- | 9:00 am

Meet a crypto creator who’s playing to win

Bryce “Brycent” Johnson was one of the first influencers of the NFT game ‘Axie Infinity,’ encouraging his followers to buy in. Now he’s leaving it behind.

When Bryce Johnson first discovered Axie Infinity, in spring 2021, he was four years out of college at Virginia Commonwealth University and had just started his fourth job as a software engineer, working deep in the bureaucratic morass of the government-facing IT firms around Washington, D.C. Johnson, known among his friends for being “extremely genuine,” with an infectious smile, was driving home from work one day in his Honda Civic, when he happened to hear a guest on a podcast make the case for investing in the metaverse. Specifically, Axie Infinity, a Pokemon-style digital card game that had been gaining momentum in Southeast Asia. Axie‘s battling chimera are NFTs, or non-fungible tokens, and the game’s growing popularity was fueling speculation that Axie might be the key to unlocking broad-based crypto adoption.

At the time, almost no one was streaming Axie on platforms like YouTube and Twitch, despite the fact that tens of thousands of people were playing daily. The company behind Axie, Sky Mavis, had raised $1.5 million in seed funding two years prior and was effectively unknown in the United States. Smooth Love Potion (SLP), the token that Sky Mavis had created to compensate players for their participation, could be converted to other cryptocurrencies and then to fiat currency. During the height of the pandemic, when COVID-19 ravaged economies in nations such as the Philippines, Axie became attractive as a source of income.

“I was just taken aback by the whole idea and decided to dive in,” Johnson says.

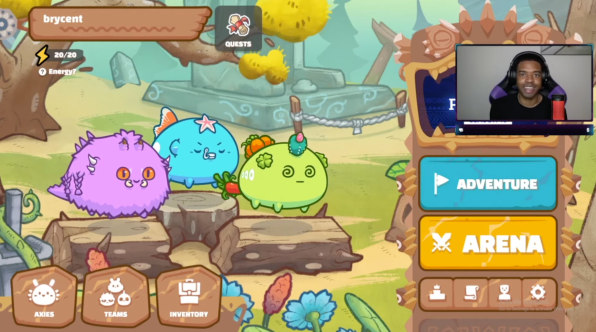

On April 27, 2021, he posted his first Axie video on YouTube, titled, “How to Win: Axie Infinity Arena! (Beginner’s Guide).” Seated in a standard-issue black and purple gaming chair, Johnson, calling himself Brycent, explains how to pick a team of Axies and deploy them in head-to-head competition. He also casts himself as his viewers’ peer. “I lived in the depths of mediocrity on the Axie leaderboard for quite a long time,” he says at the start of the 11-minute video. “We’ve come out of that place of darkness, and now I can share my tips with you so you don’t have to go through the same sadness and depression that I went through.”

[Screenshot: byrcent]

Almost overnight, Johnson says, he became “the face of Axie.” His timing could not have been better. In May 2021, Axie‘s parent company, Sky Mavis, attracted $7.5 million in Series A funding from web3 tastemakers including Mark Cuban, Reddit cofounder Alexis Ohanian, and Twitch cofounder Kevin Lin. In July, tech pundit and investor Packy McCormick devoted 8,800 words to Axie in his influential newsletter, Not Boring, titling the piece, “Infinity Revenue, Infinity Possibilities.” McCormick charted the game’s meteoric rise, which coincided with Johnson’s. “In April, Axie did about $670k in revenue. In May, it did $3.0 million. In June, $12.2 million,” he wrote, delivering the kicker in bold: “In July, just 18 days into the month, it’s already at $79 million.” (July 2021’s total revenue: $196,893,595.19.) In Axie, crypto commentators like McCormick didn’t just see a gaming company with “infinite” revenue potential. They saw the future of labor, in which gamers earn a basic income by playing for metaverse tokens after their real-world jobs have been automated away. A “documentary” about Axie’s developing-world player base, quietly bankrolled by an Axie investor, was published around the same time and racked up over 380,000 views, only adding to the mythology.

But Axie and Johnson’s fortunes would soon diverge. First, Sky Mavis lost control of Axie‘s in-game “tokenomics,” sending prices for SLP and governance token AXS into free-fall. As their Axie incomes declined, players left in droves. Then, the game suffered an embarrassing $625 million hack that was the product of its developers’ failure to establish sufficient security protocols. Daily revenue for Axie Infinity has been hovering around $28,000—a 99% drop from Sky Mavis’s peak 24-hour take of $17.5 million last August, when the game banked $364 million in revenue.

