- | 11:00 am

GCC sports tourism poised for boom as Saudi market targets $22.4 billion by 2030

The Gulf currently captures just 5–7% of global sports tourism spending, leaving room for growth as economies diversify beyond oil.

Saudi Arabia’s sports market is projected to nearly triple, reaching $22.4 billion by 2030, according to a new report by PwC Middle East, as Gulf countries step up efforts to capture a larger share of the $2 trillion global sports tourism industry.

The report, titled Game On for the GCC: Turning Sporting Ambition into Lasting Tourism Impact, estimates the Middle East’s sports sector at around $600 billion, growing at an annual rate of 8.7%.

Globally, sports tourism now accounts for 10% of total tourism spending and is expanding at a compound annual growth rate of 17.5%, expecting to surpass $2 trillion by the end of the decade.

PwC cautioned, however, that the region faces the risk of “one-off event fatigue” unless governments shift their focus from hosting major tournaments to developing a sustainable, year-round sports economy that drives repeat tourism, job creation, and long-term investment.

According to PwC, the Gulf currently captures only 5–7% of global sports tourism spending, leaving significant room for growth as economies diversify beyond hydrocarbons. The report emphasized the need to create experience-led destinations that combine sport, retail, leisure, and culture to extend visitor stays and increase spending.

It also highlighted opportunities to boost fan engagement through digital innovation, storytelling, and multi-day festivals, as well as to establish a connected GCC-wide sports ecosystem through improved travel links and unified marketing.

“Sports tourism has emerged as a cornerstone of destination strategy and a catalyst for hospitality investment,” said Jonathan Worsley, Chairman and CEO of The Bench, organizers of the Future Hospitality Summit. “It goes far beyond filling hotel rooms; it drives infrastructure development, elevates brand visibility and unlocks year-round demand, all of which the GCC is uniquely positioned to capitalize on.”

PwC also called for greater investment in women’s sports, youth engagement, and workforce development, noting that over 60% of the region’s population is under 35—a key driver of future sports demand.

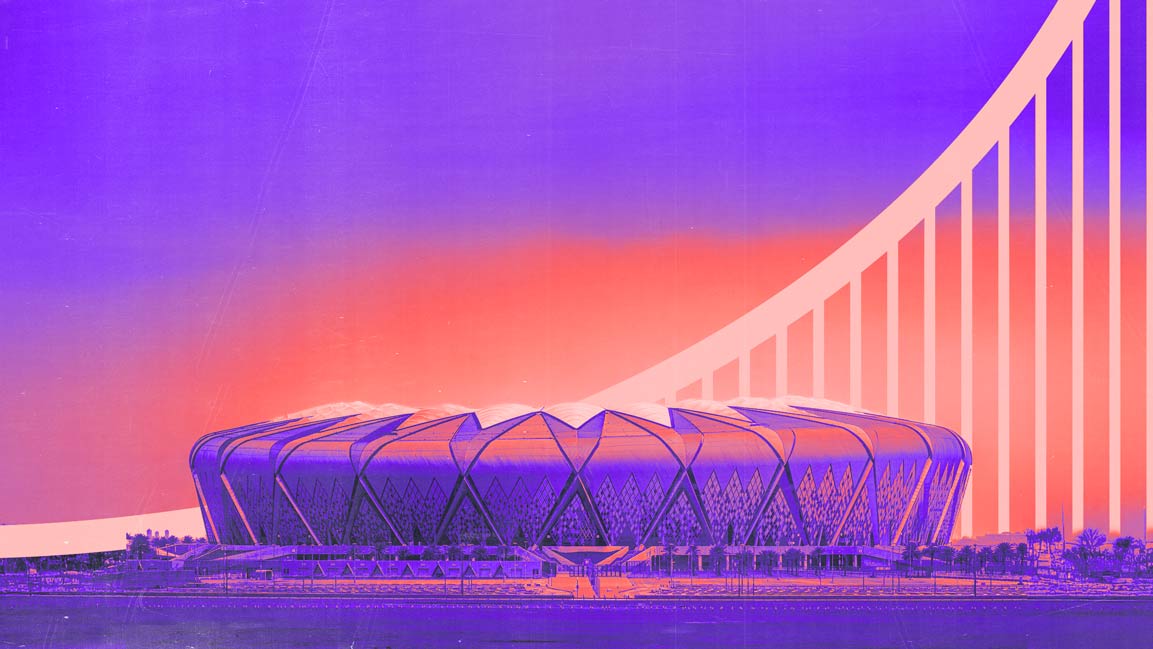

Both Saudi Arabia and the UAE have made sports a central component of their diversification agendas, following Qatar’s successful hosting of the 2022 FIFA World Cup. Saudi Arabia’s Public Investment Fund (PIF) is leading major initiatives, including a $1 billion investment in DAZN, new stadium developments tied to its 2034 World Cup bid, and the privatization of football clubs under Vision 2030.

The Kingdom is also investing heavily in infrastructure and major events such as the Esports World Cup and the Islamic Solidarity Games in Riyadh. Meanwhile, the UAE is expanding its sports ecosystem, with construction underway on a 24,000-seat air-conditioned stadium in Abu Dhabi and Mubadala Capital increasing its global sports investments.

Both nations are deepening their involvement in sports media, gaming, and fan engagement, signaling a regional shift from one-off global events to a sustained, year-round sports economy that drives growth across multiple sectors.