- | 9:00 am

Is ‘opulomania’ a growing problem in the Gulf?

Addiction to buying high-end goods is leading to financial strain, emotional distress, and identity crises.

From gold-encrusted coffee to luxury cars and handbags, the Middle East’s relationship with luxury is impossible to miss. Today, the Middle Eastern luxury goods market is estimated at around $15.85 billion. It is expected to double in size by 2030, driven mainly by the UAE and Saudi Arabia, according to Boston Consulting Group.

This is giving rise to a new malaise. Often dubbed opulomania, the obsessive pursuit of luxury goods, it is, in many instances, a stand-in for emotional well-being, identity, and social validation.

Fuelled by social media and rising wealth, opulomania, despite its social acceptance, carries real costs. It is leading to financial strain, emotional distress, and identity crises, especially among the working middle class.

According to Akshay Sardana, Vice President of Strategy and International Development at The Continental Group, the region’s relationship with luxury isn’t new. “It predates both the oil economy and Instagram,” he says. “That legacy hasn’t disappeared — it just manifests differently. Today’s expression isn’t through gold-threaded cushions but through sneaker drops, G-Class SUVs, and watches that require a background check and blood type to acquire.”

This cultural comfort with conspicuous consumption contrasts with more discreet displays of wealth in other parts of the world. Sardana notes, “In other regions, wealth might lean toward discretion. Here [the Gulf], it’s more often about celebration.”

Jan Gerber, CEO of Paracelsus Recovery, believes social media plays a central role in amplifying such lifestyles. “It presents a constant stream of curated images that suggest success is synonymous with visible wealth. This drives us to consume not out of enjoyment, but from a need to be perceived in a certain way.”

For Kartik Iyer, a Dubai-based podcaster, the impact of this cycle is unmistakable. “We’ve gone from ‘Save for your future’ to ‘Fake it till you max out your credit card,’” he says. “The algorithm doesn’t reward financial discipline. A post about building an emergency fund will get only a fraction of the views of a Gucci unboxing or a 7-star getaway.”

OPULOMANIA, DECIPHERED

While opulomania is not a recognized clinical disorder, Gerber describes it as a psychological defense mechanism. “It’s the compulsive need to acquire luxury goods to manage distressing emotional states,” he says. “It appears as compulsive shopping, obsessive comparison, and identity construction through brands.”

This mechanism is cyclical and unsatisfying. “The anticipated satisfaction — the idea that ‘once I have X, I’ll feel whole’ — never arrives. It leads to a cycle of pursuit and disappointment, not unlike addiction,” Gerber adds.

He notes that Opulomania is often entangled with other mental health issues, including anxiety, trauma, low self-esteem, and loneliness. “It’s never in isolation — it’s always part of a broader clinical picture,” he emphasizes.

DESIGNER DEBT AND CREDIT COUTURE

Luxury spending in the Middle East spans two distinct financial realities. At the top, the ultra-wealthy tend to operate with cash-heavy clarity. “At the other end, you have installment illusions — BNPL as the modern layaway, dressed in Loro Piana,” says Sardana.

There’s a growing financial strain among mid-income earners trying to keep up with appearances. “Spending is as much about belonging as it is about aspiration. People are optimizing for validation, not just balance,” he adds. This includes personal loans for destination birthdays and credit cards maxed out for matching luxury sneakers. “Aspirational spending has moved from occasional to operational,” Sardana says.

Iyer says the issue often shows up in his DMs. “People finance electronics, vacations, and clothes using BNPL and rack up debt in the tens of thousands…People pay for stuff they don’t need, with money they don’t have, to impress people who don’t care.”

The emotional motivations behind luxury purchases are often overlooked. Sardana explains, “People are juggling multiple credit lines for lifestyles that look Forbes-worthy — but their balance sheets tell another story.”

He refers to this phenomenon as the “invisible influencer tax,” describing how borrowing is used to maintain curated narratives for social media.

However, he also sees signs of a countercurrent. “Some Gen Z clients are pushing back. They’ll buy the Rimowa, but they know the Depop value too. We’ve had people opt for impact portfolios over designer bags. It’s a reminder that financial tools are being used in more personal, socially embedded ways.”

Men and women experience luxury-related pressures differently. For men, luxury signifies power and provision. For women, it’s about beauty, elegance, and maintaining the family’s status. “But in both cases, luxury becomes a form of social performance tied to self-worth,” says Gerber.

Sardana adds that these decisions are not reckless but deeply cultural. “Short-term savings are often used for social obligations — weddings, hospitality, seasonal clothes. These are responses to expectations that carry real weight.”

