- | 1:00 pm

Payment security is key to consumer loyalty, says new report

Safe and secure checkout is a priority for 39% of the region’s consumers.

Cashless payment trends in the Middle East and North Africa (MENA) region have surged over the last few years, but consumers prioritize safe and secure checkout.

According to Checkout.com’s fourth annual report, The State of Digital Commerce in MENA 2024, 91% of the region’s consumers have shifted towards e-commerce shopping in the past two years. At the same time, the number of people who shop online at least once per day has grown by 80% since 2020, with Saudi Arabia leading with a 90% increase.

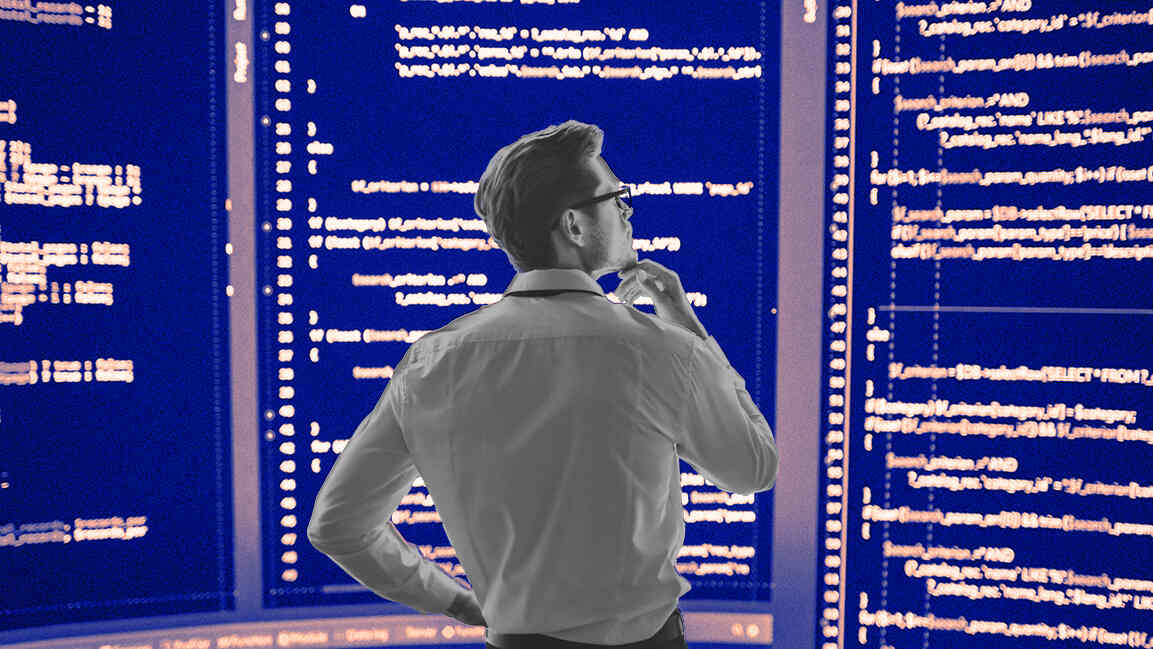

Amid these increased consumer demands, merchants across the MENA region have been seeking digitization solutions, innovative payment strategies, and, most importantly, payment security.

While e-commerce presents attractive prospects for consumers, such as speed, convenience, and anonymity, its surge also works in cybercriminals’ favor. The e-commerce ecosystem includes multiple stakeholders, including the retailer, the customer, the processor, and the networks, so fraudsters can exploit multiple potential access points.

E-commerce fraud can take many forms, such as criminals using stolen credit card numbers to make purchases, transaction replays, and chargeback fraud.

About 33% of MENA consumers say they have been victims of it, which can damage customer trust and a company’s reputation.

