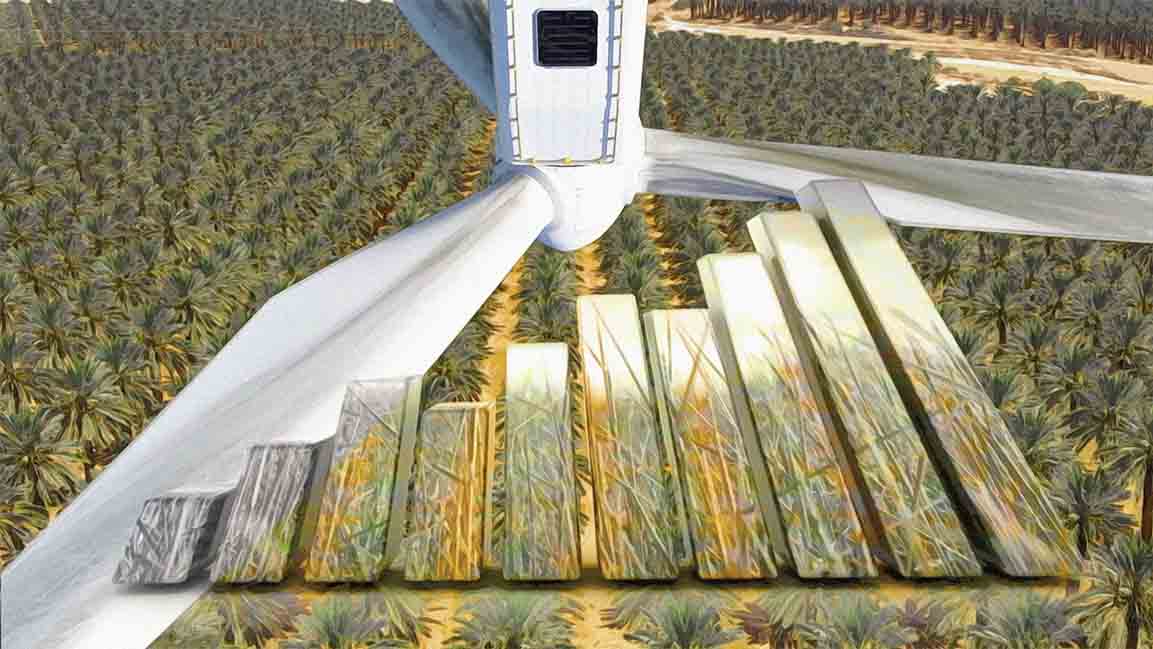

ADGM implements regulatory framework for sustainable finance

The new framework will help speed up the UAE’s net zero goals by 2050.

Abu Dhabi Global Market (ADGM) has introduced a sustainable finance regulatory framework for investment funds, portfolio and bond management, and environmental, social, and governance (ESG) principles.

The framework will aid in the enhanced growth of a sustainable finance ecosystem and support the UAE’s mission to net zero greenhouse gas emissions by 2050.

ADGM will also recognize products and services working towards the transition to net zero by placing a designation mark, which will be used in marketing and client communications, influencing investors to direct capital into a green transition.

Dr. Sultan Al Jaber, President Designate of COP28 UAE, welcoming ADGM’s regulatory framework for sustainable finance, said the lack of available, accessible, affordable finance is putting the world’s climate goals and sustainable development at risk, and addressing this issue is one of the top priorities of the COP28 Presidency and stressed on the vital role that mobilizing capital to net zero has on enabling increased green transactions from local and global financial institutions.

“Finance is the key to turning good intentions into real results. The Paris Climate Agreement set our collective ambition, and we need initiatives such as ADGM’s Sustainable Finance Regulatory Framework to help us keep 1.5C within reach.”

Other initiatives, such as the School of Sustainable Finance and the Research Center at the ADGM Academy, back the framework and its stakeholders.