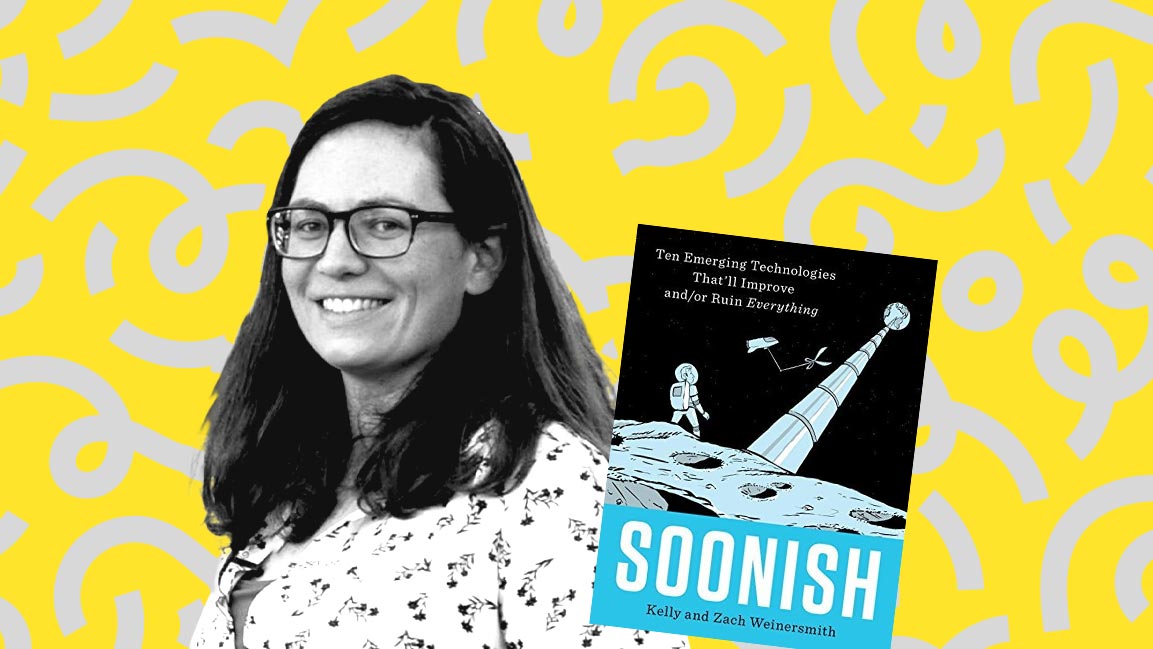

DO WE NEED FINANCIAL LITERACY?

Will financial literacy help curb opulomania? Probably not. Sardana says, “Most programs treat overspending as a knowledge gap, but the issue isn’t that people don’t understand the cost of debt — it’s that those principles feel disconnected from how people live.”

He believes financial education must evolve. He adds that telling someone in their 20s to invest in an index fund instead of buying a designer bag misunderstands the emotional return they’re seeking. “Financial literacy can’t fix a dopamine addiction.”

Instead, he advocates for an approach that stops moralizing and starts contextualizing. Real literacy helps someone realize that retail therapy is often just therapy in disguise.”

We’ve normalized the idea that more luxury equals more happiness, but it’s often just a distraction from deeper emotional needs.

Iyer is part of a new wave of influencers reshaping financial aspirations. “I’ve consciously moved away from showcasing luxury labels in my wardrobe,” he says. “Instead, I focus on reframing what aspiration looks like — making saving smart, building assets, and earning passive income feel aspirational.”

He stresses that creators are responsible for showing the full picture and believes platforms must also do their part. “Imagine if the algorithm boosted content that made people smarter, not just more envious. That’s the shift we need — from flexing to empowering.”

Countries like the UAE and Saudi Arabia have positioned themselves as global capitals of ambition and luxury. Gerber says, “When luxury is normalized and expected, those who can’t keep up often internalize a sense of failure. It sets the stage for mental health issues, addiction, and opulomania.”

Luxury in the Middle East is more than a market — it’s a mirror that reflects aspiration, emotion, identity, and, increasingly, anxiety. But behind the glow of Rolexes and Rimowas, luxury addiction often includes debt and distress.

Sardana acknowledges this dynamic but sees promise in the region’s evolving consciousness. “Yes, opulomania is real. But beneath the surface, there’s a generation asking better questions: What does luxury mean to me — and do I own it, or does it own me?”