“I think we’re maybe in the transition phase from that trough of disillusionment to the slope of enlightenment where, you know, the real work gets done,” Sky Mavis cofounder and growth lead Jeff Zirlin tells Fast Company.

Johnson, meanwhile, is moving on. He hosted a 24-hour stream for the buzzy web3 game Illuvium, for example, and tweeted his enthusiasm for STEPN, an app that pays users in cryptocurrency for completing real-world runs (provided, of course, that they first pony up for a virtual sneaker, with prices topping $1,000). Last month, Johnson signed with VaynerSports, the Gary Vaynerchuk-backed talent agency for professional gamers like Kyle “Bugha” Giersdorf, Fortnite‘s 2019 World Champion. “I want to be at the forefront of NFT gaming as a whole, not just Axie Infinity,” Johnson says. “If the category rises, all of these games have a chance to do well.”

In Johnson, Axie found a rags-to-riches nice guy who fit its family-friendly brand. Johnson, who says he was $30,000 in debt when he discovered the game, now streams from Miami and says he hopes to promote financial education through web3. He is not your everyday mercenary crypto shill. Yet the economics underpinning web3 rely on promoters bringing in new players and new money. Without them, as we’ve seen time and again, projects fall apart. As a gamer, Johnson is adept enough that he was able to claim, for a time, a position on the global Axie leaderboard. But his charisma in front of the camera is what has built his brand, allowing him to attract 179,600 Twitter followers, 51,300 Twitch followers, 44,100 YouTube subscribers, and a vibrant Discord community. It’s what has enabled him to have a crypto-world startup of his own—and to walk away from Axie without any real consequence despite his role in endorsing it.

MARRYING THE METAVERSE

In his early days with Axie, Johnson could hardly contain his enthusiasm. “I Spent $7,000+ On Axie Infinity NFT Land! Here’s Why…” he explained in a May 2021 YouTube video. Axie‘s developers had plans to create an iteration of the game that would revolve around “farming” web3 real estate, and had conducted an initial sale of plots of land in their Lunacia world in 2019.

He justified the cost on Axie‘s long-term merits. “I don’t believe that the market cap for this game is anywhere near where we’ll be in five or 10 years, so buying land at the ground floor for me means investing not only in my future, because I want to be financially free, but also investing in an infrastructure, a digital, virtual metaverse infrastructure of a video game that I love and I enjoy and I play,” he said. “For me, buying a piece of virtual land in Axie Infinity was truly marrying the game. Telling myself that ‘Hey, this is your home. This Axie community is where you belong.’”

Johnson’s language, intentionally or not, echoed Axie’s 2021 Creator Guide, which directed would-be influencers to strike a tone that is “upbeat and positive” and “high energy— people are very susceptible to absorbing emotions online.” For Johnson, described by a high school friend as a “ball of energy,” the Axie guidelines were a natural fit.

A few weeks after buying land, Johnson doubled down, taking out a personal loan to spend $16,000 on Auraya, an Axie known as a Mystic, imbued with special powers, as well as a cottontail and antlers. In a YouTube video with 74,000 views, Johnson plays a competitive round with Auraya on his team, notching 17 points for his player ranking. “I would highly recommend if you can afford to get a Mystic, to go for it,” he said. “I think they are going to be worth hundreds of thousands of dollars one day.”

As Axie‘s popularity grew in the spring of 2021, the cost to acquire the three chimera NFTs required to begin play had risen beyond the capability of the average Filipino to afford. A market quickly formed around the game whereby “guilds” would offer loans, known as scholarships, to would-be players who wanted a piece of the seemingly magical play-to-earn spigot. As the model evolved, middlemen entered the mix; in addition to taking their own cut, they took responsibility for training scholars and managing their performance over time.

Johnson became part of one such effort in June, joining Loot Squad, an Axie guild that had formed two months earlier. “Become the impossible!” became Loot’s slogan and Johnson’s refrain.

Loot Squad followed the same high-level playbook as other guilds, such as Yield Guild Games, but Johnson liked to think that his community was special and different. He encouraged Loot’s scholars to express their creativity and welcomed their fan art. Loot created a magazine. It promoted a scholar with artistic talent to become the team’s first in-house designer. To set Loot apart further—and to discourage scammers—Johnson and his adopted cofounders invented a hiring model that they called “watch to earn,” whereby they would select prospective scholars from the most engaged viewers subscribed (for at least $5 a month) to Johnson’s Axie streams on his Twitch channel. Johnson, who by now had moved from Virginia to Miami, would banter with his subs, patiently answer their questions, and sing along to his favorite Frank Ocean tracks.

