- | Visa

Awareness and rewards will be key to driving sustainable commerce in the GCC

New Visa research finds the higher cost of sustainable products and lack of awareness as top barriers to sustainable commerce adoption; consumers seek banks' help understanding the environmental impact of spending

Changing business practices often means disruption and being prepared to take calculated risks. Many change their business only if they’re confident of success.

The weight of evidence that new resource-efficient, sustainable business models can mean good business is growing daily. Yet, while consumers care about sustainability and the environment when they shop, only some companies know how to meet their needs with tangible action.

With the ongoing COP28 in the UAE and collaboration on climate change, businesses can play a significant role in a sustainable future, and innovation can drive the transition to sustainable commerce.

Since much of the environmental impact is wrapped up in commerce – resource depletion, pollution of plastic, water, and soil, habitat destruction, greenhouse gas emissions, waste generation, and the loss of biodiversity, an approach to sustainability should include transforming business and consumer behavior.

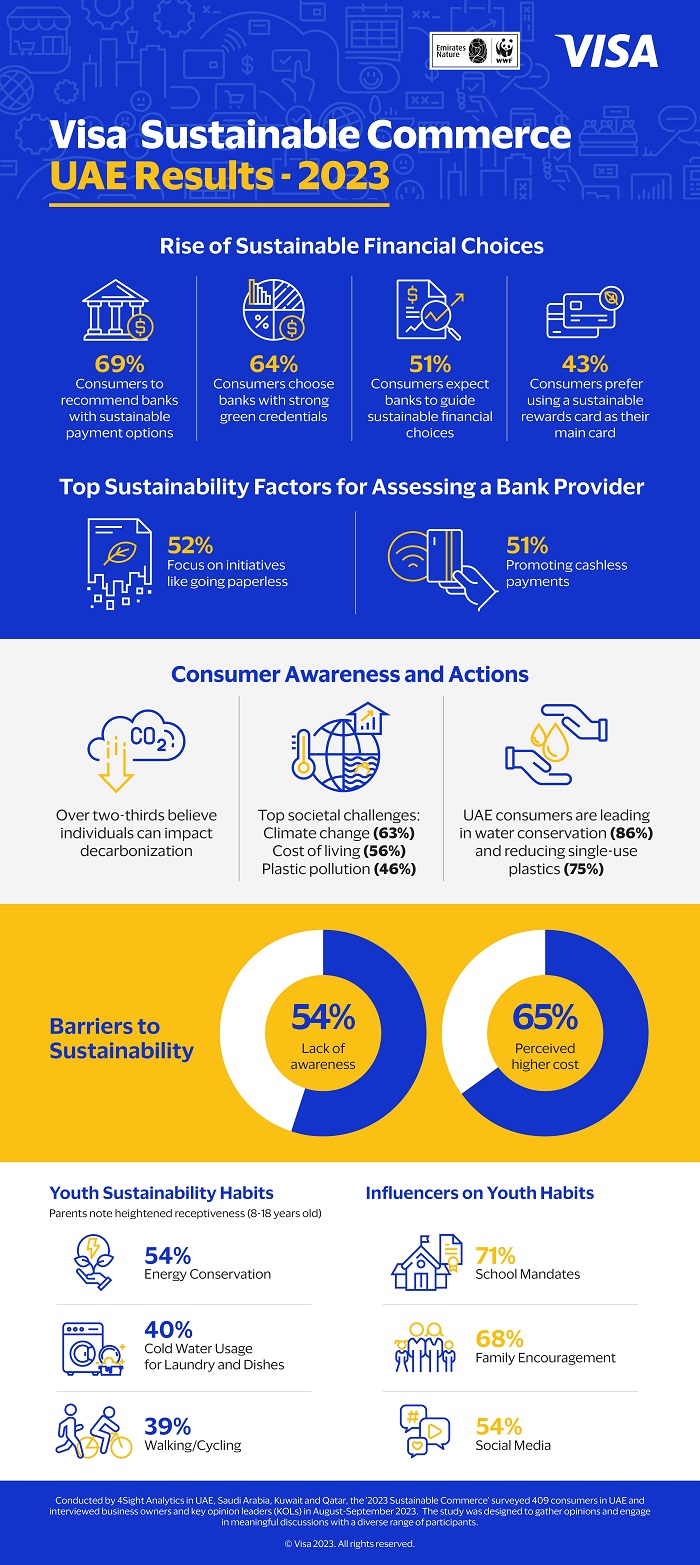

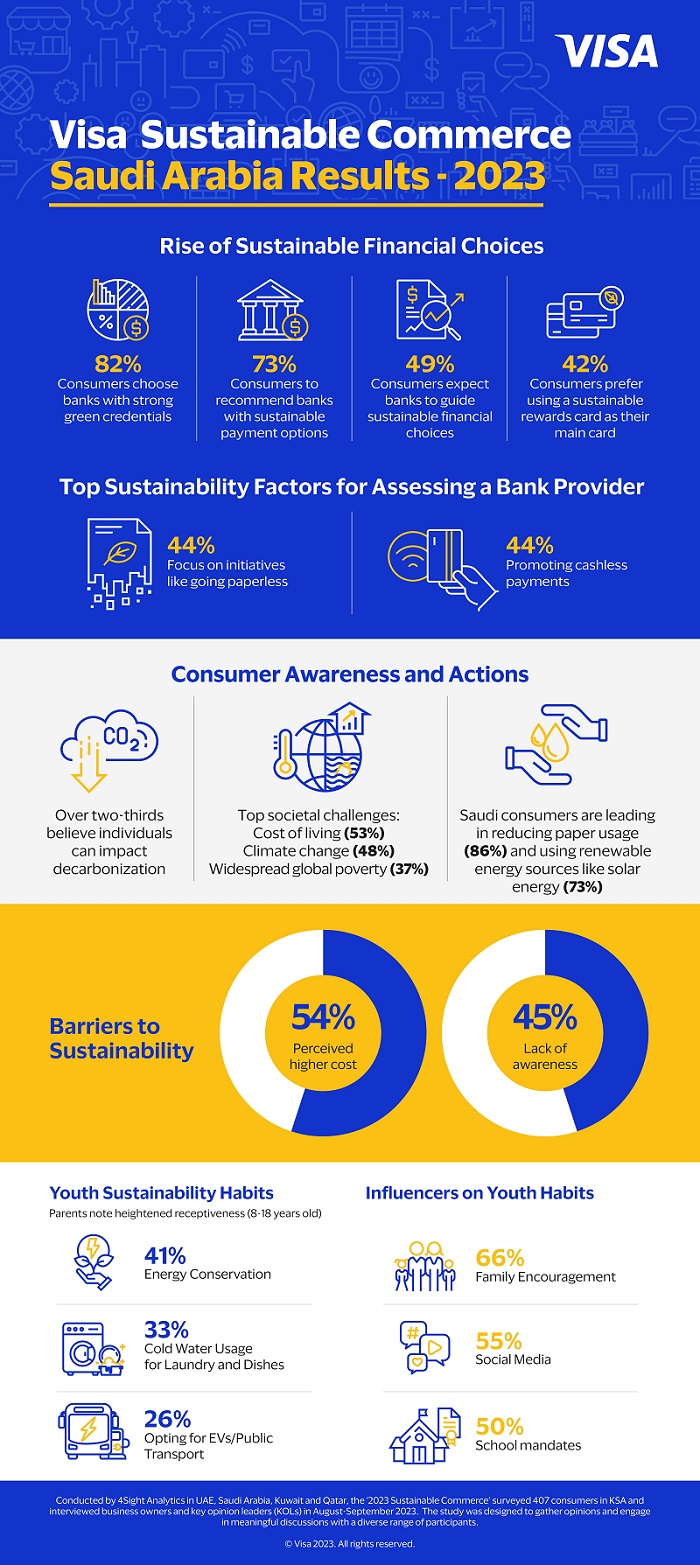

A white paper from Visa, Sustainable Commerce in the GCC Region, outlines the consumer and business behaviors, the readiness of infrastructure to support sustainable commerce in the UAE, Saudi Arabia, Qatar, and Kuwait, and reinforces the urgency for all industry stakeholders to promote sustainability through responsible innovation.

