- | 11:00 am

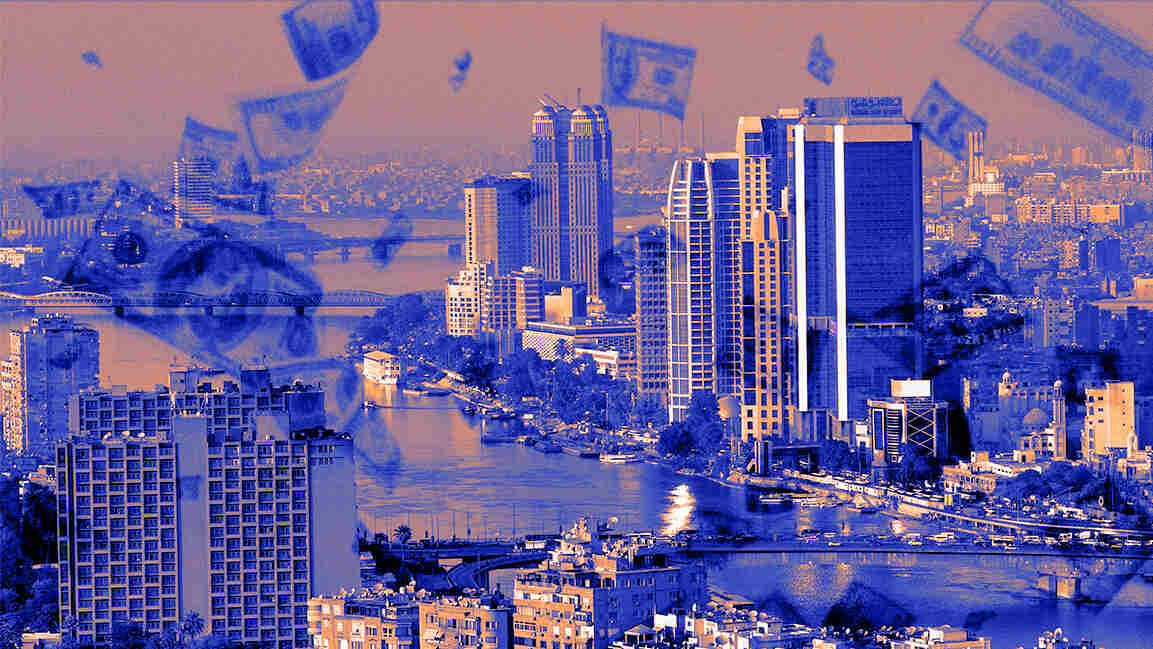

GCC investments to offset Egypt’s FDI slowdown amid US tariffs

NBK estimates that Egypt could face an external financing gap of $10 billion to $12 billion over 2025 and 2026.

Egypt may face a slowdown in foreign direct investment (FDI) due to newly imposed U.S. tariffs. However, support from Gulf states is expected to cushion the impact and help bridge the country’s financing gap over the next two years, according to the National Bank of Kuwait (NBK).

NBK estimates Egypt’s external financing shortfall could range between $10 billion and $12 billion in 2025 and 2026. However, fresh investment pledges from GCC countries—including a $7.5 billion deal reportedly finalized by Qatar and a potential conversion of Kuwait’s $4 billion in deposits at Egypt’s central bank into local currency investments—could provide crucial relief.

These investments, potentially directed toward sectors such as real estate, would help strengthen Egypt’s net foreign asset position and bolster international confidence in the country’s external financing outlook, the bank noted.

Egypt’s debt servicing burden is also expected to ease, with external repayments projected to fall to $14 billion in fiscal year 2026/2027 and to $10 billion in subsequent years—down from around $30 billion annually in recent years.

FDI inflows into Egypt rose sharply to $23.7 billion in the first nine months of the current fiscal year, up from $7.9 billion in the same period a year earlier. Much of this surge was driven by the UAE’s landmark $35 billion Ras El Hekma deal, which has paved the way for further GCC investments.

Still, the new U.S. tariffs could temper future inflows, particularly in energy-linked sectors, while the broader slowdown in global trade may weigh on key revenue sources like the Suez Canal.