- | 1:00 pm

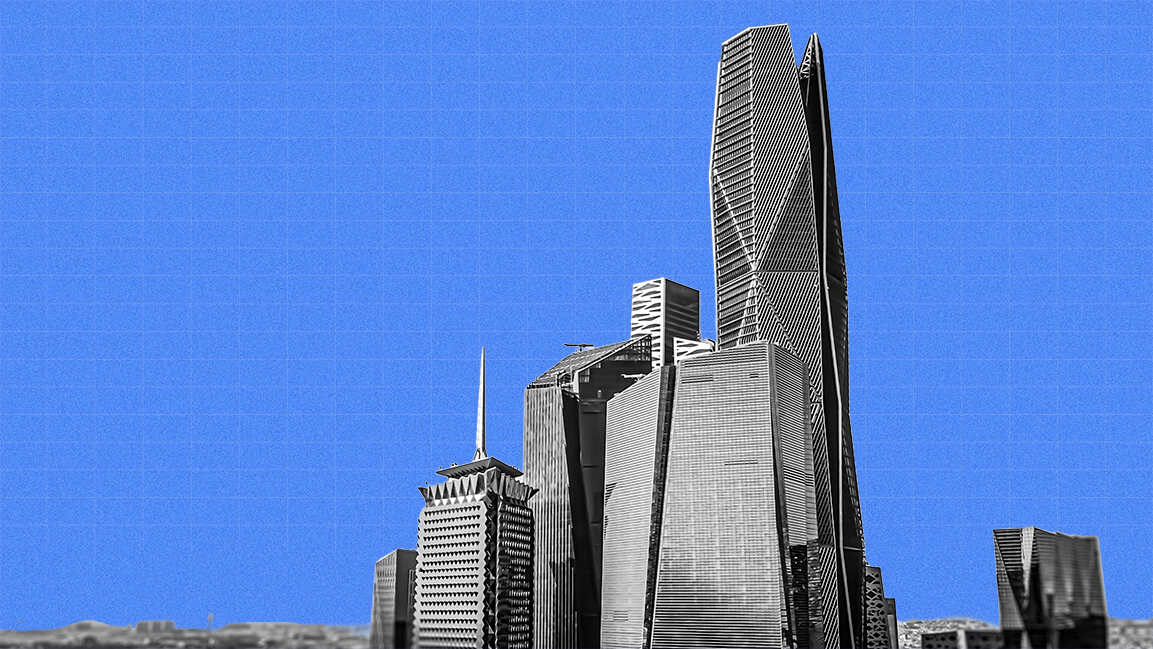

Saudi Arabia surpasses Vision 2030 targets with $314 billion in private investment

This growth is largely attributed to a 7.6% expansion in non-government sector investments.

Saudi Arabia’s capital investment is not only meeting but surpassing ambitious targets as the kingdom accelerates its efforts to expand the private sector and attract global capital.

According to data from the Ministry of Investment, Saudi Arabia’s gross fixed capital formation (GFCF) reached $313.68 billion in 2024, reflecting a 5.3% annual growth. This increase is largely driven by a 7.6% rise in investments from the non-government sector.

Saudi Arabia has introduced a series of pro-business reforms, including streamlined regulations, tax incentives, and the Regional Headquarters Program, to attract multinational corporations. Major giga-projects such as NEOM, the Red Sea, and Qiddiya, alongside public-private partnerships, are fueling investor interest.