- | 2:00 pm

UAE investors rally behind local stocks amid global trade turmoil

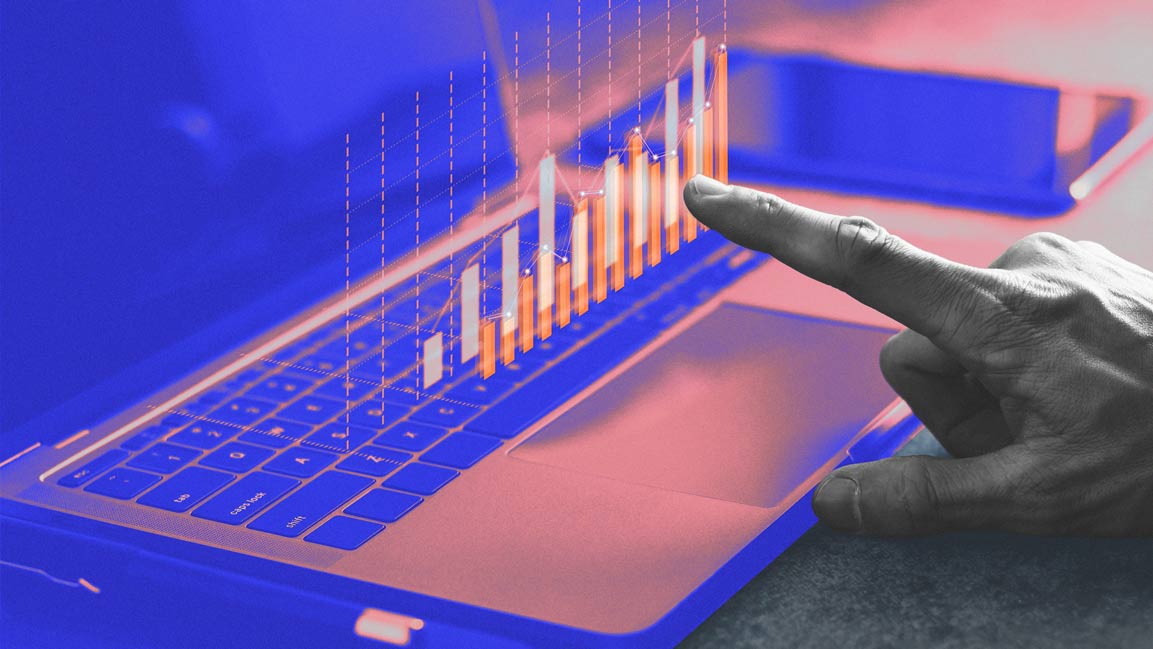

The survey, which polled 1,000 retail investors in the UAE, found that 39% are invested in Abu Dhabi stocks, 28% in Dubai, and 18% in both.

As global markets contend with rising trade tensions and economic uncertainty, UAE retail investors are doubling down on domestic opportunities. According to the latest UAE Retail Investor Beat by trading platform eToro, 85% of UAE-based retail investors are currently invested in local stocks, demonstrating strong confidence in the nation’s economic outlook.

The survey, which polled 1,000 retail investors in the UAE, found that 39% are invested in Abu Dhabi stocks, 28% in Dubai, and 18% in both. This confidence extends beyond the present: 63% say they are “very confident” in the current performance of the UAE economy, while 59% are “very confident” in the long-term performance of UAE-listed equities.

Looking ahead, 48% forecast strong gains in the UAE stock market over the next 12 months, with 34% expecting steady growth. Over a five-year period, 58% see the Middle East as offering the highest returns, ahead of the U.S. (50%). Key sectors driving optimism include real estate (55%), technology (48%), financial services (37%), and energy (37%).

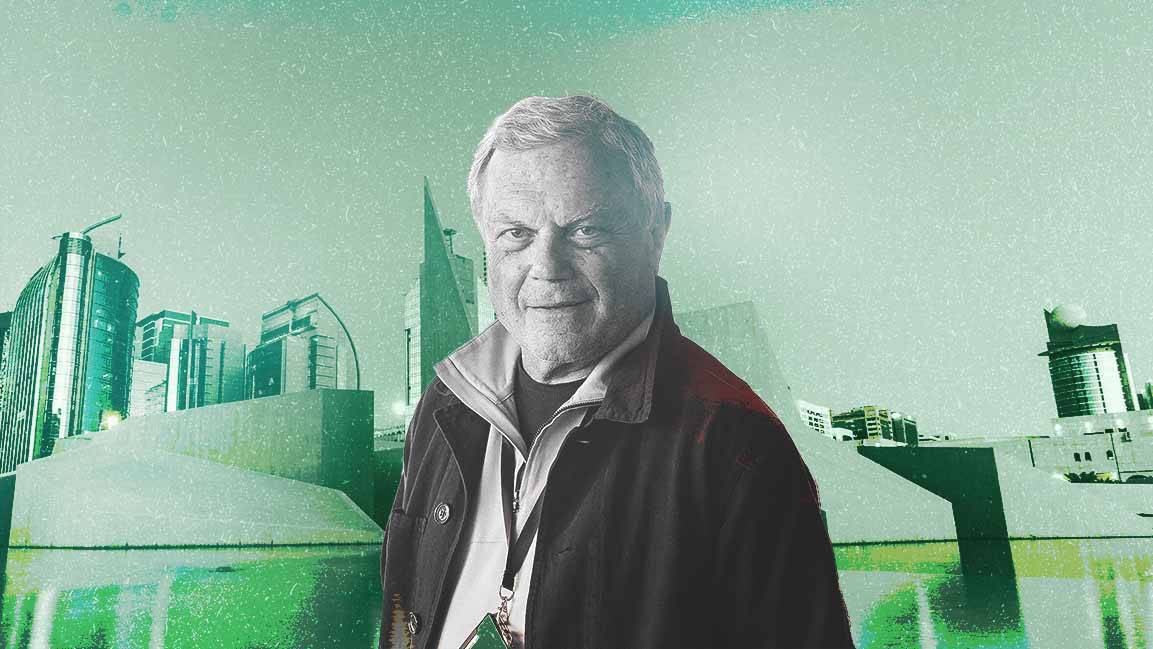

George Naddaf, Managing Director at eToro MENA, said, “The DFM and ADX are among the best-performing stock exchanges in the world this year. Investor confidence in the UAE market remains strong. The fact that 85% are already invested in UAE equities reflects a clear preference for local opportunities in the current environment.”

Despite this confidence, 90% of investors believe tariffs and trade wars will impact their portfolios, and 89% have adjusted or plan to adjust their investments. Most are increasing exposure to UAE equities (53%) and commodities (51%), particularly gold, seen as the most resilient asset by 49%.