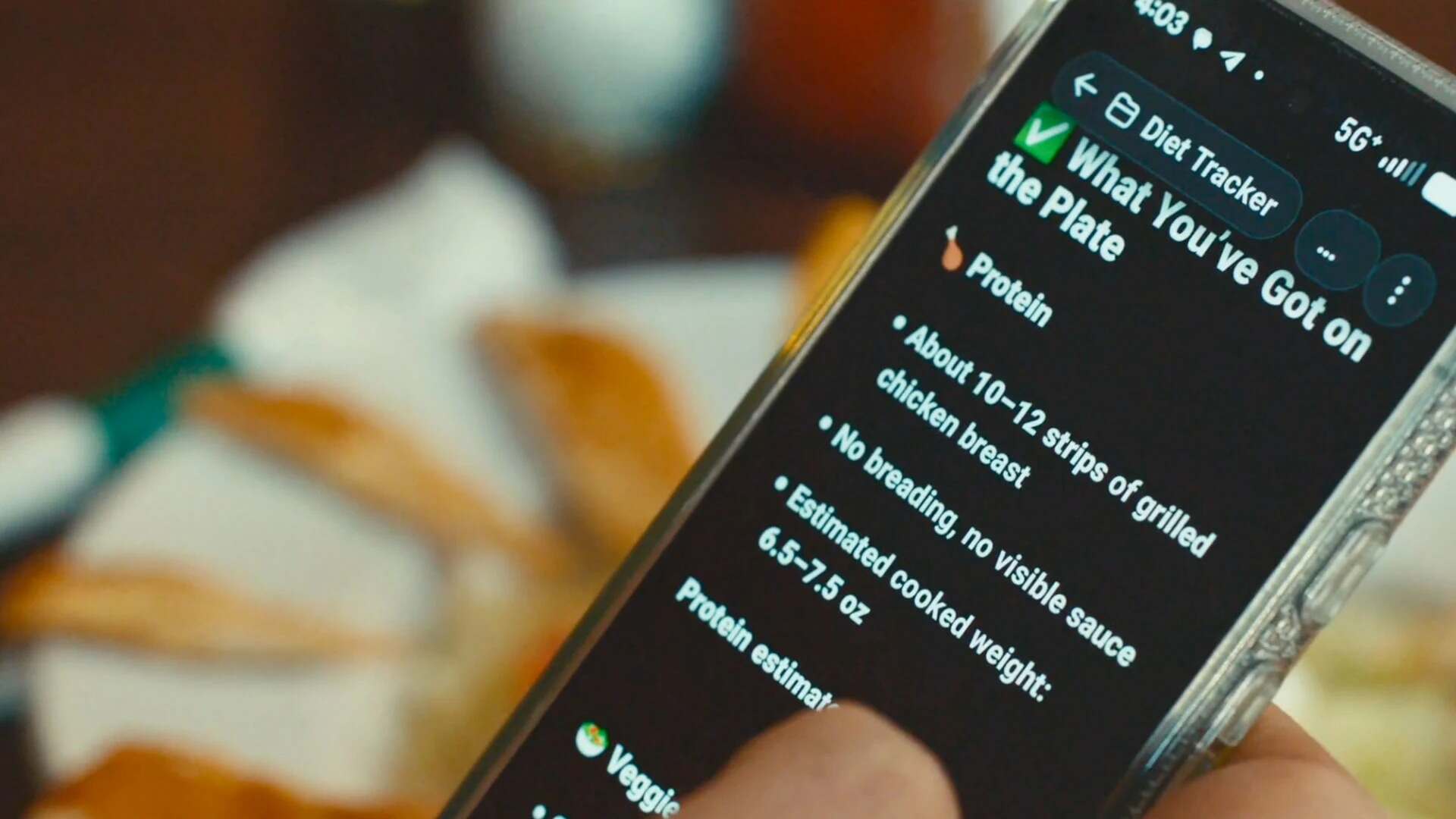

Safe and secure checkout is a priority for 39% of the region’s consumers.

In addition, 30% of shoppers have recorded a single falsely declined payment, leading them to shop from a competitor’s website.

Now accepting applications for Fast Company Middle East’s Most Innovative Companies. Click here to apply.