- | 8:00 am

The unexpected winner of the AI data center boom

AI has fueled data center hypergrowth. While everyone debates the value of all this new infrastructure, one clear victor has emerged.

The data center boom is fully underway, and the numbers are staggering: billions of dollars in costs, millions of square feet worth of buildings, gigawatts of energy, and millions of gallons of water used per day. But before these AI-fueling behemoths can get up and running, there’s an extensive amount of prep work needed to build the infrastructure those data centers rely upon, with a whole other set of staggering costs, material flows, and resource requirements.

The infrastructure behind (and below) the data center boom is in the midst of its own massive scale building boom, with no end in sight. That’s created a thriving business for the companies that provide the raw materials used to make that infrastructure.

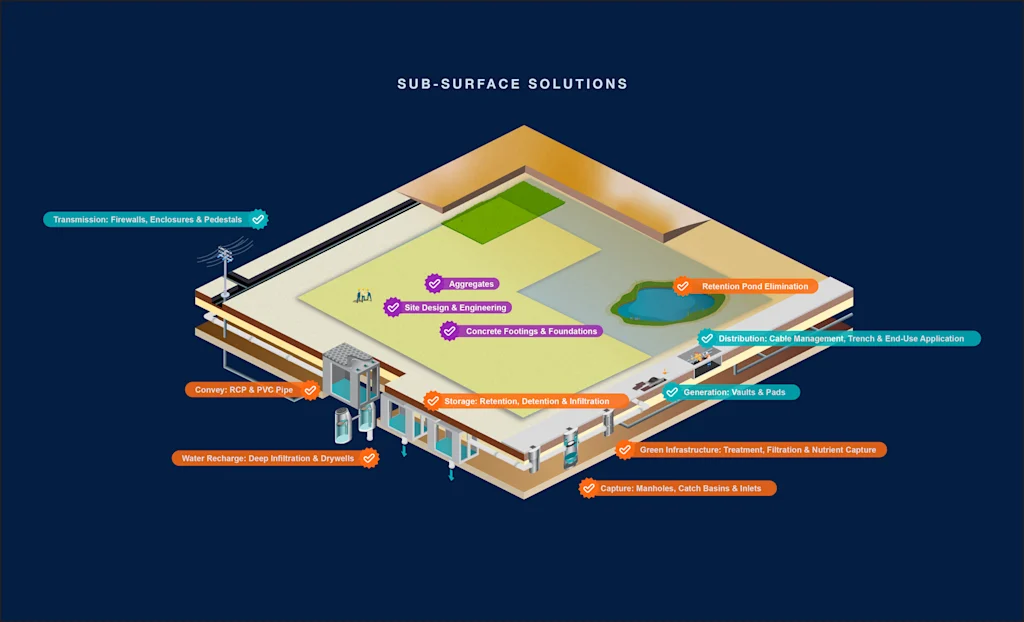

“The focus for the most part is always on the facility . . . but what gets a lot less attention today is actually what it takes to build the infrastructure around them,” says Nathan Creech, president of the Americas division at CRH, the $81 billion market cap building materials company. “Most people don’t see the below-the-ground infrastructure for water, for telecom, for energy that it takes, or the road systems to get in.”

CRH is the largest building materials company in North America and Europe, providing aggregates, cement, road, and water infrastructure for building projects around the world. The company is currently working on more than 100 data centers in the U.S. This data center work was highlighted in the company’s third quarter financial results as a “robust” growth area and part of its $11.1 billion in quarterly revenue, which the company expects to continue to rise for the foreseeable future.

Most of CRH’s large data center projects are covered by nondisclosure agreements, but you can probably imagine some of its potential customers. As competition for AI dominance heats up, so-called hyperscalers like Amazon, Meta, Google, Microsoft, and Oracle are investing in ever bigger data centers. AI companies like OpenAI and Anthropic have announced multibillion-dollar data center building sprees. According to one report, total data center construction spending is expected to exceed $52 billion in 2025. These investments will lead to a lot of state-of-the-art buildings. But first, they’ll require even more traditional infrastructure. And with construction material costs rising 40% over the past five years, all that infrastructure is part of the reason so much money is being spent to build these data centers.

“Think about the water, energy, and communication systems required to operate them—it’s a huge logistical challenge and demands a significant amount of expertise,” says Creech.

