- | 11:00 am

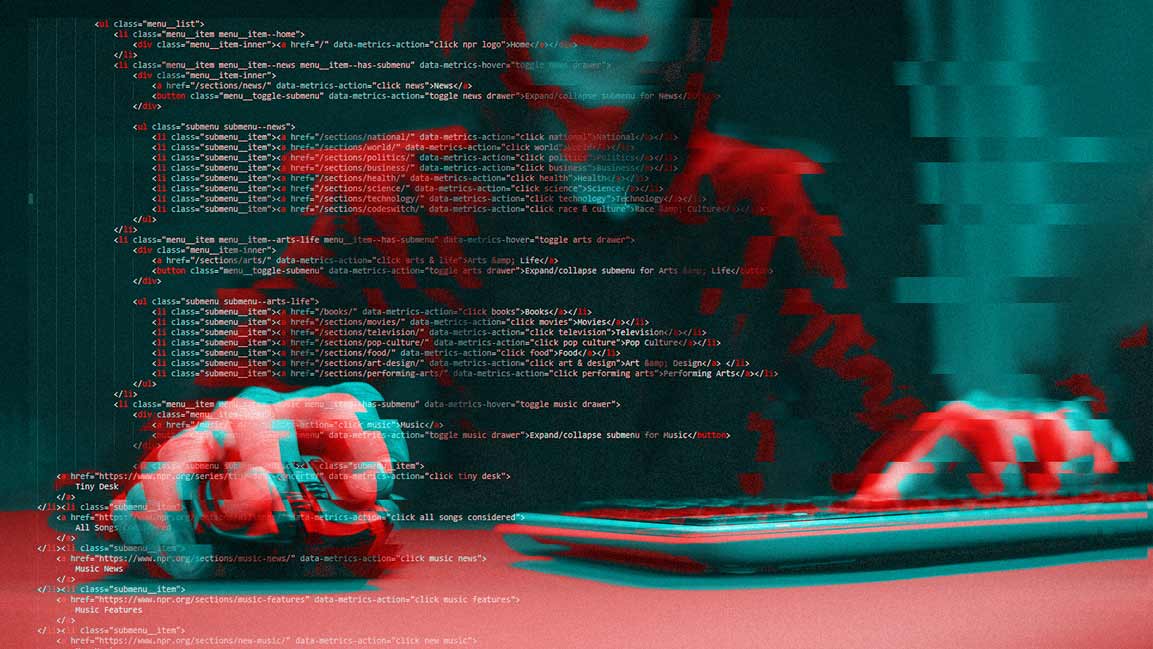

Nearly half of UAE retailers hit by cyberattacks in 2023

Over a third of UAE shoppers were targeted by payment fraud in the past year.

As businesses and individuals embrace digital innovation, the frequency and sophistication of cyber threats continue to rise.

A new study by payments platform Adyen paints a concerning picture of the UAE’s retail sector – one increasingly besieged by cyberattacks. The research reveals that 44% of UAE retailers experienced cyberattacks or data breaches in 2023, a significant 39% jump compared to 2022.

This surge in cybercrime translates to millions lost annually. The report estimates that, on average, UAE businesses fell victim to losses of approximately $2.9 million each due to fraudulent activity.

Consumers are not spared either, with over a third (35%) of UAE shoppers reporting they were targeted by payment fraud in the past year – a worrying trend considering the average financial impact per affected individual reached $884 in 2023, a 270% increase from the previous survey.

“Fraud is a pervasive challenge for retailers, and today’s findings demonstrate how it can significantly impact profits,” said Roelant Prins, CCO of Adyen. Fraudsters are deploying more sophisticated methods when they attack businesses, and it’s critical to invest in the right defense mechanisms to protect the company and customers.”

The report highlights a growing sense of insecurity among consumers. A significant portion (22%) of UAE shoppers feel less secure compared to a decade ago, directly attributing this to the rising threat of payment fraud.

This concern translates into consumer behavior, with nearly a third (29%) actively seeking out retailers with robust security measures and a similar number (28%) appreciating online stores that employ multi-factor authentication despite any perceived inconvenience.

UAE businesses are taking notice and actively exploring ways to combat this growing threat. Over half (68%) are considering switching to payment providers offering advanced fraud prevention solutions.

Additionally, 67% are investigating compliance with Payment Services Directive 3 (PSD3), a European Union regulation mandating stricter consumer protection measures within the financial industry.

Adyen emphasizes the importance of advanced technologies like machine learning to analyze global fraud patterns and offer real-time protection. “We use advanced technology combined with customizable risk rules to protect retailers and their customers – blocking fraud, preventing disputes, and staying ahead of the latest fraud trends.”