- | 9:00 am

How do we transform markets so that sustainability isn’t a choice but an imperative?

A long-time sustainability consultant realizes that convincing companies one by one to make sustainability commitments isn’t a viable long-term strategy any more. We must change the market incentives.

I have spent 50 years helping the world focus on making individual businesses more responsible, a story I tell in my new book, Tickling Sharks. At the end of 2024, I now see this approach as uncomfortably like cleaning up individual fish before plopping them back into dirty, polluted waters.

My rethink has been spurred by seeing leading CEOs announcing pullbacks on their climate and wider sustainability commitments. And if I had to boil down the top management excuses, they are saying that they know they must transform, but that the markets are not ready yet—indeed, are often pushing back.

You really do wonder whether they have absorbed the lessons of Clayton Christensen’s bestselling book The Innovator’s Dilemma? Incumbent industries always make such excuses as they find themselves locked into fading markets. I recently worked with the rising cohort of senior executives at Mercedes-Benz in Stuttgart, which just happened to be in the wake of their CEO’s announcement that the company would not now meet its publicly declared 2030 target of 100% electric vehicles. In the meantime, Chinese brands like BYD make quality electric cars at price points that once would have seemed like science fiction. Slapping near-50% tariffs on such imports, as the EU plans to do, can only hold back the rising tide for so long.

So, at a time when influencers increasingly talk about regeneration and rewilding, my own focus has expanded from rewilding farmland and urban spaces to rewilding markets. And no sector will feel the impact of the coming disruptions more intensely than energy.

You sense that energy sector leaders know this in their bones. At a CEO breakfast roundtable I attended at this year’s World Energy Council summit in Rotterdam, for example, a CEO called for a global carbon tax—and lived to tell the tale.

The event’s theme was “Redesigning Energy for People and Planet.” Once, that would have implied redesigning companies alongside their boards, business models, and supply chains. Today, leaders sense that we must work out how to redesign markets—no trivial task.

In her opening speech, WEC Secretary-General Angela Wilkinson, who I first met when she worked at Royal Dutch Shell, noted that the words energy transition have become “one of the most frequently-used, politically-loaded and polarizing phrases of recent years.”

She continued: “We also know that today’s energy systems are not fit for purpose. The urgency to secure more energy for sustainable development and to decarbonise all energy uses, not just supplies, is crystal clear.”

But for anyone looking for silver bullet solutions, she warned: “The uncomfortable news is that there is no one-size-fits-all solution. No quick and easy fix. Complex coordination challenges cannot be ignored or resolved, even with AI or other technology innovations. Success depends on the capabilities of whole societies to manage energy in a new era of globally inclusive, climate-resilient, sustainable development.”

During the event, I spoke at a Transformational Leadership session alongside two other market catalysts: first, Philippe Joubert, former president of Alstom Power, founder and CEO of Earth on Board and a longstanding trustee of one of my favourite NGOs, ClientEarth; and, second, Doris Honold, formerly with Standard Chartered and now board chair at the Climate Bonds Initiative.

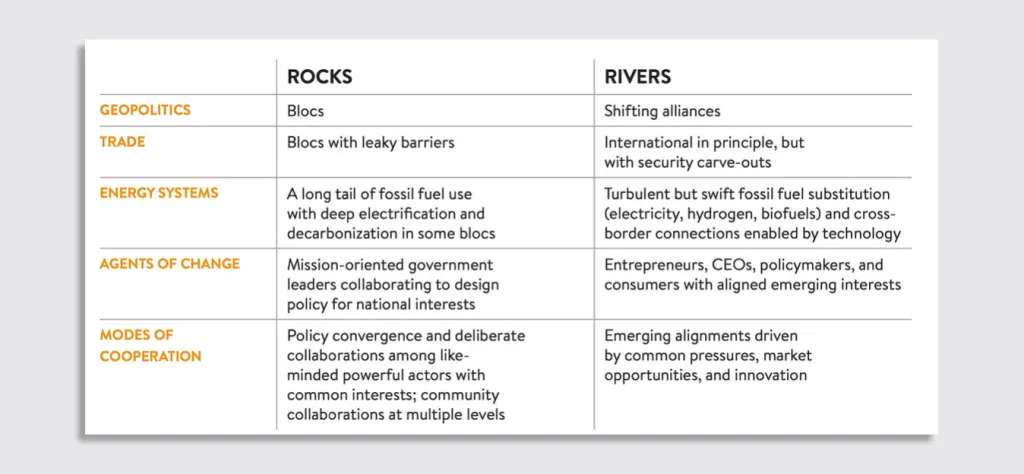

WEC talks of an “energy trilemma”, with tomorrow’s healthier energy systems needing to be increasingly secure, equitable and environmentally sustainable. This trilemma will play out differently depending on which of WEC’s two scenarios turns out to be closest to the emerging reality—or realities. The scenarios, presented at the CEO Roundtable, are “rocks” and “rivers.” To dig deeper, take a look here, but here’s a quick summary:

Some people will hunker down as “rocks,” slowing progress wherever they can. Still, it’s interesting to see fossil energy nations like Saudi Arabia and the UAE already thinking through the end game on oil. But even they, I suspect, will be caught out by abrupt shifts in market tectonics—as insurgents play the “rivers” game to upend incumbents.

If you want a sense of what this could look like, consider RE100, launched by the Climate Group to aggregate corporate demand for renewable electricity. Kicking off with 100 companies, it now has over 400, all committed to ultimately buying 100% renewable electricity. Their aggregate consumption of electricity is already equivalent to that of a country the size of France. As they say, the future’s already here.

And what goes for energy also goes for every other sector you can think of. So, yes, let’s continue cleaning up entire shoals of corporate fish, but we must also now devote more time to cleaning up the commercial seas and oceans in which they swim.