- | 11:00 am

NEOM prepares for $1.3 billion sukuk sale to fund ambitious city plans

The sukuk sale will reportedly be facilitated by banks such as HSBC Holdings and the securities arms of Al Rajhi Bank and Saudi National Bank.

Saudi Arabia’s visionary megaproject, NEOM, is set to make its debut in the Islamic finance market. Bloomberg reports that NEOM plans to raise $1.3 billion through its first-ever issuance of Islamic bonds (sukuk) later this year.

The proceeds from this sukuk issuance will fuel the extensive construction endeavors outlined for NEOM, which is projected to require a total investment of $1.5 trillion. NEOM has reportedly engaged the advisory expertise of banks such as HSBC Holdings and the securities divisions of Al Rajhi Bank and Saudi National Bank to facilitate the sukuk sale.

While Bloomberg anticipates the sukuk offering sometime in the latter half of 2024, prevailing market conditions will determine the final details concerning timing and size.

The report also mentions NEOM’s recent financial activities, including a $2.6 billion loan secured from a consortium of Saudi banks and a separate $799 million raised to support the development of Sindalah, a luxury tourism island in the Red Sea.

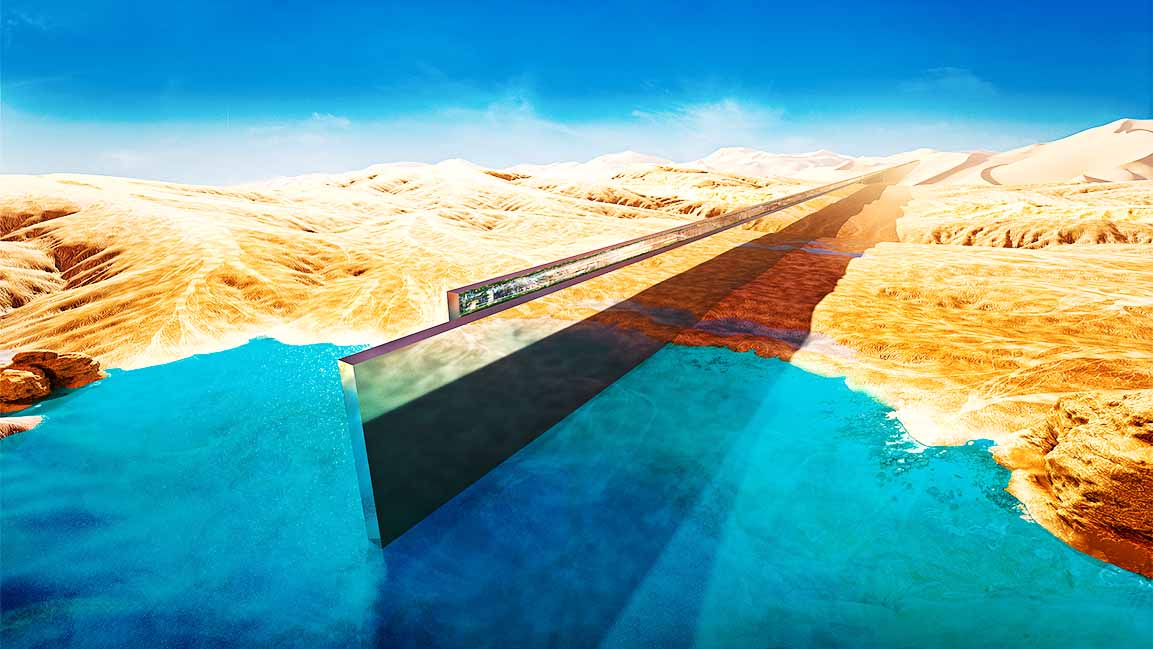

According to a report by Bloomberg in April, NEOM has revised its mid-term objectives. The ambitious development known as The Line is now anticipated to accommodate a substantially smaller population by 2030, with fewer than 300,000 residents, a significant reduction from the initial projection of 1.5 million.

This 170-kilometer, zero-carbon city will be constructed in phases, with only a 2.4-kilometer section targeted for completion by 2030.