- | 11:00 am

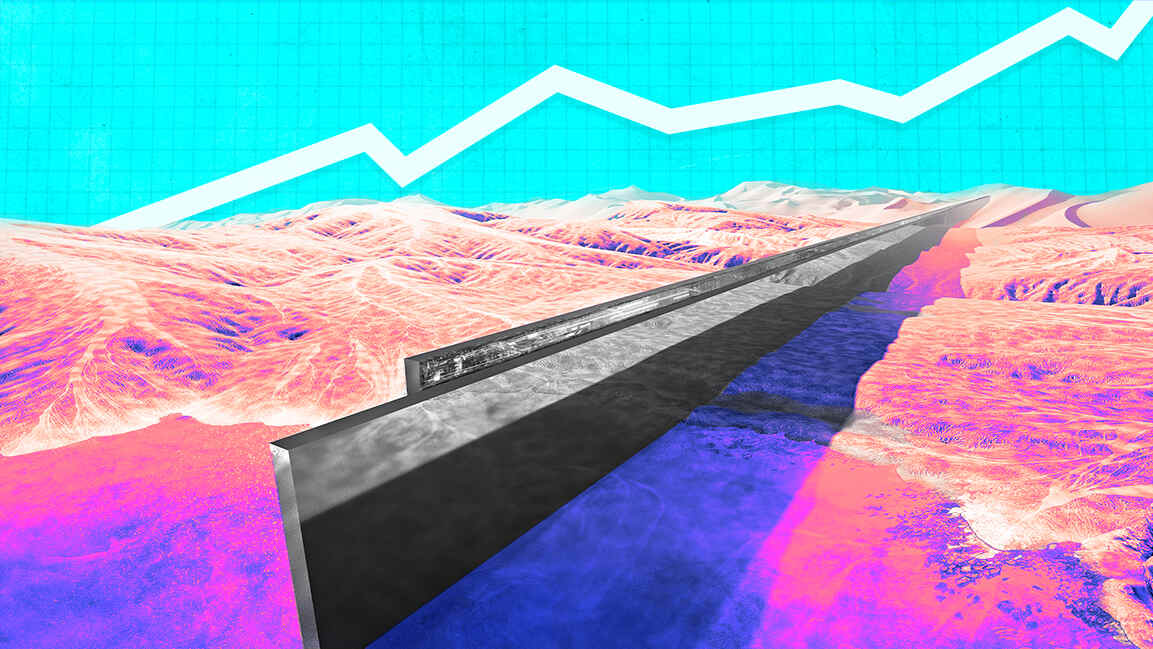

Saudi Arabia’s residential real estate market to see $1.22 billion investment in 2025

The survey of 1,037 households, including 100 expatriates, found that $733.3 million in private capital is ready to be deployed into Saudi Arabia’s giga-projects.

Saudi Arabia’s residential real estate market is set for strong growth, with private buyers expected to invest $1.22 billion in 2025, according to Knight Frank’s Saudi Report 2025. The study, conducted with YouGov, highlights strong demand for homes in the Kingdom’s mega-projects, with investors willing to pay premium prices.

A survey of 1,037 households, including 100 expatriates, found that $733.3 million in private capital is set to flow into Saudi Arabia’s giga-projects, with $701.4 million from Saudi nationals and $36.1 million from expatriates.

For expatriates, NEOM remains the top choice, though 20% have no interest in purchasing property in any of the giga-projects. Susan Amawi of Knight Frank suggested this reluctance may be due to limited information, complex ownership rules, and financing challenges, which could shift once new foreign ownership laws are introduced.