- | 12:00 pm

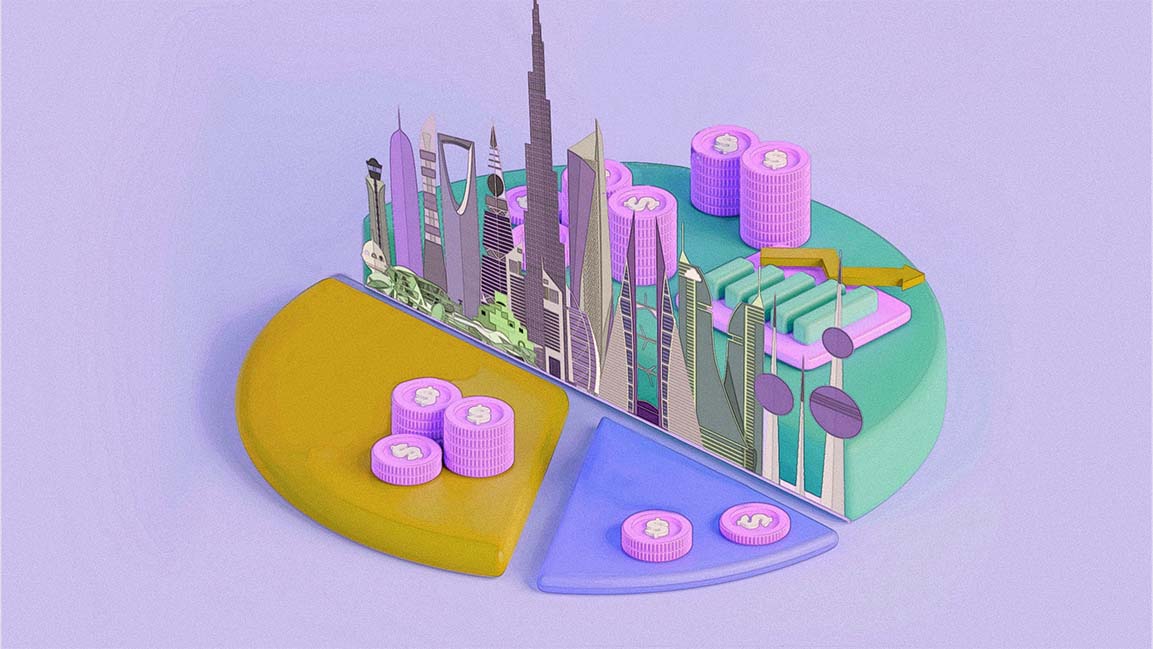

GCC sovereign wealth funds assets under management reach $4 trillion

GCC wealth funds set to increase their international investments with growing cash reserves, new report says.

Now accepting applications for Fast Company Middle East’s Most Innovative Companies. Click here to apply.

GCC governments have seen their liquidity buffers increase significantly in 2022, thanks to a surge in oil and gas revenues.

The increased liquidity has given the region more money to invest. As a result, GCC sovereign wealth funds (SWFs) are poised to make big investments in global markets in the coming years, according to an S&P Global Market Intelligence report.

The GCC current account surplus is forecast at 9% of GDP in 2023 and 6% of GDP in 2024. This means additional funds flowing into SWFs, providing more investment opportunities domestically and internationally.

The report also shows GCC SWF assets under management growing by 20% on average in the past couple of years to reach a high of around US$4 trillion. This accounts for roughly 37% of global SWF assets under management (AUM), almost equivalent to the combined AUM of all SWFs in Asia, Latin America, and Sub-Saharan Africa.

“We are also likely to see a recycling of GCC petrodollar inflows into MENA countries and other emerging markets that present interesting investment opportunities, need external funding, or are vulnerable to current geopolitical, economic, and monetary shocks. Egypt and Turkey are a case in point,” the report stated.

GCC state-owned investors have deployed around $83 billion of fresh capital during 2022. Five of the world’s ten largest investments on behalf of state-owned investors (SOIs) during 2022 were from GCC sovereign investors (62% from the UAE, 28% from Saudi Arabia, and 10% from Qatar).

“GCC SWFs are poised to grow further. In the years to come, the region’s SWFs will likely play an increasingly leading role in diversifying their respective economies and preparing them for the post-oil era (in the longer term) while expanding economic and financial ties with countries needing funding,” the report concluded.