- | 1:00 pm

Sovereign wealth funds driving M&A surge in Middle East

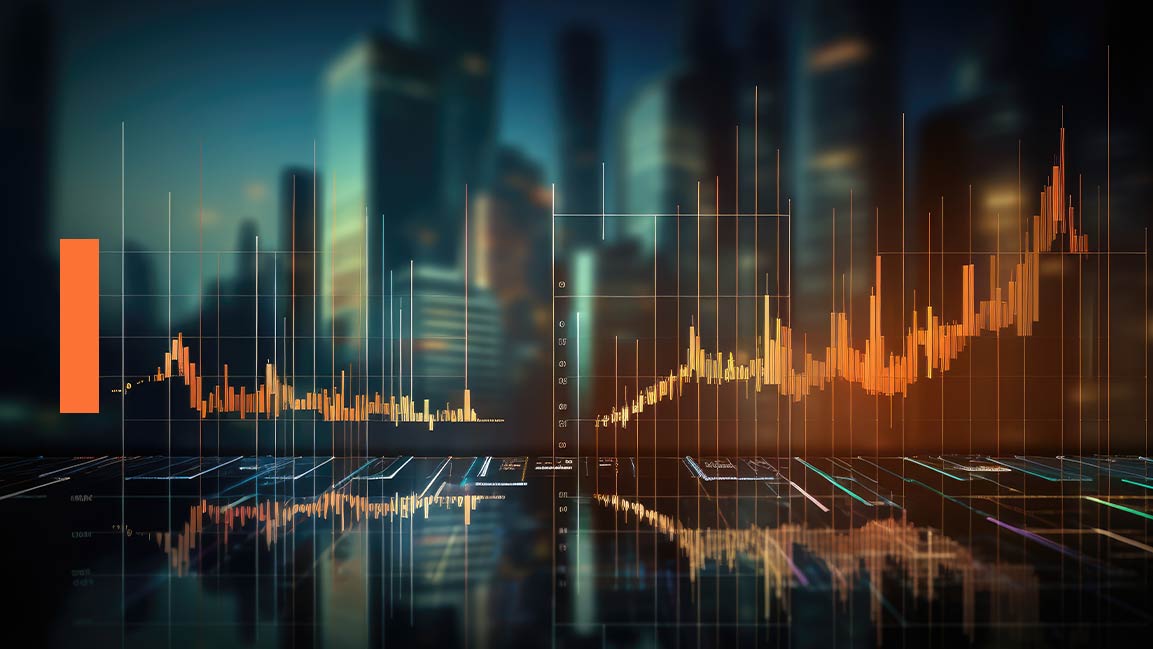

In 2023, SWFs injected approximately $81.7 billion into M&As, accounting for 86% of the total deal value for the year

While global M&A activity plummeted in 2023, the Middle East witnessed a different story, with government-backed funds driving deals.

A new report by Bain & Company reveals that while the overall M&A market in the region declined by 3% to $95 billion, SWFs poured a staggering $81.7 billion into deals, capturing 86% of the market share. This starkly contrasts the global M&A market, which plunged 15% to a ten-year low.

Experts point to rising interest rates, tighter regulations, and broader economic challenges contributing to the global slowdown. However, the Middle East appears to be charting its own course, with SWFs as a critical driving force.

“The Middle East is undergoing a significant shift towards accelerating the energy transition, with a growing emphasis on clean energy investments and ambitious net-zero targets,” said Elif Koc, a partner at Bain & Company Middle East.

“SWFs are leading the charge in reshaping the economic future of the Middle East, diversifying beyond oil and laying the groundwork for sustainable growth and prosperity.”

The report also highlights a notable trend – a surge in SWF investments in Asian companies, mainly targeting the revitalization of the manufacturing sector and fostering innovation within the region.

The value of such deals rose by 60% in the first nine months of 2023, indicating a deliberate shift towards increased engagement with Asia.

While the picture for the region appears brighter than the global context, challenges remain. Regulatory scrutiny and high-interest rates continue to impact dealmaking across the board. Additionally, the tech sector saw a significant decline in deal values, falling by around 45%.