At its peak, Loot was managing several hundred scholars, primarily based in the Philippines, and generating around $350,000 a month in revenue. (Johnson says Loot took a 25% cut of players’ earnings; other guilds might take more than half.) One Loot community member, who goes by Zenite, became successful enough playing Axie that he was able to “graduate” and recruit his own team of scholars; when SLP soared to new heights last year, Zenite was making $2,800 a month, more than triple the income of the average Filipino.

Johnson reaped the rewards of his rosy outlook just two months later. In a July 2021 video titled, “Should You Invest in Axie Infinity?” which was posted five days after McCormick’s essay, he revealed that by breeding Axies, which can then be sold or rented to other players, he had been making over $3,000 a week. Top breeders, he reported, had been making as much as $70,000 a week. On the gameplay side of the house, Loot Squad’s scholarship program had been generating about $50,000 a week. Bottom line, Johnson said, “You are still early. Axie hasn’t taken off yet, in my opinion,” noting that the U.S. and Europe were ripe for expansion. “The prices of things are going to skyrocket,” he said. “We’re going to see millions upon millions of daily active users.”

Should people invest? “The answer to me is a no-brainer: yes.”

“I’m on the Loot Squad wait list and I’m looking forward to getting to experience this phenomenon first hand!” a viewer named Ninjobu commented. “Seeing the blessing that you are to Philippines is awesome! Keep becoming the impossible Bryce! ✊???? God bless!”

Johnson and his followers didn’t know it at the time, but SLP had already hit its peak. According to CoinGecko data, the token peaked on July 13, 2021, trading at just under $0.40. At the end of Johnson’s investment video, it was trading at $0.20.

SELLING PICKS AND SHOVELS IN THE CRYPTO GOLD RUSH

By last fall, Axie‘s player base was approaching 2 million, but SLP’s tokenomics had collapsed more than 80% and complaints were mounting that the game was a bore. Johnson increasingly found himself treading a fine line. In September, he addressed “The Truth About SLP“—and plugged his new sponsor, GFuel, an esports energy drink—telling his audience, “We’ve seen the Axie team continue to put out good updates.” Shortly thereafter, Sky Mavis raised a $152 million Series B funding round led by Andreessen Horowitz, at a $2.8 billion pre-money valuation, according to Crunchbase.

Johnson also created a video in response to another creator’s criticism of Axie‘s allegedly “shady business practices,” and a video addressing a Twitter spat between Axie’s Zirlin, who goes by Jiho online, and Kieran Warwick, the developer of a new NFT game called Illuvium. On Twitter, Warwick had labeled Axie “literally a Ponzi,” and expressed fear that Axie‘s imminent collapse would spell doom for the NFT gaming space overall, including his own efforts. “Ignore losers as they love the attention,” Zirlin subtweeted in reply. Johnson was careful to avoid picking sides or taking a stand on the substance of the accusations, framing his video addressing the brouhaha as a parody of the high-drama hot-takes that proliferate on YouTube.

Starting in November, Johnson says, he privately started thinking about diversifying away from Axie. “I did some self-reflection,” he says, about guilds and the scholar model. “It just felt more and more like a pay-to-win Ponzi, as bad as that may seem.” He felt an obligation to be transparent, but he didn’t want to burn bridges. He told himself, “You need to get some assets out and you need to be at the forefront of the conversation in terms of making these games more sustainable, because if you aren’t, you’re just another part of the problem.”

Publicly, though, he continued to post on “The Future of Axie Infinity SLP!?” and “What Happens to SLP in 2022?!” In December, he predicted that his audience would be “extremely prosperous” over the long-term, even if they felt the pain of SLP having fallen to about $0.03.

At the same time, Loot was evolving as well. It raised a $5 million seed round in December led by the crypto researcher Delphi Digital, with additional funding from such angel investors as rap artist G Money, NBA player Grayson Allen, and Axie‘s Zirlin and his cofounder Aleksander Larsen. In pursuit of greater community engagement, Loot had started running competitions it called “bounties” in order to reward scholars for contributing in ways beyond the monotony of gameplay. Often, the bounties involved helping Johnson maintain his web2 presence; scholars would pull together highlight clips for YouTube or create NFT memes to post on Twitter. Loot would use a bot that it started calling “Loot Bolt” to pay out prizes, typically in the range of $5 or $10.

