- | 11:00 am

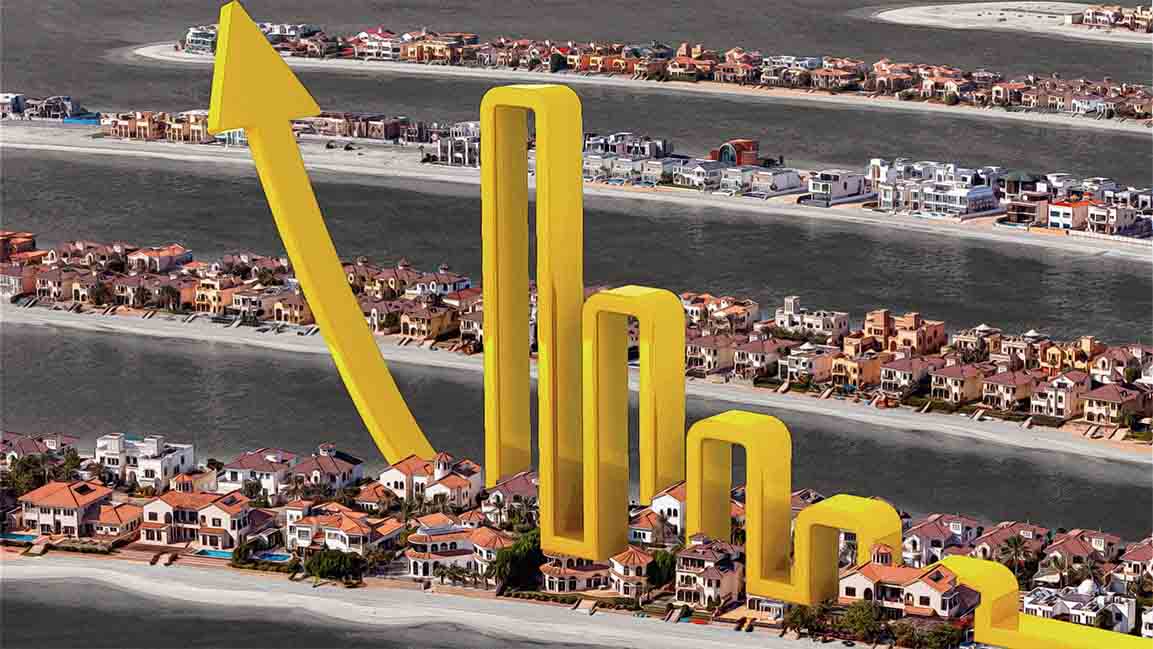

Dubai’s luxury house prices see unprecedented 50% jump, reveals report

For two consecutive years and counting, Dubai takes the lead in the Knight Frank index for luxury property growth.

Now accepting applications for Fast Company Middle East’s Most Innovative Companies. Click here to apply.

Dubai reportedly continues to hold its status as the leading global market for prime real estate. According to Knight Frank’s Prime Global Cities Index, luxury property prices in the emirate experienced a remarkable increase of 48.8% during the twelve months leading up to June 2023. Based on property valuations, this index monitors luxury residences’ price trends across various international cities.

This surge stands as the highest increase on a global scale, solidifying Dubai’s position at the apex of the index for the eighth consecutive quarter.

In contrast to the Q3 2020 pandemic-induced property price dip, Dubai has seen a 225% surge. Luxury property prices rose significantly in Tokyo by 26.2%, securing second place, with Manila at 19.9% in third. Miami claimed fourth with a 7.5% growth, and Shanghai followed with 6.7%.

Overall, annual prices registered a 1.5% increase across the 46 markets studied, indicating improvement over Q1 2023. Likewise, Q2 2023 saw a price increase in 57% of cities, while 14 markets observed price declines during the same quarter.

“The 1.5% average annual growth remains modest, and well down on the recent peak of 10.2% seen in the final quarter of 2021 but is the strongest rate growth since the third quarter of 2022,” says the report.

“Global housing markets are still under pressure from the shift to higher interest rates – but the latest results from the Knight Frank Prime Global Cities Index confirm that prices are being supported by strong underlying demand, weak supply following disruption to new-build projects during the pandemic, and an ongoing return of workers to cities,” says Liam Bailey, Knight Frank’s global head of research.

Several other prominent markets have witnessed a slowdown. Toronto saw a slight decline of 0.1%, while London, Brisbane, Beijing, and Hong Kong witnessed drops of -0.5%, -1%, -1.5%, and -1.5% respectively. Los Angeles and New York faced more significant setbacks, with declines of -2.5% and -3.9%, among several others.