- | 8:00 am

How Nvidia became a household brand

The chip maker has ridden the AI wave to a $1.1 trillion-dollar valuation and wide name recognition—even though most people aren’t exactly sure what it does.

Traditionally, a company works to create a familiar and admired brand, and if it succeeds, that adds to its value. But every so often, this process is reversed, and a company somehow becomes a widely known and admired name because of its remarkable market value. That seems to be the story of Nvidia in 2023. A company most hadn’t heard of last year is now one of six in the world currently worth more than $1 trillion. As The New York Times recently declared, it is “the most visible winner of the artificial intelligence boom.”

This is not the first time in the brief history of generative AI that a new household name seemed to emerge overnight. Earlier this year, ChatGPT creator OpenAI opened its API to third-party developers, and soon the range of established and startup companies announcing they were working with or integrating ChatGPT made it a kind of “Intel Inside” of AI. Then again, “Intel Inside” was actually a determined marketing effort that aimed in part for consumer familiarity, and ChatGPT is directly available to the public. Nvidia’s transformation from obscure tech company to name-check flagship of the machine learning era has been even more remarkable.

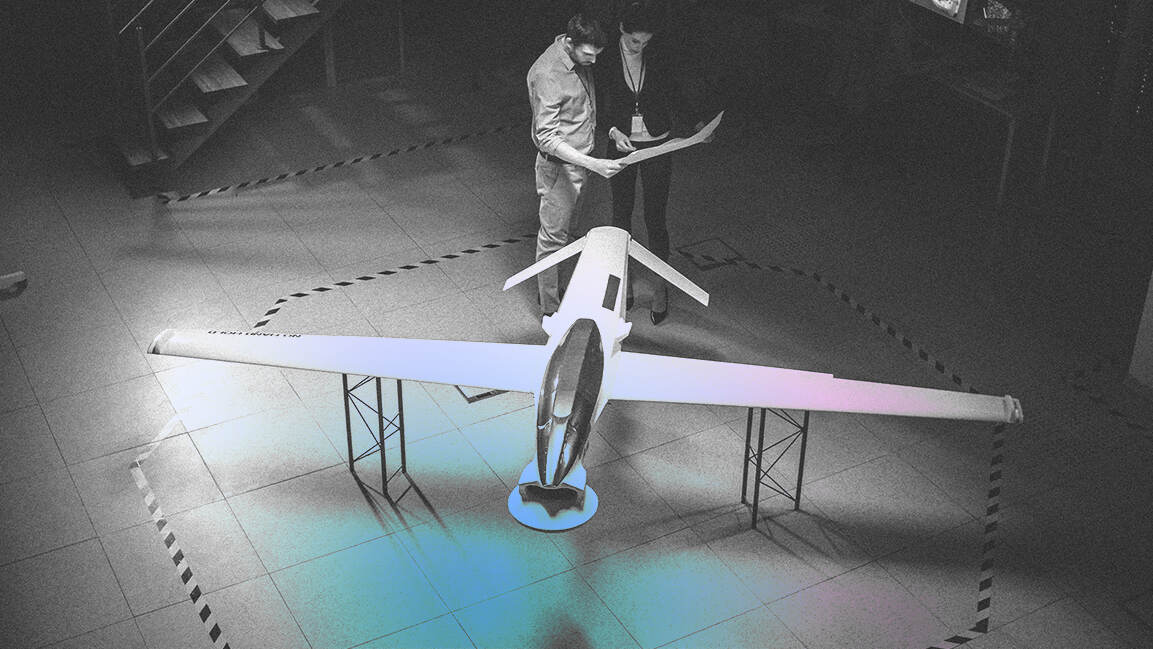

There was, of course, no shortage of general AI-related hype when Nvidia announced its first-quarter numbers back in May. But those numbers, and its projections, came in so far ahead of Wall Street expectations that NVDA had one of the biggest single-day jumps in market history, despite a choppy market at the time. Among other things, the company raised its expected revenue for the second quarter from $7 billion to $11 billion—a remarkable leap. At the time, Nvidia said that more than 40,000 companies use its chips (or graphics processing units—GPUs, as they are technically known) to power various machine learning and AI initiatives, services, and products.

More recently, when the company reported actual second-quarter numbers, they were even better: revenue of $13.5 billion, projected to reach $16 billion in the third quarter. Its share price soared again. Nvidia has tripled in value this year, making it the S&P 500’s top performer, and regularly one of the most active stocks in terms of trading volume.

This eye-popping share performance has helped put Nvidia in the distinct category of brand names that have reached a certain level of mainstream familiarity and a highly positive reputation as a kind of stand-in for an entire socio-tech trend, without actually selling anything to the public. That’s not unprecedented, but it’s rare. One example from an earlier tech revolution: Cisco. The maker of enterprise networking hardware was seen as part of the internet’s backbone in the late 1990s, when CSCO surpassed consumer-facing giants like Dell and Microsoft to become the most valuable company in the world. Few in the mainstream could explain what Cisco actually did, but many had heard of it and thought well of it. Its CEO, John Chambers, was a business press folk hero.

The Santa Clara-based Nvidia, which actually dates back to the early 1990s, was early in recognizing generative AI’s potential. Particularly in the past decade, it has built what the Times called “a nearly impregnable lead” in developing chips uniquely engineered to handle machine learning tasks.

Notably, the company seems to have been particularly adroit at cultivating and serving a kind of de facto community of AI developers—becoming, along the way, the chip brand those developers and other clients learned to depend on. Its founder, Jensen Huang, has evangelized about the significance of AI for years, giving Nvidia even more credibility with its customer base. So while its competition has obviously increased (everybody from Google to Intel has dipped into producing GPU chips), Nvidia has an estimated 70% share of the market.

That said, Nvidia’s strategy includes investing in and teaming up with some machine learning enterprises that may put it at odds with its own customers. And certainly its lineup of competitors is formidable, and will only get more so. More broadly, there’s no guarantee that the AI boom won’t overheat and stall, knocking Nvidia down a peg in the process: There’s already skepticism about the pace of development, startup challenges, and concern that NVDA’s rise is a function of a meme-stock-like frenzy.

Back when Cisco was the world’s most valuable company, it was the height of the dot-com boom; some predicted it would be the first company to hit a $1 trillion valuation. That didn’t happen. (Cisco peaked at around a $546 billion value in 2000, and is today worth about $232 billion.) Still, the company remains profitably in business; and the internet, for which CSCO was a sort of proxy, is clearly bigger than ever. But Nvidia may learn that there’s something even harder than achieving a role as a mainstream stand-in for an entire tech revolution—and that’s keeping it.