- | 1:00 pm

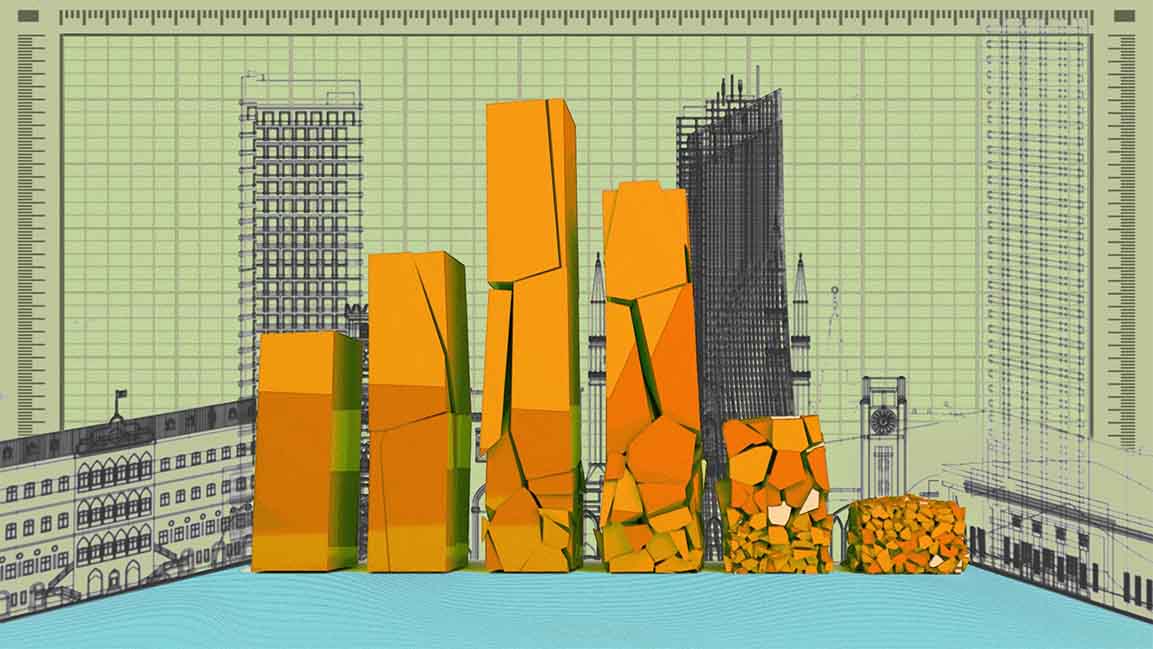

Lebanon’s cash economy is a major impediment to recovery, says World Bank

The annual inflation rate rose to 264% in March as the country’s currency lost value.

The Lebanese pound has lost 98% of its value since 2019, the World Bank said. Greater liabilities and low assets had led to a cash economy dominated by the US dollar, estimated at $9.9 billion in 2022. The annual inflation rate rose to 264% in March as the country’s currency lost value.

“The collapse of the local currency, which has lost more than 98% of its value since 2019, and a largely insolvent banking sector, have led to a pervasive dollarized cash economy estimated at $9.9 billion in 2022,” the World Bank said in its latest report, Lebanon Economic Monitor, Spring 2023: The Normalization of Crisis is No Road for Stabilization.

The report notes that the cash economy, accounting for around half the country’s economy, is a “major impediment to economic recovery.” It further found that there had been a 63% rise in cash transactions between 2021 and 2022, rising from $6.60 billion in 2021 to $9.9 billion in 2022. This shift to cash transactions happened due to a “complete loss of confidence in an impaired banking sector and the domestic currency,” the World Bank added.

The report warns that huge dependence on cash transactions can compromise fiscal and monetary policy effectiveness, heighten the risk of money laundering, increase informality, and prompt tax evasion.

In early February, Lebanon’s central bank devalued the pound/lira, changing the official exchange rate. The new rate was set at 15,000 Lebanese pounds/lira to the US dollar, in contrast to the fixed rate of 1,507.50 Lebanese pounds/lira to the US dollar that had been in effect since 1997.