- | 8:00 am

Disney has big plans for Hulu

The entertainment giant has no timeline for killing the streamer’s app, even if it really wants you to watch via Disney+ instead.

Last week, Disney briefed the press on how it’s bringing the entire Hulu catalog into its Disney+ app, with a dedicated tab for accessing Hulu’s more adult-oriented fare. But despite all the headlines you might’ve seen about the Hulu app shutting down, Disney says it’s not happening anytime soon, if at all.

According to Disney, the company has no timeline for getting rid of the dedicated Hulu app, and will continue to sell stand-alone Hulu subscriptions. The company still sees Hulu as an important part of its streaming strategy, serving as a catchall for content that doesn’t fall under tentpole Disney brands such as Star Wars and Marvel. Outside of the United States, Disney is even ditching the Star brand that it used for this type of content as it tries to make Hulu a recognizable brand globally.

Jason Wong, Disney’s senior vice president of product management, tells Fast Company that Disney does want to shift Hulu subscribers over to its unified app. Both services are still growing and have a combined 183 million subscribers. A decision to wind down the stand-alone Hulu app, though, will depend on how customers respond to the Disney+ push.

“Our strategy is to build up the Disney+ application and make it a great place for both Disney+ and Hulu users. If you want to consume Hulu on the stand-alone Hulu app, you can continue to do that,” Wong says.

Hulu plus Disney+

Hulu launched in 2007 as a joint venture between NBC and Fox, with a focus on streaming network TV shows. Disney became Hulu’s majority owner after acquiring 21st Century Fox in 2019, and it bought out the remaining 33% stake from Comcast (which owns NBCUniversal) for $438.7 million in June. This gave Disney full ownership of a service with more than 55.5 million subscribers. (Disney+ has 57.8 million subscribers in the U.S. and Canada, and 127.8 million globally.)

Disney is now positioning Hulu as its brand for general entertainment, in contrast to the more family-friendly properties—Disney, Pixar, Marvel, Star Wars, National Geographic—that fall under the Disney+ banner. That covers originals from Hulu and FX, next-day network shows from ABC and Fox, and licensed content from other networks.