What it takes to build a data center

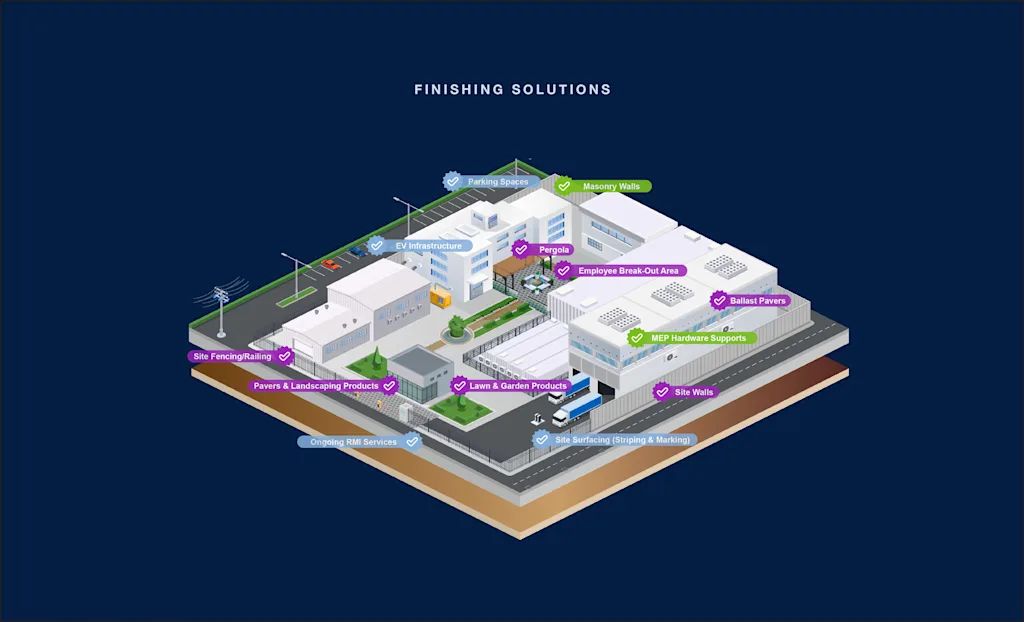

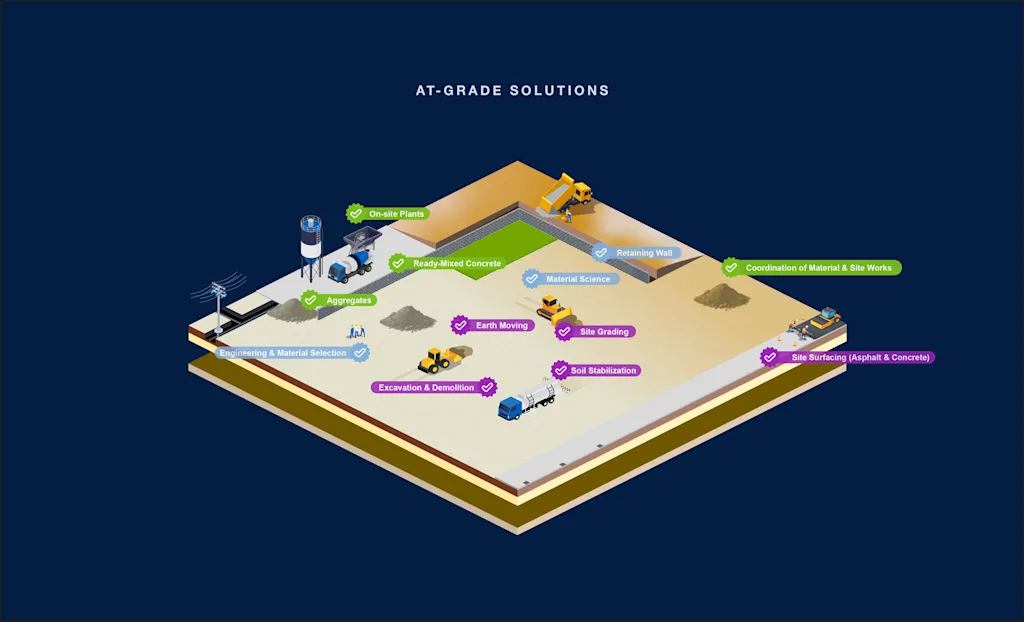

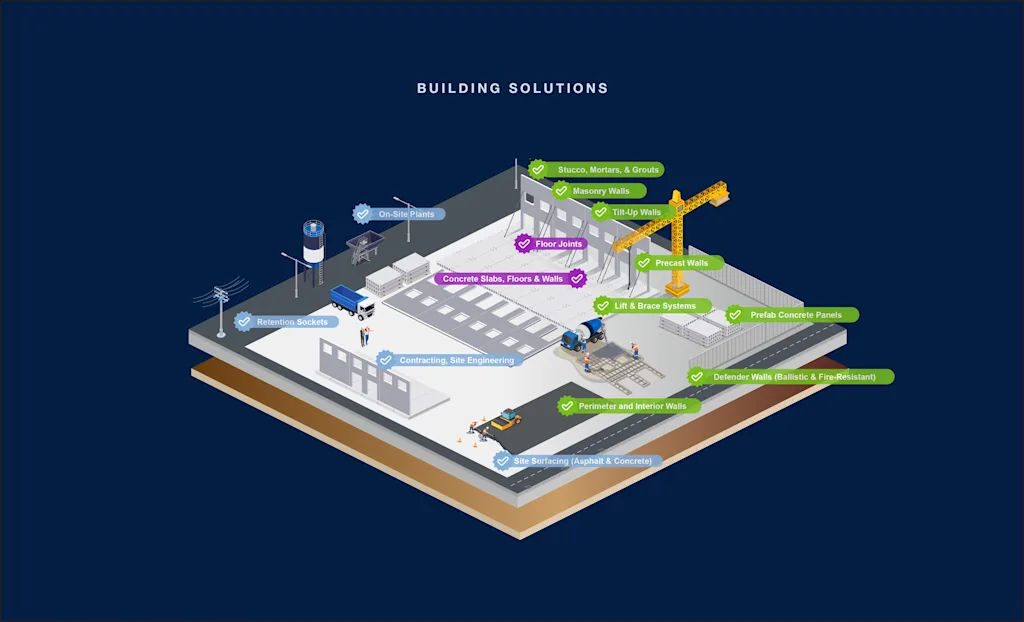

Once a big tech company has identified the site for a new data center—a process that requires its own complex calculus to balance spatial demands, electricity generation capacity, and access to water—a significant amount of concrete and asphalt has to be laid down.

The estimated size of data centers varies from 20,000 square feet to 100,000 square feet, but CRH notes that average data center building typically requires 150,000 tons of aggregates, or enough to build a four-mile long lane of interstate highway. This is used to lay the concrete foundation for the building, as well as subsurface structures like water retention cisterns and retaining walls. Most of this material is mined and supplied locally. Roads have to be built to access these sites both during construction and operation, requiring even more raw materials.

CRH operates more than 2,000 manufacturing plants and quarries across the U.S., and Creech estimates that 85% of U.S. data centers sit within 30 miles of one of these facilities. For those projects that aren’t located near an existing facility, CRH builds them.

“You hear about the main investments, but what you never hear about are the investments that we’re making in greenfields and building out new mines and making sure that there’s asphalt plants and concrete plants and pipe plants and paver plants that are in the area,” Creech says. “Because our products, you can’t ship them very far.”

Speed has become a priority for many of these projects. Earlier this year Meta revealed that it was accelerating the startup time for new data centers by building them with hurricane-proof tents. A spokesperson told Fast Company at the time that tents are currently being set up as part of at least one of the multi-gigawatt data centers the company is building, located in New Albany, Ohio.

Creech says this time pressure has also changed the way CRH approaches these big projects. Typically site works and utility infrastructure can take between three and six months to build, but he says there have been cases where CRH has sped up the delivery timeline of the baseline concrete pad infrastructure to just four weeks.

The race to stand up AI data centers has some analysts concerned about overbuilding, cautioning that dynamics in data center technology and future demands may put some of the infrastructure being built at risk of becoming obsolete or even unnecessary. Some have even called this an “infrastructure bubble.”

In the near term, none of these concerns seem to be stopping the building boom that’s now underway. And as it continues to progress, it’s going to require a whole lot of concrete.