- | 9:02 am

Buy now, pay later services are retailers’ next great hope

‘BNPL’ started as a credit card killer, but what if it’s really an end run around the Facebook ad-industrial complex?

The fashion retailer Express, a mall-culture staple, is on a mission to transform itself for the digital era. It manages a flock of social-selling influencers and is using data to personalize the experience of browsing its hot-pink crop tops and sequined statement blazers. The finishing touch on this brand makeover? A partnership with the buy now, pay later (BNPL) company Klarna to cobrand digital ads and offer Klarna’s “Pay in 4” product—which splits shopping-spree expenditures into four interest-free biweekly payments at checkout. “We want to give customers with a certain perception of us an opportunity to change that perception,” says Brian Seewald, SVP of e-commerce at Express. “We’re taking the risk out of a purchase with BNPL,” he says, adding that Express customers who opt to use Klarna have a higher average-order value.

Buy now, pay later services, which offer shoppers a financing solution and credit card alternative, have been embraced by more than 100 million people around the globe in less than a decade. Most BNPL companies operate two consumer products: an interest-free offering, which breaks up a purchase, typically a smaller-scale transaction, into three or four equal payments; and interest-based installment loans, which spread out the cost of larger purchases, like furniture. Market leaders Affirm, Afterpay (which Block, formerly Square, acquired for $29 billion), and Klarna are now ubiquitous on e-commerce sites. Meanwhile, leading digital wallets PayPal and Apple Pay are pursuing their own BNPL products. Affirm shares tanked 10% in July of last year when Bloomberg reported Apple’s intention to launch a pay-later product with Goldman Sachs.

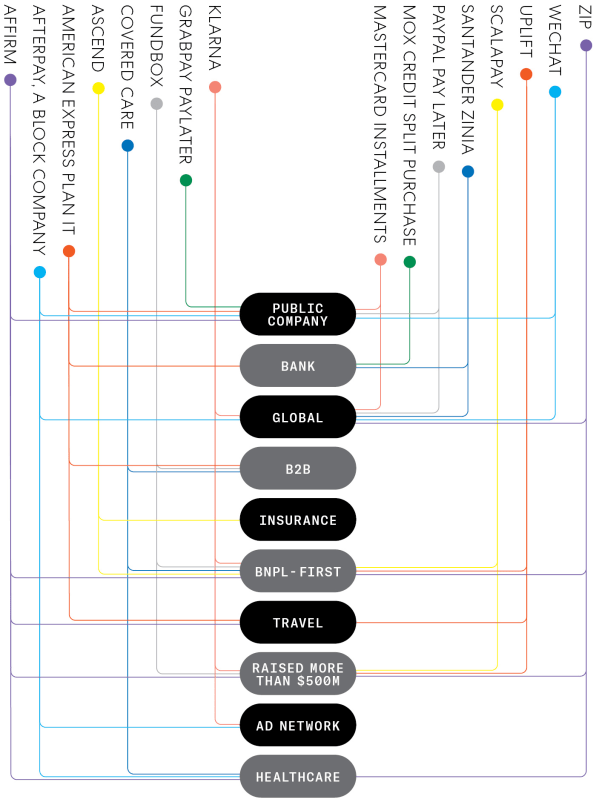

Buy, Buy, Buy: Mapping the Spreading BNPL Sector

But for retailers like Express, which aims to reach $1 billion in e-commerce sales by 2024, BNPL is not only an additional payment option for consumers but also an increasingly essential marketing tool for retailers. Klarna is embracing the opportunity to help merchants like Express by claiming dollars that might otherwise have been spent on Instagram or other digital ads. The company, which was valued at $45.6 billion in February, uses its app and email newsletters to promote partner brands, taking a small cut of any leads it generates. “We now speak as often to the chief marketing officer as we do the head of payments,” says David Sykes, head of Klarna North America, “and it’s because the value proposition has evolved.”

Research boutique MoffettNathanson estimates that consumers used BNPL to purchase almost $80 billion in goods globally in 2020, $20 billion in the U.S. alone. In a nod to the sector’s rising prominence, the three major credit agencies have said they will incorporate BNPL payment histories by the end of the year; and the Consumer Financial Protection Bureau, which is in the midst of an inquiry into the potential for BNPL to be used for data harvesting and lead to higher debt, among other concerns, may choose to weigh in on credit-reporting requirements.

Until now, the dominant narrative explaining BNPL’s success is that consumers—particularly, younger ones—are hungry for financing options that are less predatory than credit cards with their 15% average APR. But there is more to the story. Due to privacy changes, most notably the tracking restrictions that Apple made available to iPhone users in April 2021, retailers have not been able to target customers through platforms like Meta, which owns Facebook and Instagram, as they had before. Nor can they definitively attribute an e-commerce sale to a digital ad. BNPL companies, thanks to their increasingly robust apps and email lists, can solve both those problems. Moreover, they have an advantage over social media and digital advertising in understanding consumers’ credit, and, by extension, their buying power. Even as they undercut credit cards, BNPL companies are, by design, amplifying consumer spending. Consumers can still get a fair deal with BNPL products, provided they stay within their budgets and pay on time. But they should understand who BNPL companies are actually working for.

