- | 9:00 am

How Egyptian companies are capitalizing on the construction boom in Saudi Arabia

Saudi Arabia aims to increase homeownership for millions of families across the kingdom to 70% by 2030

Egyptian real estate developers are expanding in Saudi Arabia, partnering with the government and local entities to establish commercial, residential, and mixed-use properties there.

The launch of the housing program, which aims to increase homeownership for millions of families across the kingdom to 70% by 2030, is a key part of this growth.

Egyptian developers are, therefore, capitalizing on this opportunity. Commenting on this trend, Catesby Langer-Paget, Head of Savills Egypt, one of the world’s leading property advisors, says, “We are indeed observing a trend for Egyptian real estate developers expanding into Saudi Arabia. This is due to economic opportunities, strong demand for housing, cultural and economic ties, competitive advantage, and regional presence.”

MARKET OPPORTUNITY

Like Egypt, Saudi Arabia has a growing young population. About 70% of the population is estimated to be under 35, driving the need for accessible and affordable housing.

To keep up with demand, Saudi Arabia will need to build 115,000 homes each year for the next six years to hit the country’s homeownership targets, according to global real estate consultancy Knight Frank. As such, development projects are aggressively on their way in the kingdom.

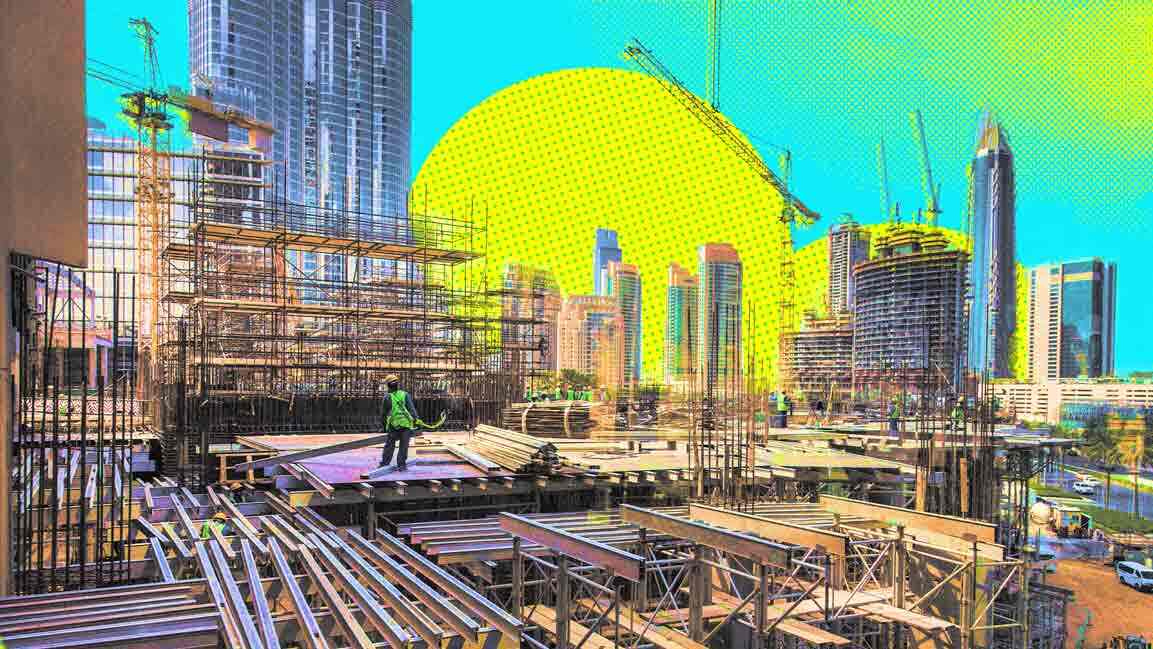

Yazeed Al-Shamsi, co-founder and CEO of Ejari, a prop-tech startup in Saudi Arabia, is seeing firsthand the impact of these projects. “It’s one of the largest construction sites in the world,” he says.

