- | 10:00 am

EV drivers in the Middle East may soon swap batteries instead of charging

By introducing battery swapping stations, this Chinese company aims to eliminate long charging times and accelerate EV adoption across the Middle East.

If you took a road trip across the GCC in an electric vehicle, you’d quickly realize it’s not all smooth driving. Long stretches of highway, scorching temperatures, and limited fast-charging stations. Chinese EV maker Nio thinks it has the missing piece. Rather than waiting around to recharge, drivers could simply swap out their depleted battery for a fresh one and be back on the road in minutes.

Mohammed Maktari, CEO of Nio MENA, says EV adoption in the region is still patchy, and for good reason.

CHARGING AHEAD, DIFFERENTLY

Citing Jordan as an example, where nearly 80% of new vehicles sold in 2024 were electric, Maktari says the shift from petrol to electric was largely driven by generous incentives, near-zero import duties, and the country’s surplus power generation. In Lebanon, the trend is taking a different route. “Without exaggeration, I would say 50% of Beirut homes now have solar rooftops,” he notes. “That’s changed how people think about electricity and charging.”

But not every market is as plug-and-play. Kuwait, for instance, offers electricity at a negligible cost, yet struggles with infrastructure. Saudi Arabia, though full of potential, presents a more complex mix of logistical and regulatory hurdles.

Even though the kingdom has a large overall automotive market, its premium EV segment is only about half the size of the UAE’s. Still, the ambition to connect the region remains.

“Making way for a seamless inter-GCC trip in an EV is the end goal.”

BETS ON BATTERY SWAPPING

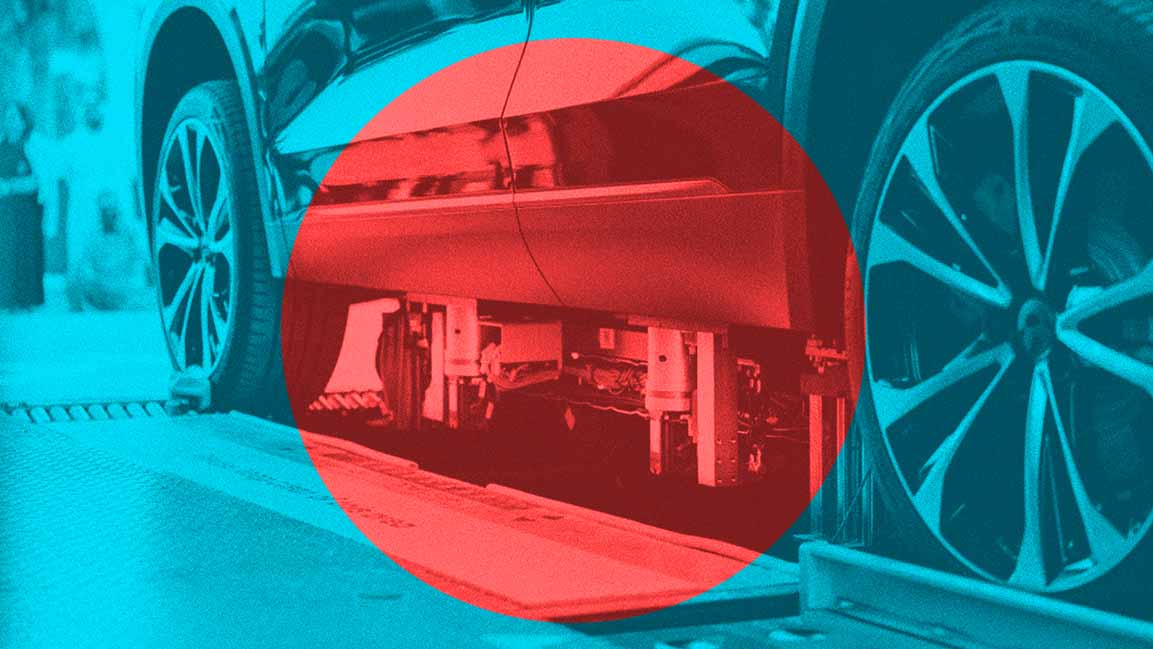

A key part of Nio’s regional strategy hinges on its battery swapping technology. Instead of plugging in and waiting for a fast charge, Nio drivers can pull into a station and leave with a fully charged battery within minutes. The concept has already taken off in China and is gaining momentum in Europe.

“It’s like changing a mobile phone battery, except you’re also dealing with coolant and high-voltage connectors, all automatically, with the car systems live,” explains Maktari.

A proof-of-concept station is already running on Yas Island in Abu Dhabi, and a second one is underway in Dubai. Each battery swap is expected to cost around $30 ( approximately AED 120). Beyond saving time, the system helps reduce battery wear by avoiding the stress of frequent fast charging.

