- | 11:00 am

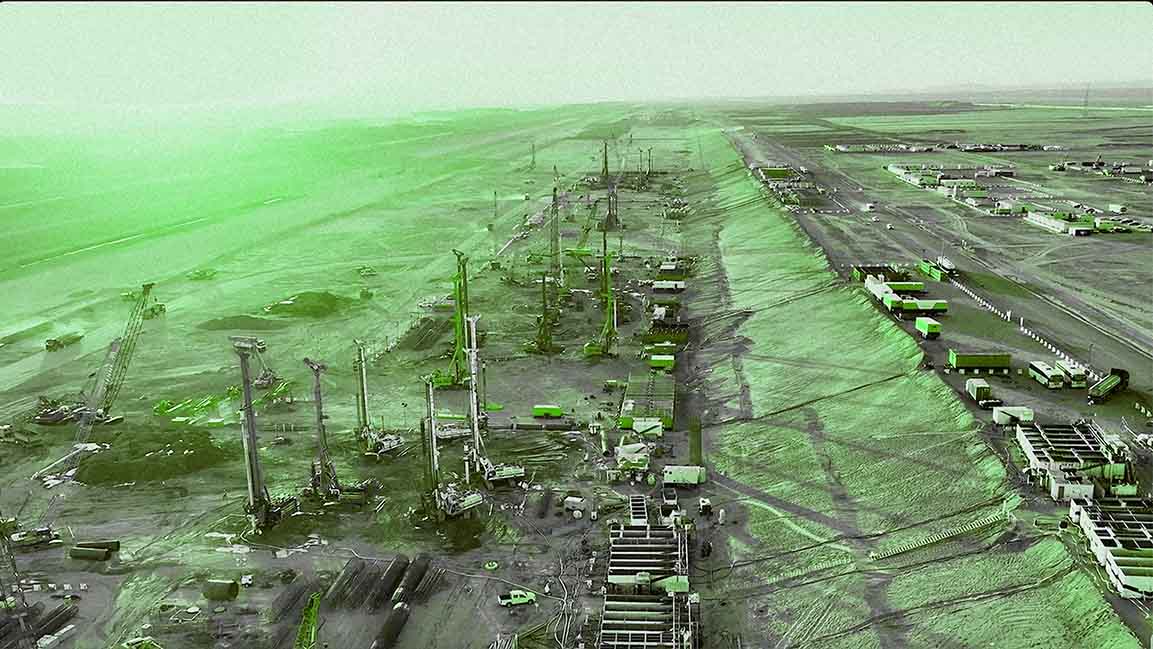

Giga-projects driving Saudi Arabia’s construction boom

Construction cost inflation in Riyadh is easing from 2023 highs.

A recent analysis by global consultancy firm Turner & Townsend paints a picture of a booming construction sector in Saudi Arabia fueled by ambitious state-backed initiatives. Giga-projects like NEOM are attracting significant domestic and international investment.

The report underlines the role of mega-events like EXPO 2030 and the 2034 FIFA World Cup in driving construction activity within the kingdom. This follows a separate report from JLL, a real estate services firm, which positioned Saudi Arabia as the global leader in construction projects for the first quarter of 2024.

JLL’s analysis reveals a $1.5 trillion in construction projects currently in the Saudi pipeline, representing a dominant 39% share of the entire Middle East and North Africa region’s $3.9 trillion construction market.

“The stand-out story is the accelerated development of Saudi Arabia,” said Mark Hamill, director and head of Middle East real estate and major programs at Turner & Townsend, referencing groundbreaking projects like The Line, King Salman Park, and Diriyah Gate.

The report acknowledges the broader trend of growth across the Gulf region, driven by diversification efforts beyond traditional oil dependence despite ongoing geopolitical uncertainties. However, it also cautions of persistent challenges.

While construction cost inflation in Riyadh is easing from 2023 highs (7.0%), it’s still projected to remain at 5.0% throughout 2024. Additionally, a shortage of skilled labor threatens to hinder project completion timelines.

Despite these challenges, the report finds Saudi Arabia actively attracting global corporations through its Regional Headquarters Program, offering cost advantages for office investment (the average cost per square meter in Riyadh’s central business district is relatively low: $2,266.

Looking beyond Saudi Arabia, the report reveals Doha, Qatar, as the second most expensive construction market ($2,096 per sq m), followed by Dubai ($1,874 per sq m) and Abu Dhabi ($1,844.2 per sq m).

The analysis highlights the need for technological advancements to overcome industry-wide hurdles.

“Accelerating digitalization also presents a huge opportunity,” said Neil Bullen, managing director of global real estate at Turner & Townsend, “but this requires keeping up with the skilled labor demand – persistent shortages risk constraining potential growth.”