- | 9:00 am

The lithium rush: How the UAE and Saudi Arabia are racing to power their EV ambitions

Experts say securing the lithium supply chain would help to reduce dependency on imports and lower costs

The UAE and Saudi Arabia, countries that relied on oil for decades, are spending billions to develop an automotive industry and turn themselves into hubs for electric vehicles (EVs) manufacturing as part of attempts to diversify their economies.

But there’s a catch, which raises questions about the commercial viability of the EV dream. To become a hub for EVs, countries must overcome obstacles, including a lack of infrastructure, talent, and raw materials, especially lithium.

It is crucial to bolster domestic lithium production – enough to meet the demand for millions of EV batteries, significantly more than all EVs currently on roads.

The kingdom established its EV brand, Ceer, and built an EV metals plant. Its sovereign wealth fund aims to produce 500,000 EVs annually by 2030.

The UAE plans to build an electric vehicle assembly facility in Abu Dhabi’s industrial zone to manufacture thousands of cars a year with smart electric firm NWTN, which is looking to increase the share of electric and hybrid vehicles in the market by 50% by 2050.

All these will boost demand for battery materials in both countries. To meet the demand, both countries need to set up facilities to process lithium locally.

The forecast is that the total number of EVs in the UAE will exceed 370,000 by 2032, representing 11% of the country’s passenger vehicles.

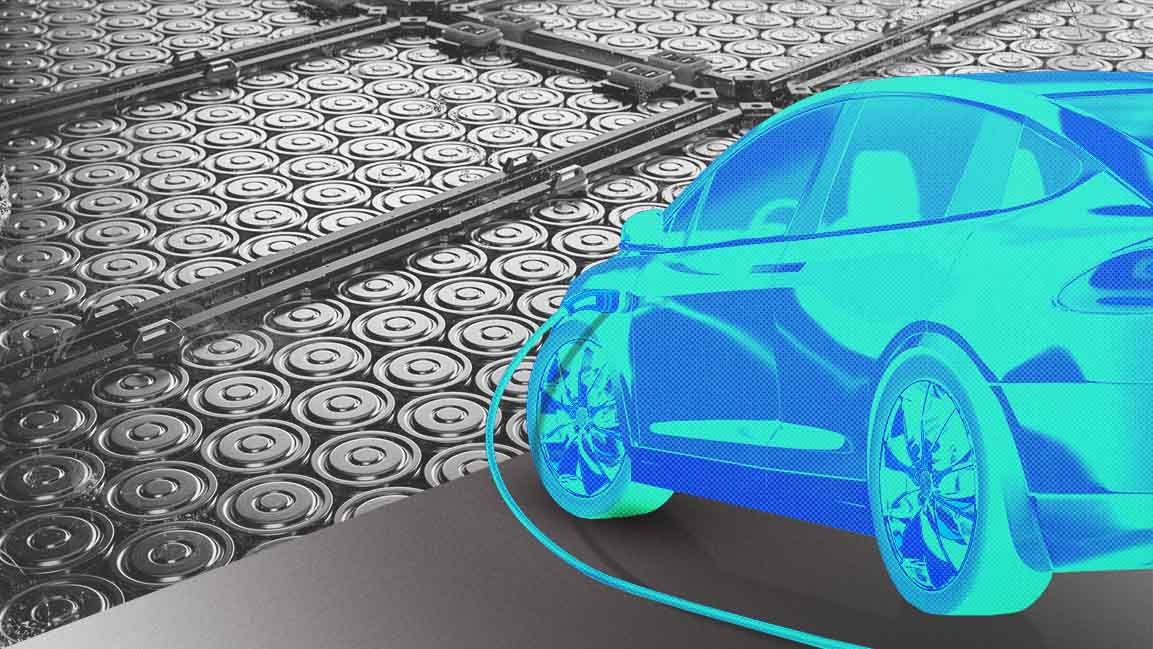

Lithium is a key mineral used in battery manufacture, which analysts say the EV industry will depend on for years to come, even though cheaper battery technology alternatives using less or no lithium are being studied.

In April, at the World Economic Forum’s special meeting in Riyadh, Minister of Industry and Mineral Resources Bandar Alkhorayef told Reuters, “Lithium is a very important mineral that happens to be part of a very important part of the supply chain, especially for batteries. I wouldn’t imagine that we would live without it.”

Furthermore, lithium’s role is also becoming increasingly important as the region moves to renewable energy sources and channels investment into creating a lower-carbon economy.

“Local production of lithium batteries is a key enabler for the energy transition and scaling of EV adoption in the Middle East by ensuring a stable and timely supply chain for OEMs,” says Karim Henain, partner at Bain and Company Middle East.