In its early days, in the mid-2010s, BNPL had a relatively simple job. By offering to break a purchase into monthly payments at the point of sale, BNPL could reduce cart abandonment, a common problem for larger-ticket items, especially those being sold by startup brands such as Casper Sleep and Peloton. Leading BNPL players claim that they can increase checkout conversion rates by 20% to 30%. “We are in the business of bringing [merchants] new customers, increasing their cart size, increasing their conversion at point of sale,” Affirm cofounder and CEO Max Levchin said last year.

That core promise—that consumers will spend more—is still at the heart of the product’s appeal to retailers. Florist UrbanStems, for example, says that customers who pay with Affirm spend $7 more per order on average. Retailers have been willing to pay BNPL companies roughly 5% to 6% per transaction for that lift, approximately double what they pay to process credit card transactions. “It’s beautifully measurable, and that’s why [merchants] are willing to pay a premium,” says MoffettNathanson partner Lisa Ellis. She likens BNPL to a modern updating of a store credit card. “You come for the financing, but you stay for the marketing.”

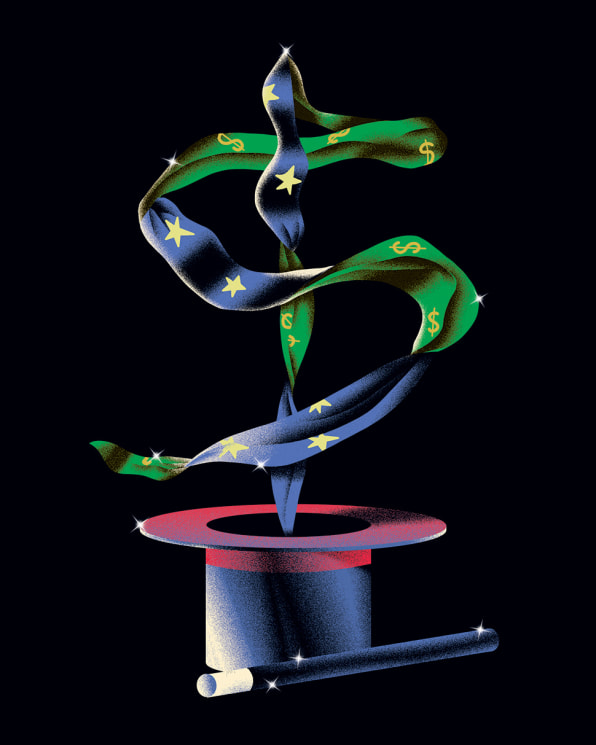

[Illustration: Sandro Rybak]

BNPL players are following the store-card playbook, but with apps and emails replacing mailers and “friends and family” sales. Afterpay, which originates one-third of its transaction volume through its own app, introduced a pay-for-performance ad platform last August. Nick Molnar, Afterpay’s cofounder and coCEO, says Afterpay Ads, as it’s called, is designed to help retailers identify consumer categories where they’re underperforming. Now that Afterpay’s merger with Block is complete, “taking commerce into Cash App becomes incredibly interesting,” he says, referring to Block’s banklike offering, which has 44 million users that Afterpay can market to.Afterpay will have company, as competitors look to build modern, digital malls of their own. Try BNPL once, download an app to track your payments, and suddenly you’re getting notifications about can’t-miss deals. Affirm says that its shopping app has generated more than 10 million referral clicks to merchant sites. PayPal, the largest of the diversified BNPL players, has also started leaning into e-commerce; in 2019, it acquired Honey, a shopping-and-rewards platform, for $4 billion.

David Oksman, VP of marketing and e-commerce at Samsonite, a PayPal partner, is anticipating a “cookie-less future”—meaning that those bits of code used to track people online will be no more. He believes that tools like PayPal’s Pay in 4 can create customer loyalty, and has been experimenting with BNPL mentions on social media. “Like everyone else,” he says, “we are looking at new channels.”

“The most recent change with Apple and their advertising tracking is probably going to end up being a footnote in what is continuing to be a fundamental pivot in advertising online,” Affirm CFO Michael Linford told investors at a Citi fintech conference last November. “Merchants are being squeezed.”

By February, that “footnote” was looking more like a chapter heading after Meta forecast that Apple’s privacy changes would reduce its 2022 revenue by $10 billion. The announcement offered a peek at the dollars that will be available to BNPL companies, which master the dark arts of digital marketing, but also served as a reminder that BNPL startups are playing someone else’s game, with little power to set the rules.

Apple and Goldman have kept quiet about their potential BNPL plans (and declined to break their silence for this story). But Apple’s power to determine whether it wants to take the path that Affirm, Klarna, and others are pursuing is as profound as it was in kneecapping Meta’s ad business. Consider this:

In 2021, Apple Pay processed an estimated $90 billion in transactions for U.S. retailers. If Apple converted even a single-digit percentage of that total to “Apple Pay Later,” it would claim a sizable slice of BNPL business for itself—in one easy installment.