- | 1:00 pm

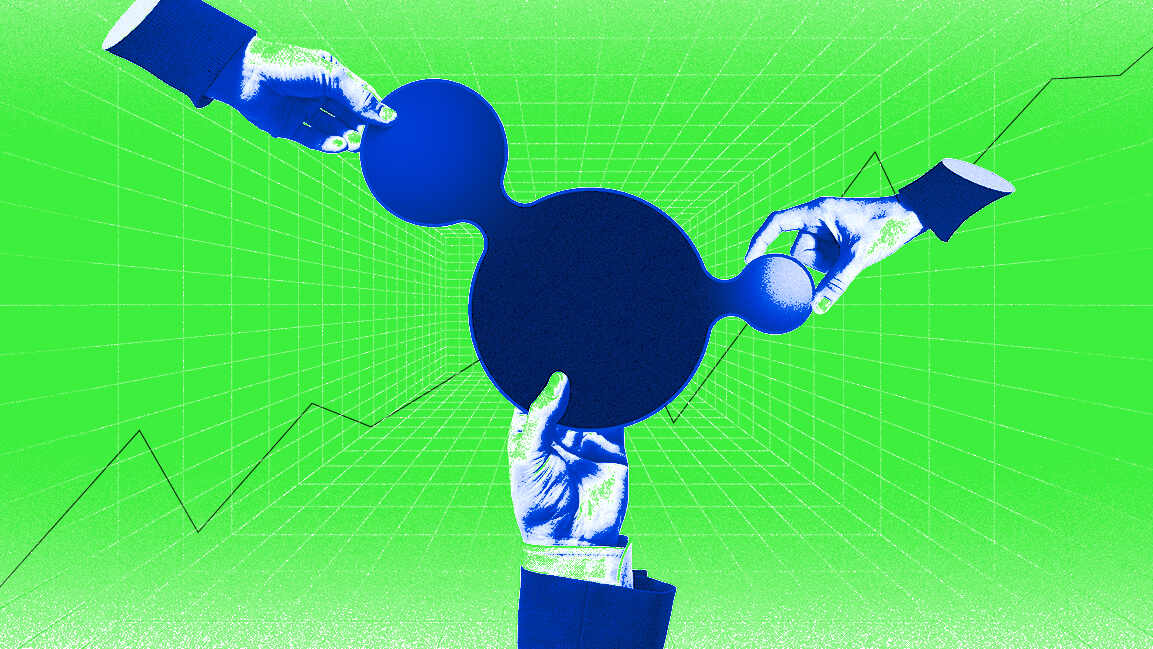

Dubai wants SMEs to grow faster. Fintech partnerships are part of the plan

New alliances with four fintech players aim to digitize finance, ease cash flow pressures, and future-proof Dubai’s small businesses for sustainable growth.

Dubai Chambers is intensifying its push to modernize financial access for the emirate’s business community, signing a series of Memorandums of Understanding (MoUs) with four specialized fintech players to expand advanced and alternative banking solutions for small and medium-sized enterprises (SMEs).

The agreements, signed with Mamo, Qashio, Pemo, and Vault, are designed to address some of the most persistent operational and growth challenges facing SMEs by widening access to innovative financial tools. Together, the collaborations establish a framework to deliver services ranging from alternative savings accounts and corporate cards to working capital loans and seamless online payment solutions, capabilities increasingly viewed as essential for efficiency and scale in a digital-first economy.

Khalid AlJarwan, Executive Vice President of Commercial and Corporate Services at Dubai Chambers, described the move as part of a broader strategy to strengthen Dubai’s business ecosystem. “This collaboration with fintech companies is a vital step in our mission to create a more dynamic and inclusive business ecosystem. By providing SMEs with direct access to advanced financial tools, we are actively removing barriers to growth and empowering them to scale more efficiently. This initiative aligns with our commitment to enhancing the competitiveness of the private sector and solidifying Dubai’s position as a leading global business hub.”

Beyond product access, the partnerships are designed to drive adoption and awareness. Under the MoUs, Dubai Chambers and its fintech partners will co-host events and workshops to accelerate digital adoption and financial innovation among SMEs. Tailored incentive programs and welcome offers are also planned to encourage businesses to transition to modern financial platforms. Educational initiatives and training sessions focused on financial automation and technology will further support companies as they navigate this shift.

Each fintech partner brings a distinct value proposition. Vault will enable businesses to generate competitive returns on idle funds, while Qashio and Pemo will streamline spend management through instantly issued corporate cards. Mamo, meanwhile, will offer SMEs an integrated platform that centralizes payment acceptance, spend management, and access to credit.

The move underscores a broader trend across the United Arab Emirates, where public-private collaboration is accelerating the adoption of fintech solutions to boost SME resilience and competitiveness. By embedding digital finance more deeply into its business support framework, Dubai Chambers is positioning fintech not just as a convenience but as a catalyst for sustainable growth.