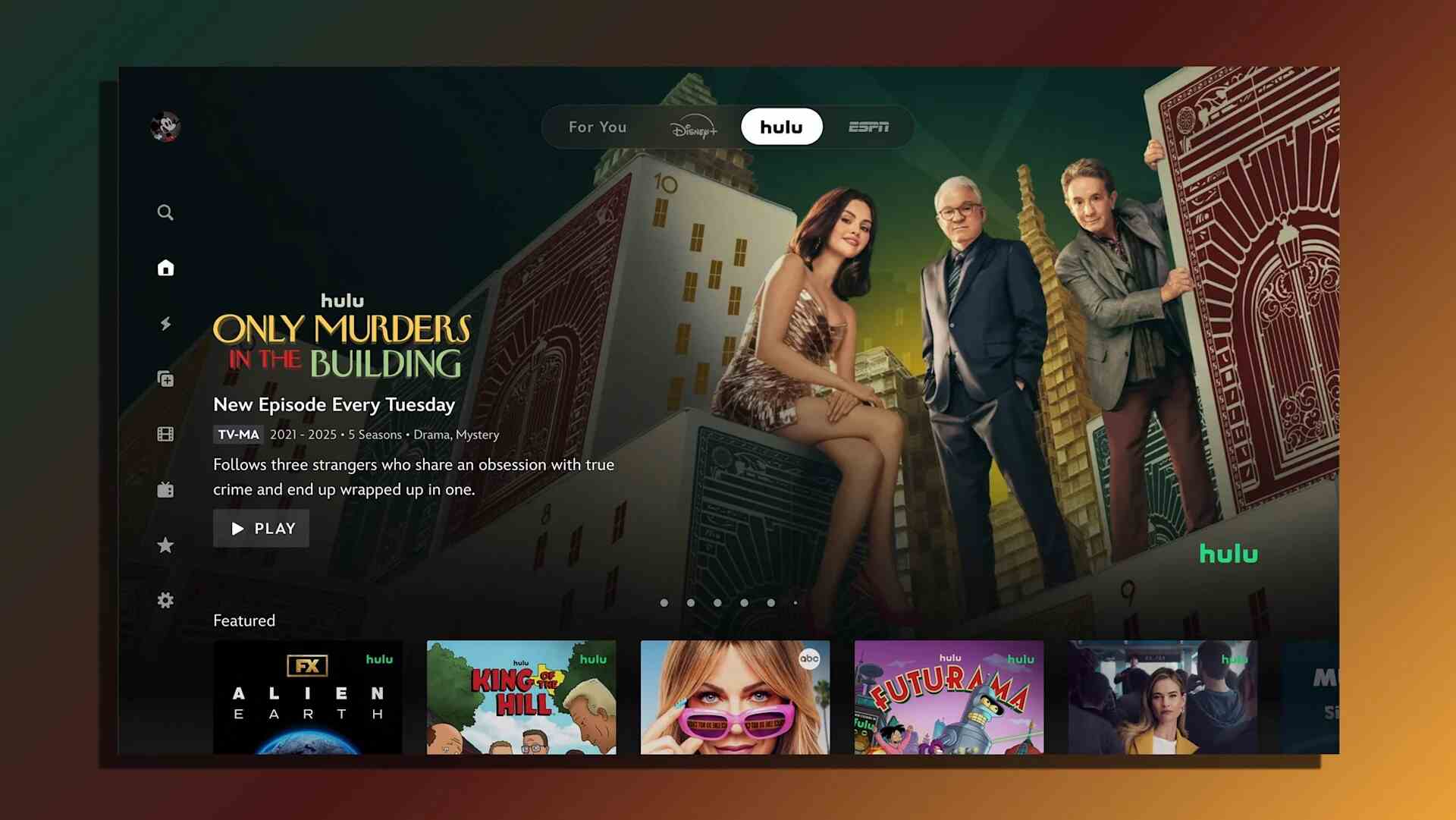

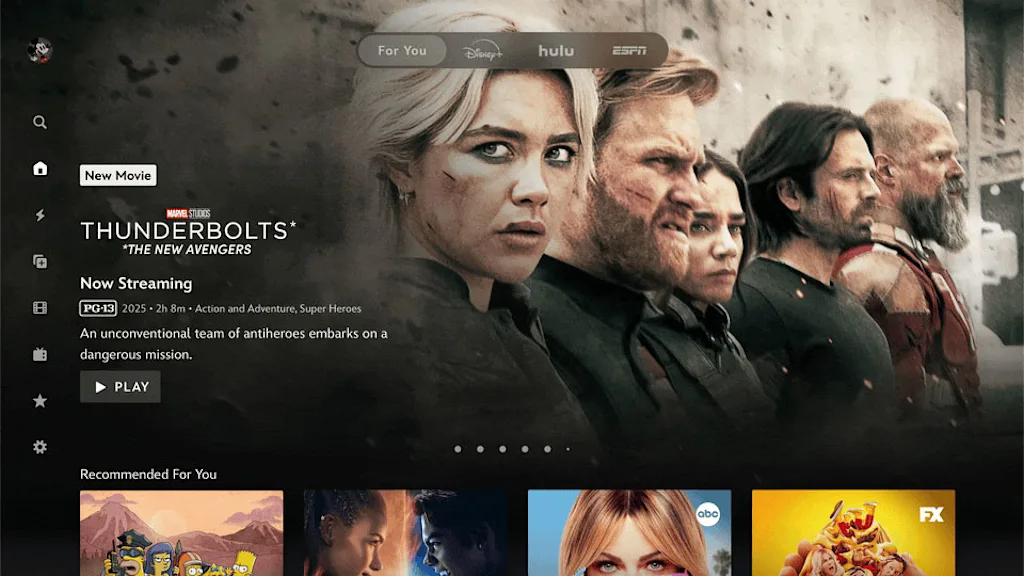

Still, Disney CEO Bob Iger has been talked up the value of having both services in a single app, and last week the company previewed what that app will look like. In the coming weeks, some Disney+ users will start seeing distinct Disney+, Hulu, and ESPN tabs at the top of the app, along with a “For You” tab with recommendations spanning all three.

This helps serve Disney’s goal of getting customers to pay for more than just one of its three services. Wong says customers will see tabs even for the services they’re not paying for, and the app will offer samplings of content from each.

“It’s to give people a bit of a taste as to what the breadth of our catalog offers, and encourages you to upsell into a bundle that makes sense for you,” he says.

The new tabs aren’t just about upselling, though. Wong says Disney’s also been refining its recommendation algorithms in the For You tab and wants to emphasize them more. This will help Disney make “bolder” recommendations knowing that users can always click into the offerings from each service individually.

“Now, if you know you’re in the mood for general entertainment or sports, it’s just one click up, two clicks over to Hulu, or three clicks over to ESPN, and it’s really fast,” he says.

What happens to Hulu from here?

Regardless of which app people use to access Hulu, Disney is adamant that it’s not going away as a distinct brand. If anything, it’s becoming more prominent. Last week, Disney ditched its Star brand for general entertainment outside of the United States. Its replacement? Hulu.

Disney had launched Star as its international entertainment brand in 2021, two years after taking over Star India and Fox’s Asia Pacific operations as part of its 21st Century Fox acquisition. It may be less attached to the brand after selling its majority stake in Star India for less than it expected as part of a plan to merge the business with Reliance-backed Viacom18.

The brand shift will require plenty of customer education from Disney. But Wong says this solves the problem of having fragmented marketing in different parts of the world.

“It’s going to strengthen and make it easier for us to talk about a unified app experience when we’re not talking about Disney+ and Star in some countries, and Disney+ and Hulu in the U.S,” he says.

As for Hulu in the United States, Wong acknowledges that having a single application may be more efficient for Disney in the long run, both from a technical and marketing standpoint. Still, it’s a long way from making that happen.

For one thing, Disney acknowledges that its work on tying Hulu and ESPN into the Disney+ app is incomplete. It has not yet demonstrated how it’ll integrate Hulu + Live TV, its $83 per month cable replacement service with features like DVR and a grid-based channel guide, though Wong says all of that will be coming to the Disney+ app eventually. The company also plans to iterate on its initial redesign based early customer feedback.

“What you see today is definitely not what all of us will be seeing even three or four months from now,” Wong says.

As it builds more features into the Disney+ app and starts nudging people to switch, it will start looking at how much time people spend in the app, how easily they can find what they want, and whether they continue to dip into the stand-alone Hulu app. The goal is for Hulu subscribers to prefer using the Disney+ app, but Wong says data from users will determine when that might happen.

“If, ultimately, our products make it hard for someone who just loves Hulu to get to Hulu content, we’ve failed,” he says.