- | 11:00 am

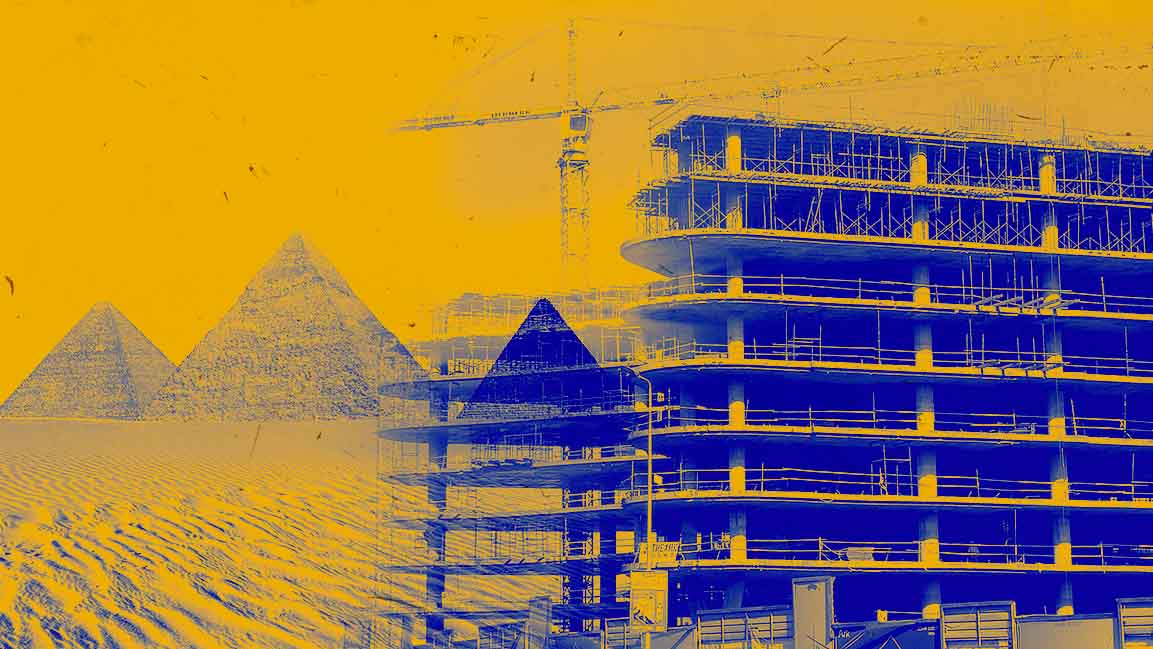

Egypt urged to create independent real estate regulator as market pressures grow

Independent regulation is key to unlocking transparency, investor confidence, and growth in Egypt’s rapidly evolving real estate sector.

As Egypt undergoes rapid urban expansion and increasing real estate investment, experts are calling for urgent regulatory reforms to protect stakeholders and strengthen market stability.

Mohamed Fouad, a real estate expert and member of the British Egyptian Business Association (BEBA), advocates for the immediate establishment of an independent Real Estate Regulatory Authority (RERA) to structure and transparently regulate the sector.

Fouad emphasized that a RERA, modeled on international successes such as those in the UAE and India, is essential for developing a clear legal framework. In mature markets, he noted, RERA plays a central role in regulation and legislation by issuing licenses, ensuring compliance, enhancing transparency, and monitoring project execution against approved timelines and budgets.

“In markets witnessing rapid urban expansion and increasing investment flows, such as Egypt, an independent regulatory authority is no longer optional; it’s a strategic necessity,” Fouad stated.

He explained that Egypt’s current system lacks cohesion, with overlapping institutional roles leading to project delays, contractual conflicts, and weak enforcement. A RERA-style authority, he said, would clearly define the responsibilities of government bodies, developers, and buyers, while providing essential oversight.

Such a body would also boost investor confidence by enforcing stricter controls on developer classification, marketing practices, and buyer protections, especially against stalled or fraudulent projects.

Fouad pointed to Dubai’s RERA as a benchmark, highlighting its role in transforming the city into a trusted global investment destination. He also cited India’s RERA, which reduced real estate-related legal disputes by more than 60% in its initial years.

Without a similar authority, Fouad warned that Egypt risks ongoing mismanagement and declining investor interest, particularly among Egyptians abroad who seek legal clarity and reliability.

He proposed that Egypt’s RERA be established under the Prime Minister’s office or the Ministry of Housing, in coordination with the Central Bank and the Financial Regulatory Authority. It should also manage a digital platform that provides real-time updates on licensed projects, aligning with Egypt’s digital transformation goals.

Fouad concluded by describing the creation of RERA as a national imperative for ensuring transparency, protecting stakeholders, and making Egypt’s real estate market globally competitive.