The problem is that we expect huge changes in business and consumer behavior overnight and look for examples of giant strides. In fact, the work paving the way for major change is often incremental, but that’s due to myriad challenges, including a lack of awareness.

To scale up what we need is qualitatively different. One message is clear: sustainability is not limited to the environment – it’s an entire ecosystem coming together and functioning smoothly.

CONSUMER PERSPECTIVE

Consumers are becoming ever more conscious of their role in sustainability and appreciate businesses that demonstrate sustainable practices, empowering them to play a bigger societal role.

They believe that decarbonization is not limited to corporate entities and that they can make a difference individually. More importantly, in the UAE, where the study was launched in collaboration with Emirates Nature-WWF, a majority view climate change as a leading societal challenge.

Across the GCC, consumers are taking the lead in water conservation, ethical sourcing, using single-use plastics, supporting NGOs promoting sustainability, and repurposing and sharing products within the community – all to ensure their lifestyle aligns with their sustainability values. From an ethical sourcing perspective, Saudi Arabia is leading by promoting urban agriculture, like rooftop farming (76%) across the GCC. Additionally, 67% of Saudi consumers pay a premium for brands or products that are sustainably produced. Qatar takes the lead in reducing single-use plastics with a rate of 82%, surpassing the GCC average of 72%.

Interestingly, children demonstrate a heightened environmental consciousness in all the GCC countries, such as walking or cycling and opting for organic products. The primary influencers driving sustainability habits among the youth include family members encouraging sustainable behaviors, social media, and school mandates.

