- | 9:00 am

Can the EV battery swapping services scale up in the Middle East?

The versatility of battery-swapping technology makes it suitable for various types of vehicles in the future.

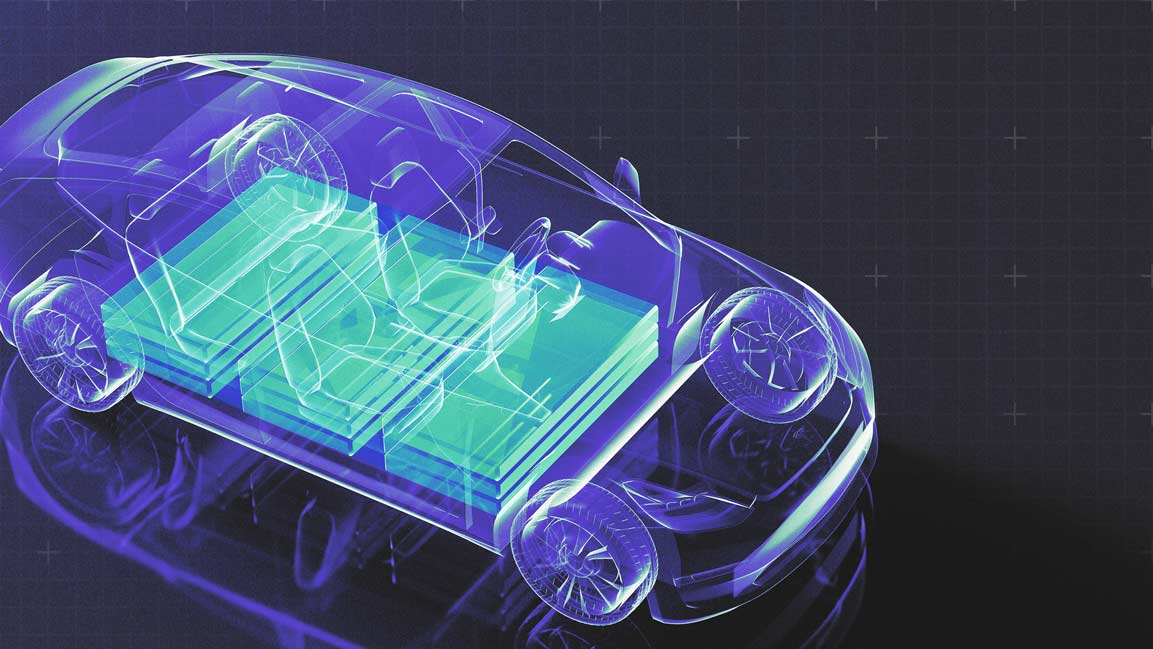

It takes two minutes to swap a depleted battery out of an electric vehicle (EV) and replace it with a charged pack. For many delivery drivers, speed matters immensely because the alternative is lengthy waits on the side of the road.

Electric car owners also don’t have to worry about sitting around waiting for their car to charge up. Some electric car owners in big cities in the Middle East can often plug into a charger overnight if they have a house of their own, but others are more likely to live in apartments that may not have chargers in a parking garage.

The swapping system is designed to be more convenient.

Right now, there are battery-swapping stations in and between major cities in the region. If a customer runs out of power and gets stranded, there are apps to send a mobile charging unit to give a quick charge or swap batteries.

That’s all to say that battery-swapping services are an important part of EV infrastructure if we want to see commercial fleets ditch gas for electricity.

Like how tire manufacturers benefit when car sales soar, the region’s battery swapping services anticipate a bright future, thanks to the increasing adoption of EVs.

The EV sector is poised to become a major player in the region’s transportation landscape.

Countries like the UAE and Saudi Arabia are leading the charge with comprehensive strategies, including developing local manufacturing capabilities, expanding charging networks, and offering incentives for consumers to adopt cleaner, more efficient vehicles.

Within a few years, electric cars will likely be as cheap to buy as cars running on gas, so battery-swapping services will also likely become more convenient and crucial. It is not surprising that the battery-swapping market is poised for significant growth from 2024 to 2030.

“Although it is too early to predict whether battery swapping will be the key solution to EV charging, it is gaining significant traction,” says Safak Yucel, Associate Professor and Associate Director at the Business of Sustainability Initiative, Georgetown University’s McDonough School of Business, Dubai EMBA Program.

“The appeal lies in reducing charging time and eliminating the inconvenience of traditional charging methods. Additionally, by transferring battery ownership from the end-user to the manufacturer or a third party, battery swapping lowers the upfront cost for consumers, addressing the cost-related hurdle of EV adoption,” he adds.

A MIXED SUCCESS

The concept of battery swapping isn’t new. The industry has tried it with mixed success, especially in the US. Better Place, an Israel-based startup that raised nearly $1 billion in funding and had opened a small network of charging stations in Israel by 2012, filed for bankruptcy in 2013 after it failed to make the model a success. Tesla tested battery swapping and opened a station in 2013 but then abandoned the idea to focus on building a network of superchargers.

