- | 1:00 pm

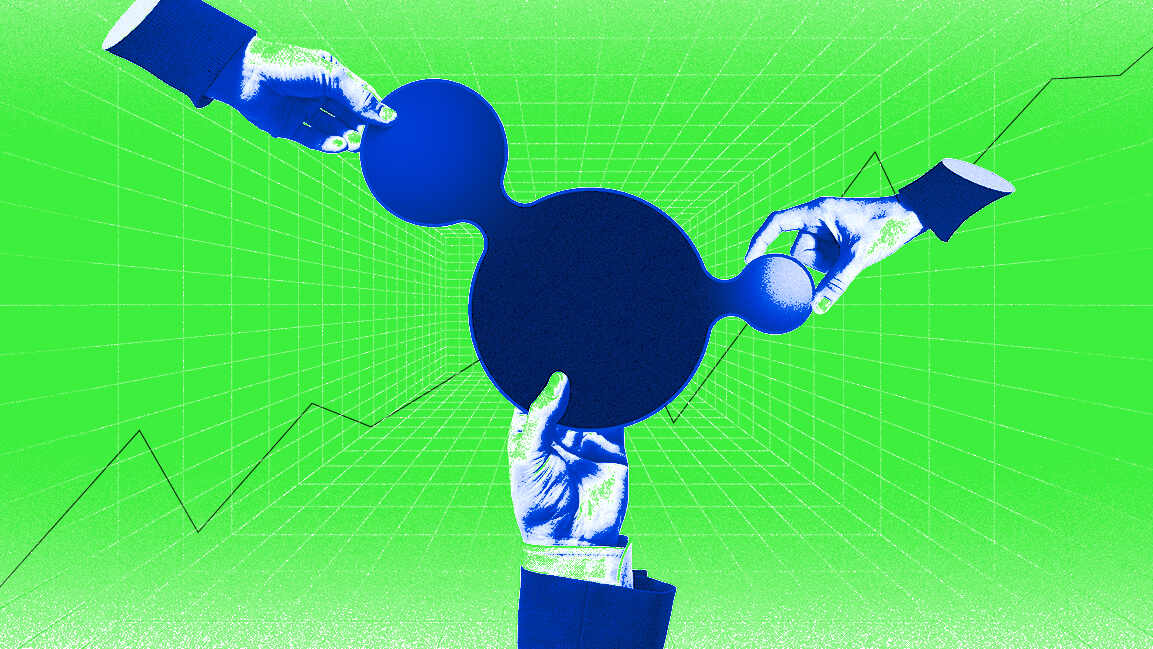

Fintech funding surges in UAE, defying global slowdown

Fintech funding in the UAE saw total investment soar 92% in 2023.

The Middle East has become a hub for fintech innovation and growth, significantly impacting the region’s economic landscape. The region has seen a significant leap in digital connectivity in recent years, which has increased digital adoption and laid a robust foundation for fintech growth with the embracement of digital banking, online transactions, and financial apps.

Most importantly, the growth is driven by fintech-friendly regulations. The Middle East has fintech-focused free zones, accelerators, and incubators that provide support and resources for startups.

For all these reasons and more, the Middle East fintech industry is experiencing significant growth and investment opportunities.

Despite the drop in global investment, fintech in 2023 was $51.2 billion, down 48% from 2022, when total investment in the sector totaled $99 billion; fintech funding in the UAE saw total investment soar 92% in 2023.

According to Innovate Finance, this is the first time the UAE has made it to the top 10 list of most well-funded fintech hubs in 2023. The UAE pulled in $1.3 billion in funding across 54 deals, marking an “exponential” increase for the country compared to last year, the industry body said in its Fintech Investment Landscape 2023 report.

The UK was the second-biggest hub for fintech investment in 2023, with total funding for the country’s financial technology industry totaling $5.1 billion in 2023. India came in third with a fintech investment worth $2.5 billion, Singapore was fourth with $2.2 billion of funding, and China was fifth with $1.8 billion.

Now accepting applications for Fast Company Middle East’s Best Workplaces For Women 2023. Click here to register.