However, consumers need help from businesses to make the most sustainable choices possible. These insights suggest sustainability is a competitive edge for business.

ROLE OF FINANCE AND PAYMENT INDUSTRY

As environmental urgency ramps up for climate action, the financial and payment industry can do more to support businesses and consumers’ sustainable choices.

To double down on efforts to build sustainable commerce, the industry can provide green financing options, ethical investment opportunities, eco-friendly payment methods, and support green technologies.

“More than 40% of consumers in GCC are looking to their banks for guidance in making more sustainable financial choices. This underlines the growing demand for financial institutions to play a more active role in promoting sustainability,” said Dr. Saeeda Jaffar, Visa’s SVP and Group Country Manager in GCC.

Visa recently launched the Eco Benefits Bundle, a climate banking platform in collaboration with Ecolytiq and Mashreq in the UAE and Qatar Islamic Bank (QIB) in Qatar. This innovative solution integrates eco-friendly features into card payments, enabling users to track their environmental impact and contribute to carbon offset initiatives.

The study revealed that a significant number of individuals (69% in the UAE; 72% in Qatar; 73% in Saudi Arabia, and 71% in Kuwait) are ready to recommend banks that provide sustainable payment options and will choose a bank with strong green credentials. They expect their banks to guide them in making sustainable financial choices and help them understand the environmental impact of their purchases.

Clearly, finance and payment players can bridge the gap between businesses and consumers. For businesses, it can create products and services that are pro-sustainability – better interest rates, higher loan tenures, easy documentation, and reward the consumer opting for sustainable products and services through special benefits.

“Government policies and financial institutions can bridge the gap between consumers and businesses in driving sustainable practices,” said Laila Mostafa Abdullatif, Director-General at Emirates Nature WWF.

The study found rewards for sustainable behaviors are a significant attraction.

BARRIERS TO SUSTAINABLE COMMERCE

As societal consciousness regarding environmental issues expands, there’s a rising preference among consumers for businesses that actively demonstrate sustainable practices, and businesses are increasingly willing to take cues in sustainability from consumers.

But there are challenges. Cost is the foremost barrier to sustainable adoption, often overshadowing other factors. The Visa study found the majority of consumers are reluctant to buy sustainable products because of the perceived higher cost.

It’s no secret that sustainable products are more expensive than conventional ones due to expensive raw materials. But how many customers would choose to pay added cost for a product that offers no improvement in performance?

And if customers won’t choose to pay the premium, how can businesses afford the huge investment required?

While the GCC region has been collectively promoting sustainability, businesses think the consumers haven’t “evolved” yet; they are often reluctant to embrace the green premium.

This can make it challenging for businesses to prioritize long-term sustainability over short-term profits, leading to a low adoption rate.

The availability of sustainable finance doesn’t solve that problem if businesses have no financial case for investing.

For MSMEs, the major barriers, apart from cost implications, are lack of technical know-how, sustained long-term financial support, and raw materials and end products coming at a significantly higher price.

While medium-sized enterprises show a better grasp and comprehension, micro and small businesses prioritize survival. Limited resources, time constraints, and immediate financial concerns are barriers to adopting sustainability.

While sustainability is a rising concern across GCC, businesses and consumers lack a holistic understanding of the concept.

This may be attributed to limited exposure, lack of organic integration of sustainable practices in everyday life, and measuring sustainability without technology is unattainable. Also, there’s a perennial perception that embracing certain sustainable actions is too difficult.

WHAT’S THE WAY FORWARD

For consumers, the challenges of sustainability relate to affordability and convenience; for businesses, it’s largely about profitability. To reach a truly sustainable future, regulation needs to be partnered with a strategy to create the demand for sustainability at scale, along with support from the finance and payment industry.

In the UAE and Saudi Arabia, for example, local governments provide grants and subsidies, reduced tariffs on eco-friendly products, and green tax credits; they also levy waste disposal and fines businesses for non-compliance. Kuwait and Qatar have prioritized incentives for sustainability.

Implementing regulatory policies and schemes for business incentives and holding businesses accountable could be primary drivers in shaping the course of sustainable commerce.

Even consumers lean towards laws rather than self-driven when implementing sustainability. Half of the respondents believe that the responsibility of implementing sustainability lies either with policy framework or is driven by large global corporations. And they believe stricter laws and regulations are needed to protect the environment and shape the future.

To establish the sustainability paradigm in the GCC, it’s critical to drive awareness and holistic understanding, not just restricted to the environment, regulatory policies and frameworks leading from the front, creating the right ecosystem, and a unified push among stakeholders while financial institutions and the payment industry drive initiatives by creating products and services that support business and consumer intent. Only a concentrated effort could deliver the desired push toward sustainable commerce.

The Visa, Sustainable Commerce in the GCC Region can be downloaded here.