However, China’s EV manufacturer Nio and San Francisco-based Ample have developed new approaches to offering battery-swapping services, arguing that now is the time for the model to succeed.

In the region, although more must be done to support battery-swapping service providers in building out quickly, companies are scaling businesses and have their eyes on the prize between the sustainability pitches, surging gas prices, and the rise of quick commerce.

In recent years, a new generation of EV battery-swapping services has emerged, such as Wize Power, which offers Battery-as-a-Service (BaaS) and swapping stations.

Reiterating that battery-swapping companies are gaining an edge on the infrastructure side of the EV ecosystem, its co-founder and CEO Alexander Lemzakov says, “Traditional EV charging can take from 30 minutes to several hours, depending on the charger type. Battery swapping reduces this time to 1 minute, making it much more convenient for drivers.”

“Charging stations can be set up in various locations, including existing gas stations, parking lots, and other accessible areas, reducing the need for extensive charging infrastructure,” he adds.

Battery-swapping services providers also add that by promoting standardized battery packs, battery-swapping can help alleviate compatibility issues across different EV models, potentially reducing costs and simplifying the logistics of battery replacement.

INVESTMENT IN THE SECTOR

But is this sector getting some love from the investors?

Globally, battery-swapping companies have had mixed results in attracting investment. The latest Global EV Outlook 2024 report highlights that while overall VC investments in clean energy startups, including EV and battery technologies, have decreased in 2023 compared to the previous year, the sector still shows potential.

“Startups focusing on EV charging technologies and battery components attracted significant early-stage VC funding in 2023, with $400 million for charging technology firms and $260 million for battery makers,” says Yucel.

In the region, although strategic commitment to sustainability aligns with the growth of the EV market, specific figures on VC investment in battery-swapping companies are not available.

“However, the overall trend indicates growing investment interest due to the potential for high returns and the alignment with regional sustainability goals,” says Lemzakov.

Last year, Terra raised $2 million in seed funding round to expand its electric vehicle and battery-swapping solution for last-mile delivery in the UAE. Neo Mobility raised $10 million.

“However, the nascence of battery swapping has yet to give a clear indication of its role in attracting substantial VC investment to the region,’ says Yucel.

HUGE POTENTIAL

This void gives investors an opportunity to increase the value of their cash, especially when battery swapping has huge potential to gain traction.

A clutch of delivery companies is racing to serve the growing market by offering electric last-mile deliveries to retailers and consumers in cities. There’s been an explosion in last-mile logistics, which has led to their fleets going green, which is no longer a question of environmental morality but economic feasibility.

No wonder the region’s quick-commerce companies are finding reliable allies in battery-swapping companies.

“Battery-swapping companies are increasingly forming partnerships with quick-commerce firms,” says Lemzakov.

He adds that Wize Power secured contracts with key last-mile operators and third-party logistics, which increased investor attractiveness as we prepared for the next investment round.

These partnerships are mutually beneficial. For quick-commerce firms, it reduces vehicle downtime, which is crucial for maintaining efficient operations and customer satisfaction. Battery swapping enables quicker turnarounds compared to traditional charging, thus reducing operational costs and improving delivery times.

For battery-swapping companies, collaborating with quick-commerce firms provides a steady demand for their services, helping them scale their operations and expand their network of swapping stations.

“Such partnerships are especially relevant in urban areas with high demand for rapid delivery services, where reducing downtime can significantly impact the bottom line,” says Lemzakov.

However, Yucel adds that the lack of standardization across vehicle battery units poses a major challenge, and convincing automobile manufacturers to produce consistent designs compatible with swappable batteries can be difficult. “By targeting large fleets, battery-swapping firms can achieve scale.”

While battery-swapping technology has initially found a strong market in two-wheeler last-mile delivery services due to the high turnover of vehicles and the need for quick recharges, it is expanding to passenger cars.

“In the region, where long distances and high temperatures can impact battery performance, battery-swapping offers a practical solution for both commercial and private users, ensuring vehicles are always ready to go with minimal downtime,” says Lemzakov.

The versatility of battery-swapping technology makes it suitable for various types of vehicles in the future.

While other segments of the transportation industry, such as heavy-duty trucks or public transportation, could be electrified in the future, the technology and infrastructure for battery swapping are not yet widely applied in those areas, according to Yucel. “However, the market could expand in the coming years as demand for efficient and scalable EV solutions grows.”

Building EV swapping services involves a significant investment. Innovative financing solutions, developing batteries with longer lifespans, and recycling and repurposing used batteries are needed to achieve scalability.

For now, the joint efforts of EV manufacturers, battery suppliers, research institutions, technology companies, financiers, and governments are key to accelerating EV adoption, with battery-swapping services playing a pivotal role.