- | 8:00 am

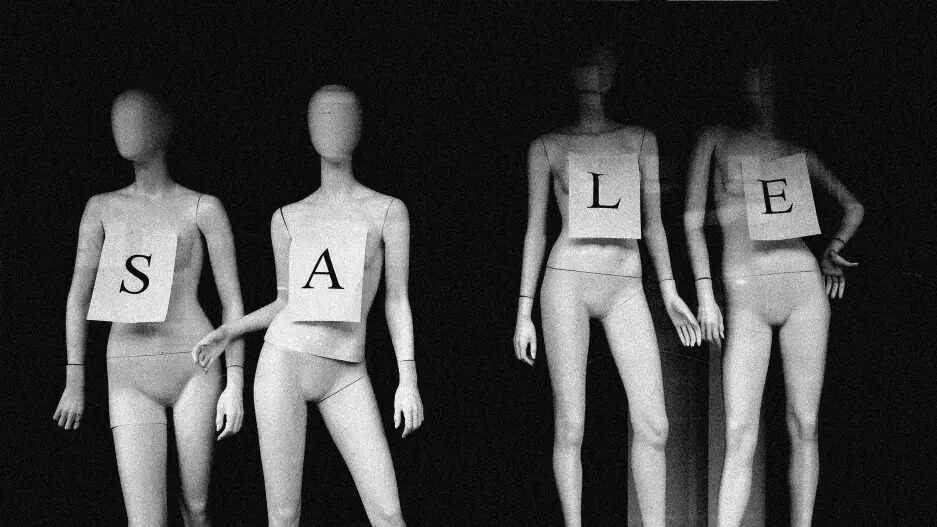

Owner of Coach acquires the owner of Versace: 3 questions it raises for luxury fashion

The $8.5 billion deal raises big question about the future of luxury fashion.

On August 10, 2023, Tapestry, a fashion company that owns Coach and Kate Spade, said it would buy Capri, the owner of brands Michael Kors, Versace, and Jimmy Choo, for $8.5 billion in cash. The deal is the latest in a series of recent high-value mergers in the luxury fashion space. Here are three questions that the deal raises for Tapestry, the brands it controls, and for the luxury sector as a whole.

1: CAN THIS MERGER CATAPULT TAPESTRY INTO HIGH FASHION?

Tapestry has always hovered just outside the deluxe fashion space—not quite at the level of fashion conglomerate Kering (Gucci, Balenciaga, Bottega Veneta, and others) or LVMH (Louis Vuitton, Dior, and Fendi, among others), but with aspirations to reach those heights. In 2017, Coach became part of the larger holding company Tapestry when it acquired Kate Spade for $2.4 billion, and it engineered a turnaround designed to differentiate itself after being stuck in a space between fast-fashion and high luxury. It applied the same principles to Kate Spade post-acquisition.

But while Coach has seen success, reporting strong earnings this year, it’s still looking for a toe-hold in the truly high-end market to be less susceptible to the fast-fashion upstarts eating away at mid-tier luxury. Capri—its most important luxury brand being Versace—offers Tapestry a door into a more upscale world. Versace’s sales have also rebounded after the pandemic, and the merger combines regional strengths (Tapestry in China, and Capri in Europe). It remains to be seen how Tapestry can integrate strategies across all its brands and compete with the larger luxury fashion houses.

2: WHAT’S THE CURRENT STATE OF LUXURY MARKET?

Luxury goods took a major hit during the pandemic but have largely come soaring back since then, especially in the U.S., as the Chinese market remained depressed for longer due to COVID lockdowns (though that market is now growing again). Part of the reason it seems vital for Tapestry to move upmarket is that, according to a recent report, most of the luxury spending is coming from wealthy shoppers, as opposed to aspirational shoppers with less disposable income. Many fashion labels are increasingly focusing on upmarket consumers as a strategy to drive sales.

These trends can also be seen in the sector’s real estate investments, as luxury fashion is bucking any fears of downtowns with large openings in high-end shopping districts. Hermès recently opened a more-than-20,000 square foot flagship store on Madison Avenue, and Rodeo Drive is seeing a boom of new retail spaces, including Dior and Louis Vuitton, specifically designed to cater to wealthier clientele. And the expansion isn’t limited to major cities: Following data from online shopping during the pandemic, Hermès is also opening stories in Austin and Naples, Florida, while Kering has said it’s looking at stores in places like Atlanta, Charlotte, and Austin for some of its brands.

3: WILL THE LUXURY CONSOLIDATION CONTINUE?

This deal is just the latest in a series of mergers and acquisitions among major fashion houses over the last few years. LVMH bought Tiffany for $15.8 billion in 2021 and Kering bought 30% of Valentino in July 2023, in an effort to shore up sinking sales from its Gucci brand.

Are more deals on the horizon? LVMH is currently the world’s largest luxury group (by sales), and clearly is sniffing around more acquisitions, any of which could further the consolidation of the luxury fashion space. In May of 2023, Richemont, the owner of Cartier, declared that it was not for sale, in the face of rumored interest from LVMH, which has also been talked about as a potential buyer for Bergdorf Goodman. Given the interest in dealmaking in the space, smaller companies like Richemont must be seen as tempting targets for all the large luxury groups, even if the LVMH rumors never end up materializing.