- | 9:00 am

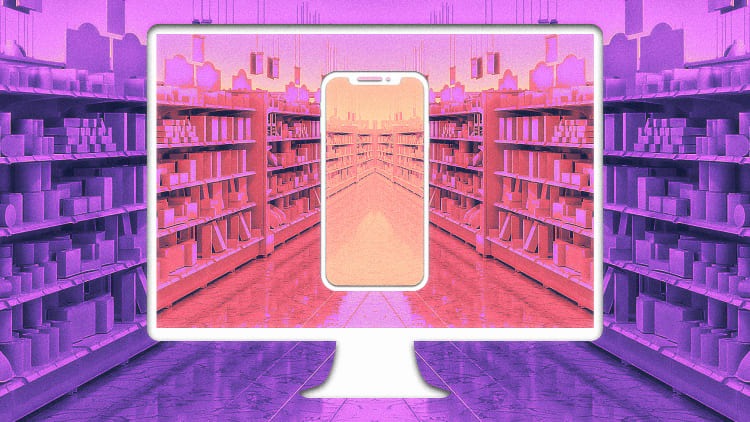

You’re still shopping on your computer—that will soon change

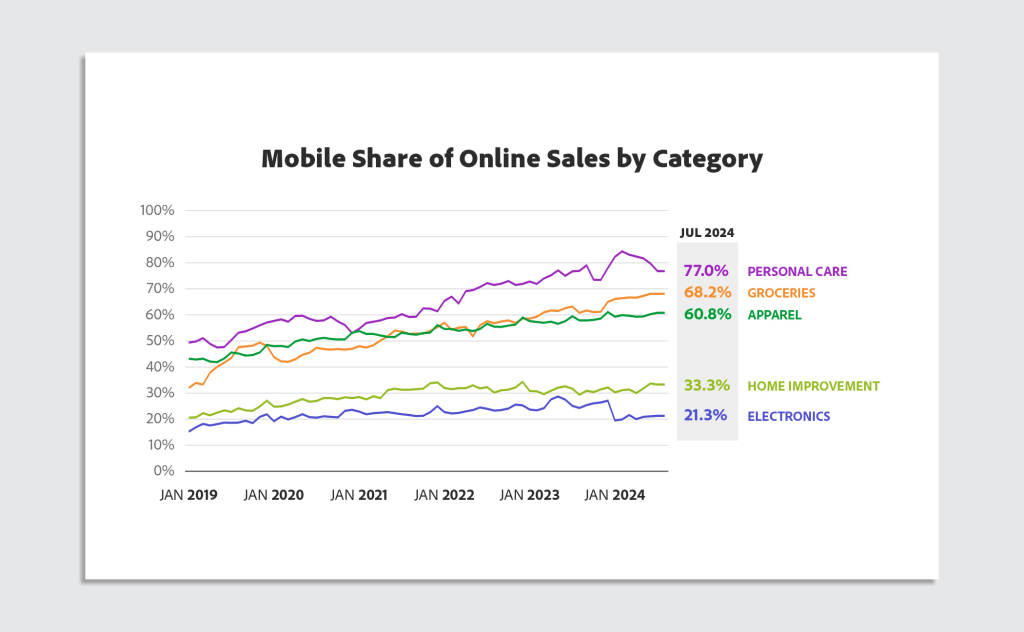

Desktop still rules online shopping, but mobile is gaining ground with some specific shopping habits.

Companies have been designing the web, apps, and online shopping around mobile-first for nearly a decade, and yet, a slight majority of shopping—52.3%—still happens on desktops, according to a new report from Adobe.

But desktop hardly owns every category during every shopping season. And the margins are now so close that, by 2025, Adobe predicts mobile will overtake desktop in overall sales as mobile has grown 10.2% year over year.

If you’re willing to dig a bit deeper, here are four big takeaways from the report, which analyzes one trillion visits to U.S. retail sites, 100 million SKUs, and 18 product categories—and points to a lot of design opportunities still to be tapped for mobile retail.