“Everywhere you go, you see cranes. You see, something is being built, not just in Riyadh, but in other areas across the country.”

However, this growth is not only being fueled by housing demand for Saudi nationals. While the homeownership target is indeed creating a need for more homes for the country’s young population, another segment is also expected to accelerate this growth—expats.

According to a survey by Knight Frank, 77% of expats in the country desire home ownership. This is partly due to the new premium residency visa, which aims to attract global talent and increase investment in the kingdom.

In addition, as part of the Regional Headquarters Program (RHP), which encourages companies to relocate their headquarters to the country, more expatriates are expected to come to Saudi Arabia, increasing housing demand. “The influx of expatriates and a young population further drives the need for diverse housing options,” adds Langer-Paget.

According to Al Shamsi, this pressure to create more homes is good for the country’s housing market, especially since rent properties have increased by 35% in the last three years. “As you increase more stock in the ownership bucket, the expectation is there will be less pressure on the rented units in the long and short term, which will be helping supply to the market, bringing rent inflation down, which has been considerably high in the last few years,” he says.

CAPITALIZING ON GROWTH

Egyptian developers are making their way to the kingdom, capitalizing on this growth. The real estate sector in Egypt is a strong and booming industry, contributing 7.1% of Egypt’s GDP or $9.1 billion in H1 2022-2023, according to Statista. As such, local developers are bringing their expertise to this growing market, seizing on investment opportunities in Saudi Arabia.

Talaat Mostafa Group (TMG), a leading Egyptian real estate company, is expanding outside the country for the first time to develop a mixed-use project in Banan City in Riyadh in partnership with the Saudi National Housing Company. The city is expected to house an estimated 28,000 residential units when completed.

Tatweer Misr, another prominent Egyptian real estate development company, has partnered with Naif Alrajhi Investment to establish a joint venture in construction and real estate investment. The partnership aims to develop residential, commercial, and hospitality projects, among others, in the kingdom.

Ahmed Shalaby, co-founder, President, and CEO of Tatweer Misr, commented on the partnership, saying, “The strategic partnership with Naif Alrajhi Investment is a first step in the company’s march towards expansion in regional markets to replicate its distinguished experience in urban development in Egypt. Tatweer Misr chose to start in Saudi Arabia in light of the economic and urban boom the kingdom is witnessing and the incentives it offers to encourage investment.”

Other Egyptian developers, including Mountain View and Palm Hills Development, are also entering Saudi Arabia. In collaboration with Maya Real Estate Development and Investment, Mountain View has already acquired its first plot of land in Riyadh to develop an estimated 500 housing units. Meanwhile, Palm Hills Development has partnered with Saudi Arabia’s Dallah Investment to develop 15 new schools in the next decade, alongside other projects in the country.

Besides providing much-needed housing units, Al Shamsi believes these projects will bring expertise and market know-how to the country. “It’s bringing in property experience from other stakeholders who’ve done it before and know how to do it,” he says.

OVERCOMING ECONOMIC CHALLENGES

These developments come as Egypt is struggling with economic instability. Since early 2022, the Egyptian pound has lost more than two-thirds of its value against the US dollar. Coupled with rising inflation, real estate companies are reeling from the impact of a weakening economy. Limited access to foreign currency is also making it difficult for companies to bring in goods and the necessary products for construction.

“Economic challenges, particularly inflation and currency devaluation, are affecting the real estate sector in terms of affordability as they are putting pressure on consumers’ purchasing power,” says Langer-Paget. “Construction and financing costs have risen significantly, tightening developers’ margins and potentially delaying some projects.”

However, while economic challenges affect real estate developers in Egypt, they also present opportunities to grow beyond their borders and develop long-term projects. “Despite some short-term market volatility, the macroeconomic challenges also present an opportunity for creating a more sustainable, demand-driven market,” he says.