- | 5:00 pm

Dubai issues new regulations to curb market risks of virtual assets

The regulator would support financial stability, investor protection, and legal stability in the virtual asset market.

As Dubai is making a play to be the hub for cryptocurrency, it’s filling all the gaps to build its regulatory architecture, especially to counter money-laundering risks. The emirate understands the risk of a crypto-fuelled scandal diluting the UAE’s good name instead of enhancing it.

And if the virtual asset market’s risk can be managed and regulated, it could equally give the emirate what it could use: a leading position in a major financial growth sector.

Now, to provide assurance and clarity on the expected level of operator accountability and reduce market risks, the Virtual Assets Regulatory Authority (VARA) has issued regulations.

Under the Virtual Assets and Related Activities Regulations 2023, “gold-standard risk assurance” and anti-money laundering standards will be applied by licensed businesses in the emirate.

The regulatory framework will provide service providers with a clear framework of laws that apply to their operations and business models while concentrating on the dangers each virtual asset activity poses to the market.

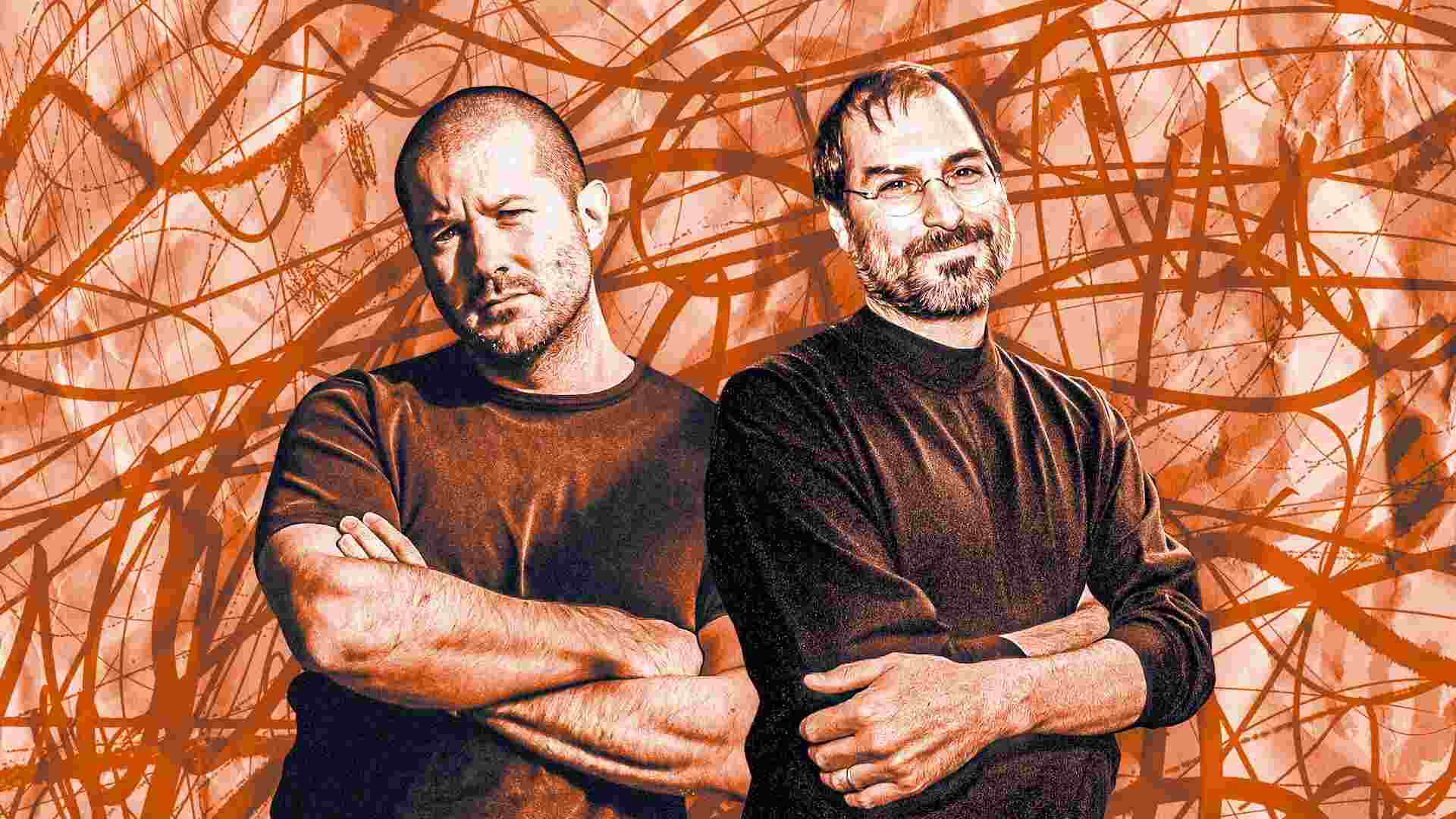

“Dubai’s D33 economic plan has outlined our mission to establish the emirate as the capital of the future economy anchored by metaverse, AI, Web3.0, and blockchain,” said Helal Almarri, director general of Dubai’s Department of Economy and Tourism and chairman at VARA’s executive board.

“VARA launches the VA framework structured to accelerate our new economy agenda, augmenting the secure and sustainable global market growth,” said Almarri while adding, “This custom-designed construct reflects the UAE’s commitment to building responsible safeguards and Dubai’s confidence in delivering a progressive VA ecosystem that nurtures next-gen innovation.”

Last year, Dubai adopted the Virtual Assets Regulation Law to create an advanced legal framework to protect investors and provide international standards for virtual asset industry governance.

The new legislation covers seven licensed virtual asset activities, including advising, broker-dealer, custodial, exchange, lending-borrowing, payments and remittance, and VA management and investment services.