- | 3:00 pm

Middle East’s sovereign wealth funds drive green investment, says report

The report showed that greenwashing is a significant challenge to ESG investing, with 89% of sovereign investors identifying it as a concern.

Now accepting applications for Fast Company Middle East’s Most Innovative Companies. Click here to apply.

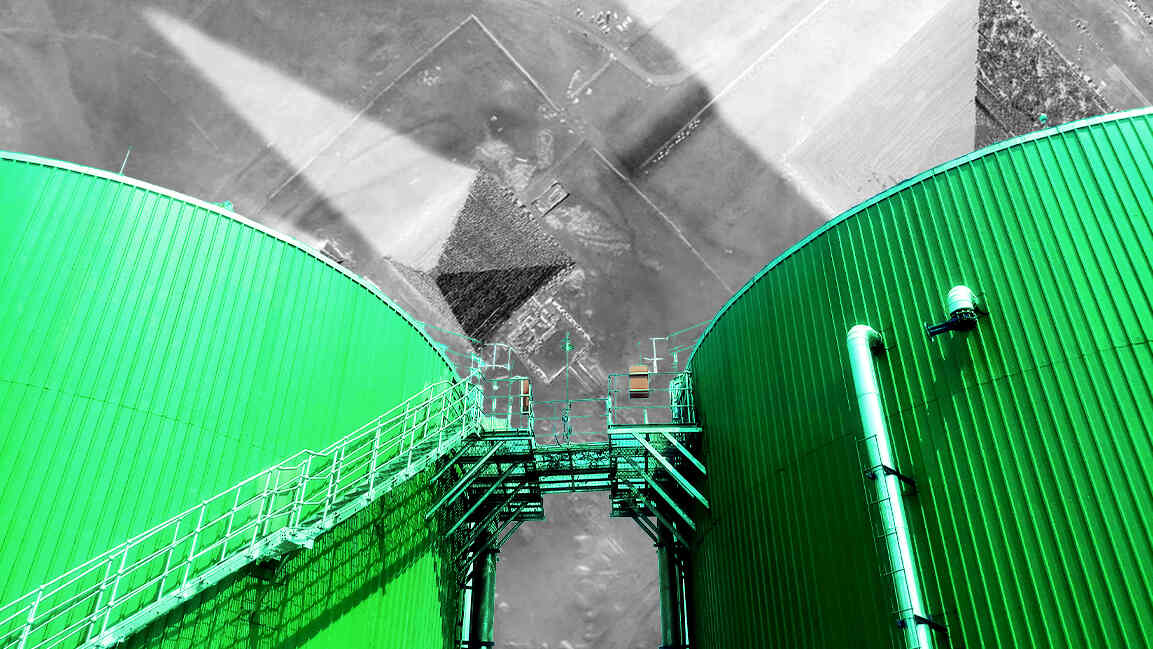

Sovereign wealth funds (SWFs) and central banks in the Middle East are leading green investments as environmental, social, and governance (ESG) policies increase.

According to data from the Invesco Global Sovereign Asset Management Study, nearly 57% of central banks and 25% of SWFs in the Middle East are focusing on direct green infrastructure investments and green bond allocations.

In the Middle East, 90% of SWFs and 22% of central banks have embraced ESG policies, prompting investors to align with their objectives. The data noted that 56% of SWFs and central banks affirm that sovereign investors can significantly contribute to financing the green transition.

“Geopolitical fluctuations and the urgent issue of climate change have underscored the necessity for secure and sustainable energy supply chains, thus amplifying the importance of renewables in investment strategies,” said Josette Rizk, Head of Middle East and Africa at Invesco.

The report showed that greenwashing is a significant challenge to ESG investing, with 89% of sovereign investors identifying it as a concern.

Over 90% of investors in the Middle East see greenwashing as a hindrance. Rizk added, “To combat this issue, SWFs are taking a proactive approach: they welcome development risks and issue green bonds themselves to ensure authentic alignment with ESG principles.”

The study showcased that Middle Eastern SWFs prefer private equity and infrastructure investments, with almost 71% drawn toward energy generation, transmission, and supply.

Conducted between January and March 2023, the study captures the viewpoints of more than 140 chief investment officers, heads of asset classes, and senior portfolio strategists from 85 sovereign wealth funds and 57 central banks. Collectively, the institutions manage approximately $21 trillion in assets as of March 2023.

Over the next 12 months, looking at evolving macroeconomic conditions such as inflation, 14% of SWFs are proactively planning to augment their allocations towards fixed-income assets.

They also indicated that 76% of investors in the Middle East are looking at opportunities in India as an attractive opportunity for emerging market debt this year, followed by South Korea (56%).

“The magnetism of the Indian market is even more pronounced among Middle Eastern SWFs, with a unanimous 100% recognizing its appeal. These figures underscore the growing confidence in India’s economic prospects and affirm its standing as a prime destination for debt investment among emerging markets,” Rizk said.