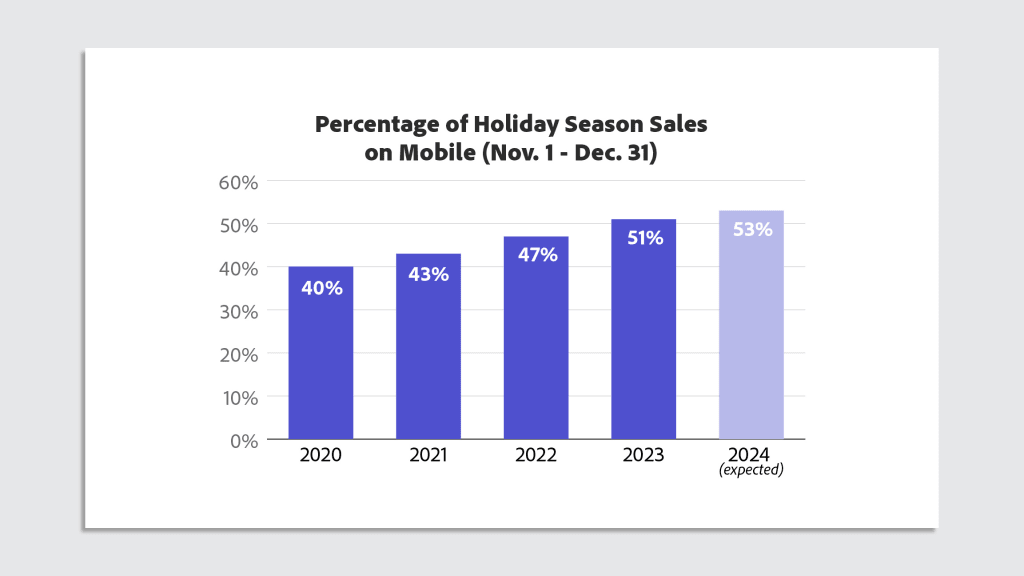

Mobile rules holidays, and impulse shopping, by design

Last year, 51% of all online holiday shopping was conducted on mobile devices (overtaking desktop for the first time). And this year, Adobe anticipates that lead growing to 54%. The reason? It’s likely linked to the urgent, limited time promotions and sales that come along with the holidays, the company claims. Nobody wants to miss a deal, so they’re that much more willing to chase it down on their phone.

This holiday halo doesn’t just include annual winter celebrations like Christmas and Hanukkah. They also include sales for Fourth of July and Memorial Day—and even the wholly corporate “holiday,” Amazon’s Prime Day. Mobile sales represent 51% across these non-winter holidays as we celebrate our days off by bargain hunting.

Cosmetics and clothing are big on mobile, even ignoring the role of influencers

Seventy-seven percent of the time, cosmetics and other personal care items are purchased on a phone rather than computer; 60.8% of the time, the same is true for apparel. It’s easy to hazard a guess as to why: Influencers across social media hawk these products frequently. Who can resist?

But as it turns out, Adobe shows influencers are only driving about 3% of the overall traffic from social media to retailers in personal care. (Such referrals actually grew by 10% year over year, but it’s still a relatively small market.) And notably, Adobe doesn’t track native sales conducted on platforms like Instagram and TikTok. So in other words, mobile sales are even larger in these categories than we think—and large even when independent of influencing.

So just why are cosmetics so much more popular on mobile? Adobe suggests it has a lot to do with price point: Personal care items tend to be inexpensive, and people are more willing to buy inexpensive items online. As for apparel, Adobe offered no distinct explanation for its popularity. But observationally, I’d point out that apparel apps and sites tend to be very well-designed for mobile. And to add upon that, apparel is often sold with the same limited time sales and perceived scarcity that makes mobile holiday sales so successful.

Groceries are a runaway hit on phones

Online grocery shopping is growing fast on mobile—68.2% of digital groceries are bought mobile rather than desktop now, which marks a 15% year-over-year growth. But why is this category taking off so fast?

No doubt, COVID popularized digital grocery shopping, and investment by Walmart, Kroger, and Target into their apps have something to do with it. But Adobe suggests that the routine habit of grocery shopping matches up well with mobile UX.

“Our take is that for some consumers, they tend to have a lot of repeat purchases in the groceries category—especially for staples like eggs or milk,” says Vivek Pandya, Lead Analyst, Adobe Digital Insights. “Mobile presents an easy way to quickly reorder these items.”

People still trust computers for big ticket items

If mobile shopping has any particular points of failure, it’s in two categories: home improvement and electronics, for which mobile accounts for only 33.3% and 21.3% of online sales, respectively. These two categories have also been more or less stagnant since 2019, all while personal care grew nearly 30% and the mobile grocery shopping share has doubled. By comparison, home improvement and electronics are total failures on mobile.

“Old habits can be hard to break, and e-commerce really had its start in a desktop-oriented world. It’s fair to say that for consumers, many are still hesitant to hit the buy button for larger purchases on a mobile device, which they don’t view as the ‘core’ channel,” says Pandya. “Another reason is that mobile experiences were a bit slow to improve. For years, shoppers dealt with UIs that lacked polish, poor navigation in some cases, and also less personalization.”

Indeed, a terrible UX (I’m looking at you, big box home improvement retailers), crossed with high price points, make it easy to imagine why consumers take a few extra moments to buy a backyard shed or new graphics card on their computer with a mouse and big screen. That said, any industry shortcoming is always an opportunity in disguise.