SECURING DOMESTIC SUPPLIES

While both countries are sourcing lithium from overseas as they look to produce EV batteries and invest in the electric vehicle sector, there are now gradual attempts to secure domestic supplies. Although, this is at an early stage.

“Securing the lithium supply chain would help to reduce dependency on imports, lower costs, and enhance energy security, enabling the region’s EV and renewable energy ambitions,” says Konstantin Lyakhov, Partner in the Energy and Process Industries Practice at Kearney Middle East & Africa.

“Saudi Arabia and the UAE are investing not only in lithium extraction technologies but also in global lithium markets to secure their future lithium demand,” he adds.

Attracting electric vehicle manufacturers also plays a significant role in enabling both countries’ economic vision.

Last September, Lucid Group, a California-based EV maker, opened its first plant outside the US in Jeddah, with an initial capacity to produce 5,000 EVs a year after the Saudi government pledged to buy up to 100,000 vehicles from it over ten years. Lucid is preparing to open a complete build unit, a factory capable of manufacturing a car, in 2026, for which construction has begun.

The PIF, which owns an over 60% stake in Lucid, invested billions in the company.

Reportedly, EV industry leader Tesla is in early discussions about setting up a manufacturing plant in Saudi Arabia.

However, plants can’t have operations up and running and are inefficient in bringing parts, especially the key material for making the batteries that power EVs, from local and global suppliers.

“Saudi Arabia and the UAE are investing in lithium processing facilities and forming strategic partnerships to secure a stable lithium supply for local battery production. In addition, there are several regional investments in the global battery value chain to secure access to and ultimately localize battery production,” says Henain.

INITIATIVES AND PARTNERSHIPS

As countries compete to secure the critical mineral, Saudi Arabia’s flagship mining company, Ma’aden, has started working to extract lithium from seawater and salinated discharges from the kingdom’s oil fields. It’s in the pilot phase.

Earlier this year, there were reports that Saudi Aramco and Abu Dhabi National Oil Company are in the very early stages of work to extract lithium from brine in their oilfields, which avoids the need for costly and environmentally challenging open-pit mines or large evaporation ponds.

Ma’aden declined to provide details on the type of lithium extraction technology used but said they’d be happy to discuss it in the near future “when we are in more advanced stages.”

Ma’aden is 67% owned by the Public Investment Fund (PIF), the kingdom’s sovereign wealth fund, and launched Manara Minerals, a joint venture with the PIF, to invest in mining assets abroad.

Manara Minerals is looking at opportunities to invest in lithium production in Chile. Reports are that Saudi Arabia is trying to secure a partnership with Codelco, a Chilean state-run company seeking private-sector partners to launch lithium projects.

Although the EV revolution hit a slow patch globally last year, it is far from going reverse. Both countries are looking for new lithium supplies in anticipation of future demand. Private and government entities are heavily involved in formalizing supply and production.

“While the UAE has been working on international lithium projects and exploring local prospects, Saudi Arabia focuses on lithium extraction and processing. Additionally, they are working towards developing strategic partnerships and investing heavily into infrastructure,” says Dr. Rula Sharqi, Associate Professor, School of Engineering and Physical Sciences, Heriot-Watt University Dubai.

The UAE, focused on the underlying business fundamentals, is expanding its lithium production plans.

Last year, China’s Sunrise New Energy was in talks with the Abu Dhabi Investment Fund about a potential partnership to manufacture lithium battery material in Abu Dhabi.

Kezad Group and Titan Lithium, a UAE-based company, are also planning a $1.4 billion lithium processing plant in Abu Dhabi to support the region’s EV industry.

“Lithium is the new oil, and through this project, we are positioning the UAE, specifically Abu Dhabi, as a pivotal hub in the lithium processing domain,” Vaibhav Jain, founder and president of Titan Lithium Industries, said in a press statement.

SERIOUS CHALLENGES

These expansive initiatives and partnerships, including projects tailored to the automotive sector, are all great news, but what is challenging is scaling local lithium production to meet the demand.

Technical barriers, intense competition from existing producers, high capital investments, and environmental policies pose serious challenges to lithium development plans.

“Scaling production in the region will be challenging due to technological hurdles and competition in the global market,” says Lyakhov. “But with the right level of incentives, international collaboration, and support from the private sector, the region can become a significant player in the lithium industry.”

Henain says limited natural reserves and the need for advanced extraction technologies add to the challenges.“Overcoming them will require significant investments and international collaborations to effectively meet the demand for EV batteries and other applications.”

It will take time to see how both countries’ strategies pan out as they enter into an array of agreements to secure the critical minerals necessary for the energy transition, but the longer-term picture is positive as governments force the transition to EVs.

“Despite these obstacles,” Sharqi says, “these initiatives are vital for establishing a strong lithium supply chain and meeting growing demand.”