- | 9:00 am

The dirty truth about lab-grown diamonds

Lab-grown diamonds come with sparkling price tags, but many have cloudy sustainability claims.

The muted sounds of hammering and sanding drift down to the first floor of Bario Neal, a jewelry store in Philadelphia, where rustic artwork that mimics nature hangs on warmly lit walls.

Waiting for one of those rings is Haley Farlow, a 28-year-old second grade teacher who has been designing her three-stone engagement ring with her boyfriend. They care about price and also don’t want jewelry that takes a toll on the Earth, or exploits people in mining. So they’re planning on buying diamonds grown in a laboratory.

“Most of my friends all have lab-grown. And I think it just fits our lifestyle and, you know, the economy and what we’re living through,” said Farlow.

In the U.S., lab-grown diamond sales jumped 16% in 2023 from 2022, according to Edahn Golan, an industry analyst. They cost a fraction of the stones formed naturally underground.

Social media posts show millennials and Gen Zs proudly explaining the purchase of their lab-grown diamonds for sustainability and ethical reasons. But how sustainable they are is questionable, since making a diamond requires an enormous amount of energy and many major manufacturers are not transparent about their operations.

Farlow said the choice of lab-grown makes her ring “more special and fulfilling” because the materials are sourced from reputable companies. All of the lab diamonds at Bario Neal are either made with renewable energy or have the emissions that go into making them countered with carbon credits, which pay for activities like planting trees, which capture carbon.

But that’s not the norm for lab-grown diamonds.

Many companies are based in India, where about 75% of electricity comes from burning coal. They use words like “sustainable” and “environmentally friendly” on their websites, but don’t post their environmental impact reports and aren’t certified by third parties. Cupid Diamonds, for example, says on its website that it produces diamonds in “an environmentally friendly manner,” but did not respond to questions about what makes its diamonds sustainable. Solar energy is rapidly expanding in India, and there are some companies, such as Greenlab Diamonds, that utilize renewables in their manufacturing processes.

China is the other major diamond-manufacturing country. Henan Huanghe Whirlwind, Zhuhai Zhong Na Diamond, HeNan LiLiang Diamond, Starsgem Co., and Ningbo Crysdiam are among the largest producers. None returned requests for comment nor post details about where it gets its electricity. More than half of China’s electricity came from coal in 2023.

In the United States, one company, VRAI, whose parent company is Diamond Foundry, operates what it says is a zero-emissions foundry in Wenatchee, Washington, running on hydropower from the Columbia River. Martin Roscheisen, founder and CEO of Diamond Foundry, said via email the power VRAI uses to grow a diamond is “about one-tenth of the energy required for mining.”

But Paul Zimnisky, a diamond industry expert, said companies that are transparent about their supply chain and use renewable energy like this “represent a very small portion of production.”

“It seems like there are a lot of companies that are riding on this coattail that it’s an environmentally friendly product when they aren’t really doing anything that’s environmentally friendly,” said Zimnisky.