“The batteries are charged under optimal conditions at the station, and you always get a healthy one back,” Maktari adds.

Still, consumer education will be critical in how well Nio performs in the Middle East.

ROADBLOCKS TO WIDER ADOPTION

There are still several roadblocks to overcome, with infrastructure topping the list. It remains one of the biggest factors shaping how Nio tailors its approach to each MENA market. While the UAE has built early momentum, other countries are at varying stages of readiness.

“There’s still work to be done in educating the market,” Maktari says.

In a region long reliant on gasoline vehicles, EV adoption faces its own set of challenges.

“EVs require a different mindset,” Maktari explains. “People are used to thinking of cars as three-year purchases, but electric motors can easily last 500,000 to a million kilometers.”

That shift in perception is closely tied to fuel prices. “When petrol costs around 2.5 dirhams a liter, there’s little urgency to switch. But once it gets closer to 4 dirhams, EVs start to make a lot more financial sense,” he adds.

Battery swapping, while still a new concept in the Middle East, isn’t new globally. Tesla briefly tested the waters back in 2013 with a battery swap station but later shifted its focus to expanding its Supercharger network. Nio, however, sees fresh potential in the Middle East and believes the region’s conditions are now right for battery swapping to gain real traction.

Nio currently operates around 3,300 battery swapping stations across China and parts of Europe, with plans to scale that number to 10,000. One of the biggest obstacles to widespread EV adoption has been charging time. While some fast chargers claim a full charge in 5 to 10 minutes, that typically refers to boosting the battery from 20% to 80%, not exactly a full top-up. Battery swapping sidesteps that issue entirely.

Each Nio station holds up to 21 batteries, which are charged using a mix of slow and fast charging based on the battery’s condition. Every battery is checked before and during the swap for performance, health, and damage, ensuring drivers always receive one that meets strict quality standards.

Vehicles are also scanned on entry, and the system can reject a swap if any safety concerns are flagged.

The entire process takes about 3 to 6 minutes, depending on steps like vehicle verification and system validation, roughly the same time it takes to fill up a tank of petrol. The system also verifies that the car is not a gray-market import and is eligible for service.

Another major benefit is the integrated digital network linking all swap stations. It calculates the vehicle’s range, directs the driver to the nearest available station, and minimizes wait times. In high-traffic areas, the flow is nearly seamless, with one car pulling in just as another pulls out.

Thanks to its speed and convenience, battery swapping has already gained strong traction in China, where around 65% of retail EV customers now use the system.

THE BATTERY AFTER LIFE

Offering battery-as-a-service naturally raises questions about what happens when the batteries outlive their use in cars. Lithium-ion batteries need careful handling, and Nio has factored that into its business model.

“Recycling and repurposing are part of the plan,” says Maktari. After around 10 years of use, most lithium-ion batteries still retain 90–91% of their original capacity. While early EV adopters may have worried about range loss—say, dropping from 250 km to 200 km, these batteries remain surprisingly efficient.

Rather than being discarded, many are getting a second life. They’re stacked and used as energy storage units for data centers, hospitals, and banks—any facility that can’t afford a power outage. This repurposing often stretches the battery’s usefulness by another 10 to 15 years.

Still, not every battery is fit for a second act. Maktari points out that a small fraction, around 10%, end up too damaged to repurpose. That includes batteries with internal short circuits, physical damage, or non-replaceable cells. In those cases, recycling is the only option.

“Fortunately, most battery packs are designed with individual cell replacement in mind,” he says. “So complete failure is rare. To address this in the UAE, we are currently in discussions with major international recycling companies to establish a reliable recycling and repurposing process.”

The plan is straightforward: any batteries under warranty that show issues will be sent to Nio’s headquarters in Abu Dhabi. There, the company’s recycling partners will assess whether the battery is fit for a second life, such as backup power in hospitals or data centers, or if it needs to be fully recycled.

“Realistically, we expect that 99% of these batteries will be repurposed rather than recycled, since most issues affect only a few cells, not the entire pack,” he says. As for local R&D operations taking off in the Middle East, Maktari is cautious. “It’s not about the vehicle itself. You need a local ecosystem—glass, wiring harnesses, packaging components that doesn’t happen overnight.”

Despite the buzz around Nio’s UAE launch, Maktari quickly points out that the real test lies in the region’s less mature markets.

“It’s a long-term strategy,” he says. “You have to build gradually. The challenge isn’t the technology. It’s aligning it with local infrastructure and how people think about cars.”

While, a seamless inter-GCC road trip in an EV may still be some way off, companies like Nio are making it a reality, sooner than later.