- | 12:00 pm

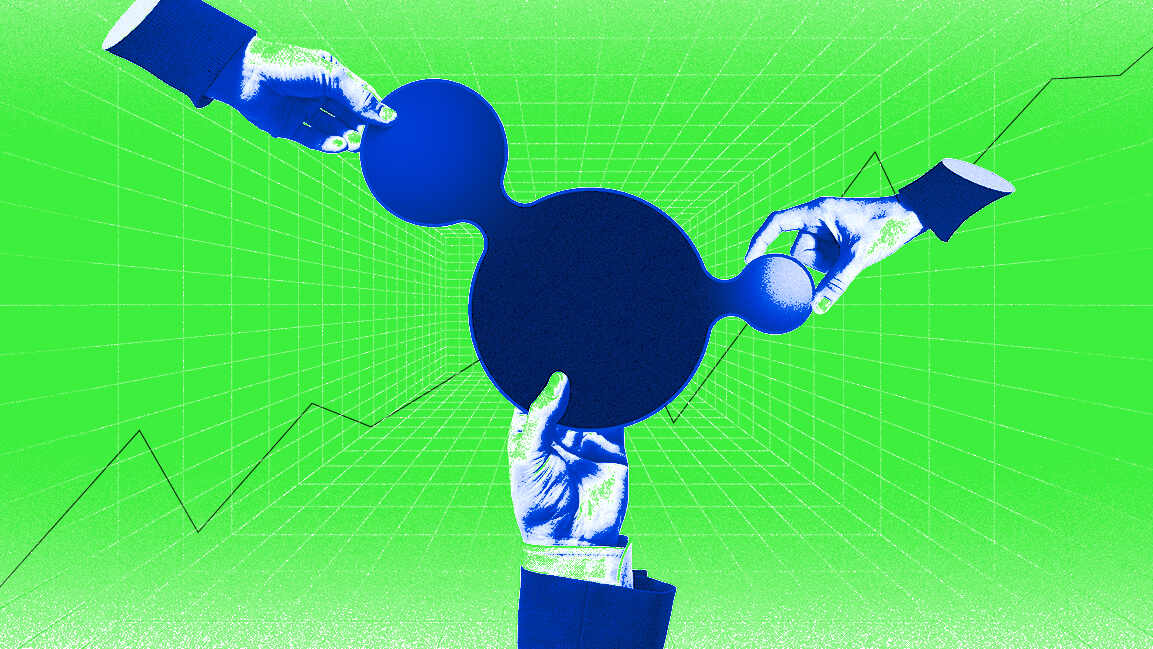

Are liquidity and policy support masking deeper risks in Gulf property markets?

In its six-month outlook to June, Markaz said GCC real estate is expected to stay in an accelerating phase

Gulf real estate markets are projected to maintain growth momentum into the first half of 2026, led by activity in Saudi Arabia, the United Arab Emirates, and Kuwait, according to a new report by Kuwait Financial Center (Markaz).

The analysis said continued expansion across the Gulf Cooperation Council (GCC) will be supported by steady economic growth, improving liquidity, and a more accommodative interest rate environment. Real estate development remains central to governments’ diversification strategies as they seek to reduce reliance on oil revenues.

In its six-month outlook through the end of June, Markaz said the GCC real estate market is expected to remain in an accelerating phase, supported by higher oil output, non-oil growth, government infrastructure spending, and anticipated rate cuts.

Improved liquidity and credit conditions are forecast to boost borrowing and investment across sectors, with real estate continuing to play a central role in regional economic development.

In Saudi Arabia, the Real Estate General Authority expects the kingdom’s property market to reach $101.62 billion by 2029, reflecting a projected compound annual growth rate of 8% from 2024.

The kingdom’s real estate market is expected to sustain growth into the first half of 2026 following a strong second half of 2025, supported by residential activity and tight office supply.

Residential transactions rose 17.9% quarter on quarter in the third quarter of 2025, with Riyadh and Jeddah posting price gains, while Riyadh office vacancy remained near 0.5%, driving prime rents up 7.3% year on year.

Demand has been supported by the Regional Headquarters Program. In October, Investment Minister Khalid Al-Falih said more than 780 companies had relocated their regional headquarters to Riyadh under the initiative, which offers corporate tax exemptions, withholding tax relief, and regulatory support.

Markaz said that despite a fiscal deficit of 3.7% of GDP in 2025, which is expected to remain similar in 2026, higher Vision 2030 spending should support construction and real estate demand. Population growth, with numbers reaching 35.3 million by mid-2024, up 4.7% year on year, is also underpinning housing demand.

The UAE’s real estate market recorded a strong performance during the first three quarters of 2025. In Dubai, transaction values rose 28.3% year-on-year to $150.88 billion, while Abu Dhabi reported total sales of $15.8 billion, up 75.8%. Transaction volumes in Abu Dhabi increased 42.3% to 15,800.

Markaz said that although Dubai’s annual sales have exceeded prior years for three consecutive years, sustainability concerns have emerged. It added that strong fundamentals reduce the risk of a sharp correction, though moderation is expected, with the market potentially peaking in the first half of 2026 as price and rental growth stabilize in Dubai and Abu Dhabi.

Kuwait’s real estate market is projected to remain stable through the first half of 2026, with land prices and rental rates expected to continue rising.

During the first nine months of 2025, total real estate sales rose 26.9% year-on-year to $9.92 billion, supported by growth across residential, investment, and commercial segments. Investment segment sales increased 60%, while residential and commercial sales rose 8% and 17.4%, respectively. Transaction volumes climbed 27.8% to 4,247. Land prices recorded annual gains across governorates, and rental rates in the investment segment rose steadily.

Markaz said Kuwait’s real GDP is projected to grow 3.9% in 2026, driven by higher oil production, stronger non-oil activity, increased project award,s and expected interest rate cuts, factors that are likely to support demand for commercial and industrial real estate.