Loot Bolt started as a time-saving shortcut, but Johnson saw a bigger opportunity after Loot’s first check-in call with Delphi Digital. One of the Delphi cofounder’s eyes grew wide as the team showed him a demo of Loot. “‘You guys need to stop everything you’re doing and break this out into an enterprise product and then get it in every single Discord,’” Johnson recalls him saying. “If you don’t have an update every two weeks in the crypto and NFT space, people are like, Oh, what’s going on with the project? . . . Well, now we’re giving them a way to continue scaling that community.”

The scholar model, Johnson realized, “is not a defensible concept” for a venture-backed company. “So my thought process was, how do we create a world where Loot not only leverages content to onboard people into web3 gaming in a more culturally intimate way, but also how do we build consumer-based tech that helps scale these gaming communities.” He felt certain that Bolt could be the key to transitioning NFT gaming away from low-skill grinding and toward specialization. “We wanted it to almost work like a combination of Fiverr and LinkedIn.”

A $625 MILLION SHOCK

The longer SLP’s price languished, the more people in the Axie community began to question the game’s leadership and the play-to-earn model that Sky Mavis had pioneered. Johnson found himself spending more and more time in Twitter Spaces conversations as Axie‘s guild owners grappled with their options. (Hong Kong-based guild owner Joseph Cooper estimates that two-thirds of scholars have quit Axie, and that guilds have only been to replace half of their departed players.) “How do we go about fixing it as a community?” Johnson asked his assembled peers in early March. “How do you think we got to the point where SLP, in a sense, has become a dumpster fire?” By March 13, he felt confident declaring that “play to earn is dead, and it’s not coming back.”

Sky Mavis, as it turned out, agreed with Johnson. Under pressure to make Axie sustainable, the company announced that it would be shifting from “Play to Earn” to “Play and Earn” as part of Axie version 3, dubbed Origin.

As the Axie community was digesting what the play-to-earn shakeup might mean for their earnings and assets, Sky Mavis dropped a bombshell: A hacker had stolen the equivalent of $625 million from the Ethereum sidechain responsible for managing Axie‘s in-game economy. In order to prevent further exploits, the company temporarily froze the virtual “bridge” that allowed players to cash out their winnings.

On Twitter, Johnson questioned the economics that Axie creators like himself had been content to accept, but he still promoted the game. When Sky Mavis decided to push ahead with Origin‘s launch, despite the hack, Johnson dutifully hosted a livestream in which he previewed new cards that would be available to players, as part of a coordinated marketing campaign. “From what I have been told so far,” Johnson said, “runes are these really cool attachments that you can provide by adding to your Axie to get different upgrades.”

IT’S TIME TO MOVE ON

Despite Axie‘s travails, Johnson is living out his creator dreams. In March, he spoke at Harvard University’s Blockchain Conference about NFT gaming. Last month, Lacoste, in collaboration with Minecraft, invited him to New York for an event celebrating their collaboration. His wardrobe now includes sold-out looks by Kith and a string of pearls, which grace his Twitter profile picture. On the weekend of May 13, he spoke at FX Summit’s Miami conference before heading to VeeCon, Vaynerchuk’s personal showcase for all things NFT, on the same bill as Pharrell Williams and Deepak Chopra, among others.

“Axie has been the first platform for someone to be able to build a career as an NFT gaming creator,” Zirlin says. “That wasn’t even a thing before Axie, so we’re really proud of how well many of our content creators have done.”

So far, none of Johnson’s post-Axie YouTube videos have gone viral, and most remain below 1,000 views. Over a year later, his first Axie video remains his most popular on YouTube, with over 180,000 views. But Johnson, thanks to Vayner’s endorsement, is thinking bigger. “We’re focused very much on higher-quality, larger-scale deals that help move the space forward in a positive way over just Hey, here’s a random game that’s minting NFTs, they want to pay you a couple grand,” he says of his role as an esports star.

Johnson is still tied to Axie through Loot Squad, where he continues to serve as CEO. Indeed, as Sky Mavis rebuilds its security infrastructure, Loot Squad has been assigned ownership of one of the revamped nodes that will protect the bridge which was exploited to rob the game in March.

But Johnson sold Auraya, his Axie crown jewel—and he’s not looking back. “I don’t want to sit around and watch my assets potentially go down in value while we wait for Axie to solve the internal issues that they’re looking to fix,” he told his viewers. “I love the game, we still support it. But [my] personal assets, like Auraya: it’s time to move on and do something a little bit different. I think for the sake of my own risk tolerance, taking profit on Auraya at this stage makes the most sense.”