HOW IT’S DONE

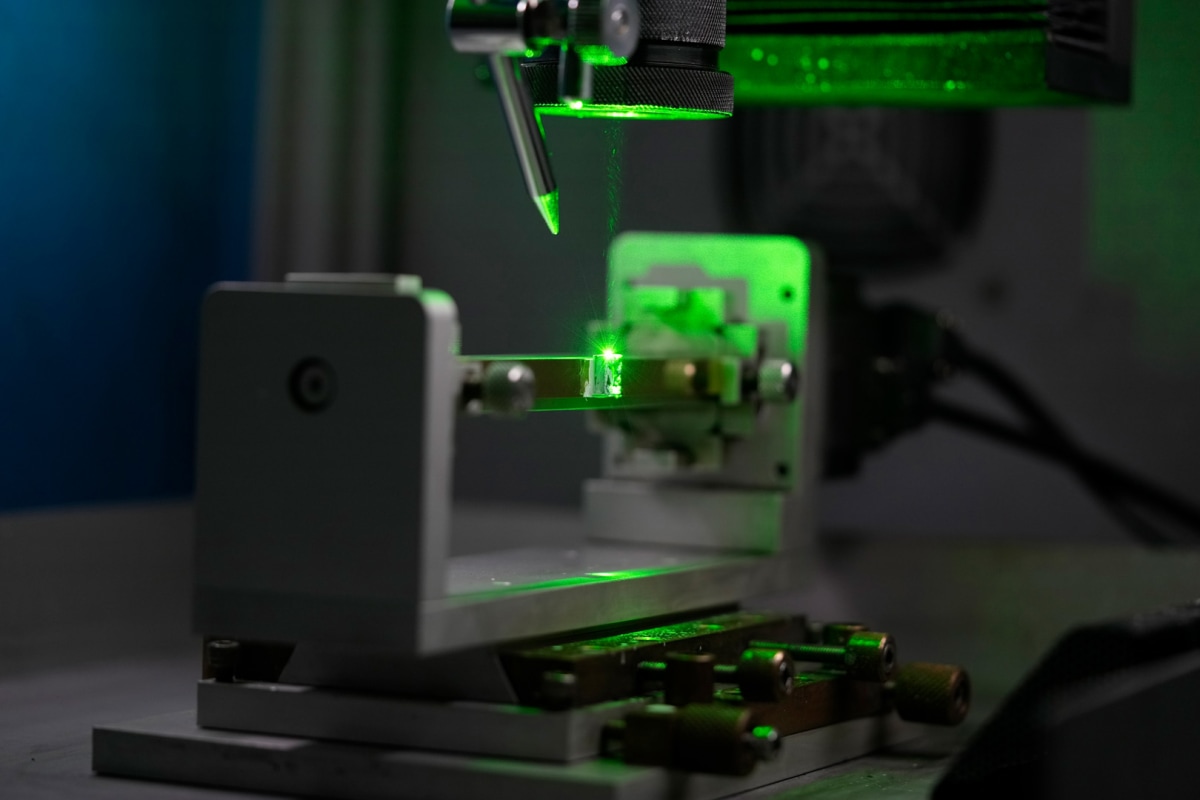

Lab diamonds are often made over several weeks, subjecting carbon to high pressure and high temperature that mimic natural conditions that form diamonds beneath the Earth’s surface.

The technology has been around since the 1950s, but the diamonds produced were mostly used in industries like stone cutting, mining, and dentistry tools.

Over time, the laboratories, or foundries, have gotten better at growing stones with minimal flaws. Production costs have dropped as technology improves.

That means diamond growers can manufacture as many stones as they want and choose their size and quality, which is causing prices to fall rapidly. Natural diamonds take billions of years to form and are difficult to find, making their price more stable.

Diamonds, whether lab-grown or natural, are chemically identical and entirely made out of carbon. But experts can distinguish between the two, using lasers to pinpoint telltale signs in atomic structure. The Gemological Institute of America grades millions of diamonds annually.

MARKETING COMPETITION

With lower prices for lab-grown and young people increasingly preferring them, the new diamonds have cut into the market share for natural stones. Globally, lab-grown diamonds are now 5% to 6% of the market, and the traditional industry is not taking it sitting down. The marketing battle is on.

The mined diamond industry and some analysts warn lab-grown diamonds won’t hold value over time.

“Five to 10 years into the future, I think there’s going to be very few customers that are willing to spend thousands of dollars for a lab diamond. I think almost all of it’s going to sell in the $100 price point or even below,” said Zimnisky. He predicts that natural diamonds will continue to sell in the thousands and tens of thousands of dollars for engagement rings.

Some cultures view engagement rings as investments and choose natural diamonds for their value over the long term. That’s particularly true in China and India, Zimnisky said. It’s also still true in more rural areas of the United States, while lab-grown diamonds have taken off more in the cities.

Paying thousands of dollars for something that drops most of its value in just a few years can leave the buyer feeling cheated, which Golan said is an element that is currently working against the lab-grown sector.

“When you buy a natural diamond, there’s a story that it is 3 billion years in the making by Mother Earth. This wondrous creation of nature . . . you cannot tell that story with a lab-grown,” said Golan. “You very quickly make the connection between forever and the longevity of the love.”

“If we really want to get technical here, the greenest diamond is a repurposed or recycled diamond because that uses no energy,” Zimnisky said.

Page Neal said she cofounded Bario Neal in 2008 to “create jewelry of lasting value that would have a positive impact on people and the planet.” All of the materials in her jewelry can be traced throughout their supply chain. The store offers both lab-grown and natural diamonds.

“Jewelry is a powerful symbol . . . it’s a keeper of memories,” she said. “But when we’re using materials that have caused harm to other people and the environment to create a symbol of love and commitment or identity, to me it feels at odds. We want to only work with materials that we feel like our clients would be proud to own.”

—Isabella O’Malley, Associated Press