- | 11:00 am

Saudi PIF-backed venture capital firm pumps $1 billion into Middle East startups

In 2023, Saudi startups raked in $1.3 billion, solidifying their VC star status.

With forward-thinking leaders, strategic investments, and an expanding community of tech enthusiasts, the technology landscape in the Middle East is advancing rapidly.

According to a UBS study, the region’s digital economy is forecasted to expand more than fourfold, reaching approximately $780 billion by 2030.

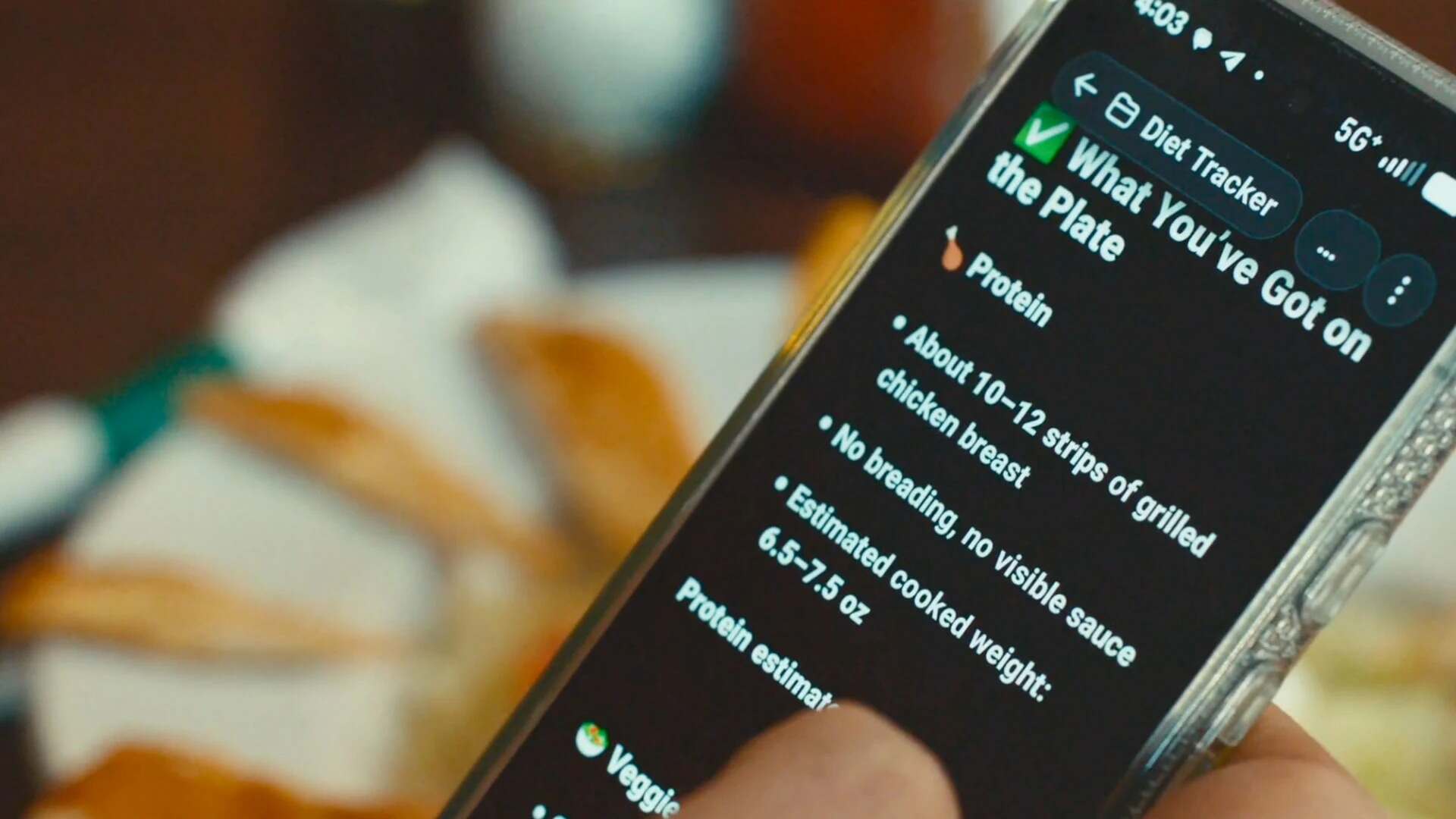

Chinese venture capital firm MSA Capital, supported by Saudi Arabia’s sovereign wealth fund PIF, aims to raise a substantial $1 billion to invest in promising technology startups across the Middle East.

“Our objective is to play at later stages and write bigger tickets in those pre-IPO rounds, then we can take them public,” said Ben Harburg, Managing Partner of MSA Capital. The firm currently manages $2.5 billion in assets and is backed by the Jada Fund of Funds, a unit of the Public Investment Fund (PIF).

This initiative comes amid a surge in venture capital activity in the Middle East. Saudi Arabia, in particular, has emerged as a key player, with startups raising a staggering $1.3 billion in 2023 alone.

This trend is fueled by Vision 2030, an ambitious plan to transform the Saudi economy and reduce its reliance on oil. MSA Capital’s focus on later-stage investments fills a crucial gap in the region’s funding landscape, where early-stage funding is more readily available.

With its significant capital and Saudi backing, the firm is poised to play a major role in scaling up promising tech ventures and propelling them toward IPOs.