- | 9:00 am

Why relationship-building, not hustle, is the most underrated career skill for women in finance

Careers are not built in isolation, especially in environments where informal networks hold real power.

For decades, the finance industry has claimed to be a meritocracy: work hard, perform well, and success will follow. But for many women navigating male-dominated environments, that equation has never fully balanced. According to Amanda Pullinger, founder of the Global Female Investors Network, the real differentiator is not performance alone. It is relationships.

“School and university reward hard work and individual achievement,” Pullinger says. “But life and business do not work that way. Careers are built on trust, visibility, and human connection.”

THE MYTH OF MERITOCRACY

Women now enter finance in significant numbers, yet representation drops sharply at senior levels. Only about 11 percent of investment managers are women, and less than 2 percent of funds are owned by women. The problem is not performance, it is access.

Pullinger points to a structural gap that often appears mid-career. Early on, women may not feel disadvantaged, but without deliberate relationship-building, sustaining progress becomes increasingly difficult.

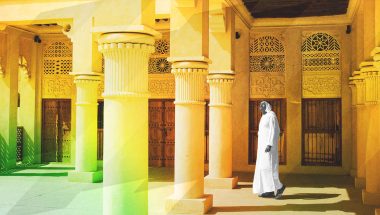

“In male-dominated environments, language, norms, and informal networks matter,” she explains. “If you have not learned how to navigate those spaces early, it becomes problematic later.”

NETWORKS AS INFRASTRUCTURE, NOT OPTICS

Pullinger has witnessed this dynamic firsthand. She spent 20 years building 100 Women in Finance, growing it from a small New York-based group into a global organization with more than 40,000 members across 19 countries. The mission was straightforward but transformative: connect women so they would not have to navigate their careers alone.

“There are moments when it is simply a relief to be in a room where people understand your experience,” she says. “Not to complain, but to say, ‘I have been through that too.’ That support changes how you show up.”

This same philosophy now underpins the Global Female Investors Network, which Pullinger co-founded to support women across the investment ecosystem, from pension funds and private equity to infrastructure and hedge funds. The model is intentionally human. Conversations are peer-based, global, and grounded in real experience.

VISIBILITY IS CURRENCY

One of the biggest challenges facing women fund managers today is not performance. It is invisibility.

“Women raising funds often struggle not because they are underperforming,” Pullinger says, “but because they lack access to the right relationships. That includes consultants, institutional investors, and the gatekeepers to capital.”

As artificial intelligence reshapes recruiting and job searches, this challenge is intensifying. Many roles are never truly open, and automated filters often obscure qualified candidates rather than surface them.

“A significant portion of jobs are filled internally or through networks,” Pullinger notes. “If you are not connected, you may never even know the opportunity exists.”

THE COST OF STEPPING AWAY

Career breaks, whether for caregiving, health, or family, remain another structural fault line. Pullinger is candid about the difficulty of returning after an extended time away, but she emphasizes that staying connected matters more than constant presence.

“Even if you take a year out, stay connected,” she says. “Maintain relationships. It makes all the difference when you are ready to come back.”

Firms often want to retain talented women but struggle to design flexible pathways. The solution, Pullinger argues, requires early and honest conversations, along with organizations willing to adapt.

CONFIDENCE FOLLOWS CONNECTION

Contrary to popular advice, Pullinger does not believe confidence is the foundational skill women need to develop.

“Confidence comes later,” she says. “The most important skill is relationship-building.” Ironically, it is a skill many women already excel at in their personal lives, yet hesitate to apply professionally. That means attending conferences, accepting invitations, speaking publicly, and showing up consistently in spaces where influence is built.

“These are not superficial activities,” Pullinger says. “They are how trust is formed.”

THE HUMAN ADVANTAGE

As work becomes increasingly digital and younger generations spend more of their lives online, Pullinger believes in-person connection is becoming more essential, not less.

“Belonging is a basic human need,” she says. “We regulate each other better in person.” Her advice is refreshingly low-tech: share experiences, talk things through, and build community. Not because it is sentimental, but because it works.

“The older I get,” Pullinger says, “the more I realize how much comes back to relationships.”

In an industry obsessed with data, that insight may be the most disruptive one of all.