- | 1:00 pm

Dubai doubles down on initiatives to boost digital economy

A new platform launched to help the country reach its target of attracting 300 digital startups to the emirate by 2024.

The UAE government last year announced its Digital Economy Strategy, which aims to increase the sector’s contribution to GDP from 9.7% in 2022 to 20% by 2033.

The strategy also includes a target of attracting 300 digital startups to the emirate by 2024 and boosting its non-oil GDP. The Dubai Chamber of Digital Economy attracted 69 digital startups in the first quarter 2023.

The UAE government has made its digital economy a key focus of its economic development strategy. This is wise, as the digital economy is a major economic growth and innovation driver.

Dubai is taking the lead by launching two new initiatives: the Business in Dubai platform and the proposed Digital Assets Law.

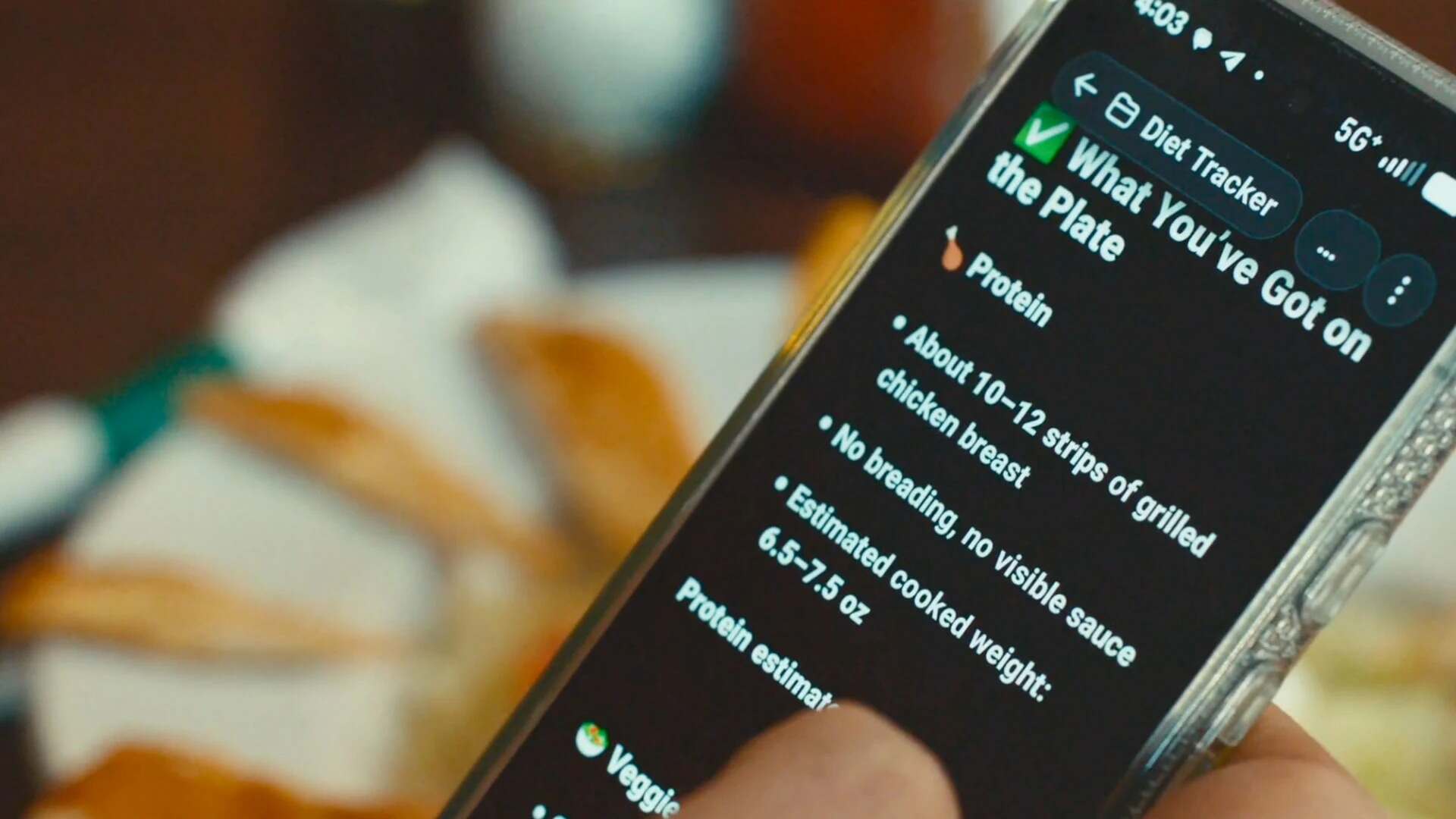

The Business in Dubai platform will help businesses of all sizes grow and thrive in Dubai. At the same time, the Digital Assets Law will provide a clear and concise framework for developing and using digital assets in the emirate.

Aligned with the country’s Digital Economy Strategy, the Business in Dubai platform includes two main pillars: A business matchmaking service that connects companies with the right partners, investors, and customers and A comprehensive range of institutional services delivered in cooperation with the chamber’s strategic partners.

At the launch event, the chamber signed seven MoUs with partners such as Letswork, in5, Dubai World Trade Centre, du, Mashreq, Dubai Islamic Bank, and the Commercial Bank of Dubai.

“The new platform will play a vital role in cementing the emirate’s digital leadership by attracting leading digital companies and specialized talent to Dubai and empowering them to contribute to the future development of the emirate’s digital ecosystem,” said Ahmad Bin Byat, Vice Chairman of Dubai Chamber of Digital Economy.

On the other hand, the Digital Assets Law aims to keep DIFC laws up-to-date with the rapidly changing world of digital assets and to give investors and users confidence in the market.

The law will create a comprehensive legal framework for digital assets, such as cryptocurrencies, NFTs, stablecoins, and security tokens, now a trillion-dollar asset class.

The law will also amend other key DIFC laws, such as the Contract Law, the Insolvency Law, the Law of Obligations, the Trust Law, and the Foundations Law, to ensure that the overall legal framework of the DIFC is compatible with digital assets.

“The proposed new Law of Security is modeled on the UNICTRIAL Model on Secured Transactions and has been adapted to take account of specific factors relating to DIFC,” said Jacques Visser, Chief Legal Officer at DIFC.

“We believe these proposals will put DIFC’s legal and regulatory framework at the forefront of international best practice,” added Visser.

DIFC recorded an increase in fintech and innovation companies from 599 to 811 in the first half of 2023 and is now home to 1,443 financial and innovation-related companies, a 15% year-on-year growth.