- | 9:00 am

What’s driving the booming used EV market in the UAE?

With growing inventory, better pricing, and rising consumer trust, the used electric vehicle market offers buyers more choices than ever.

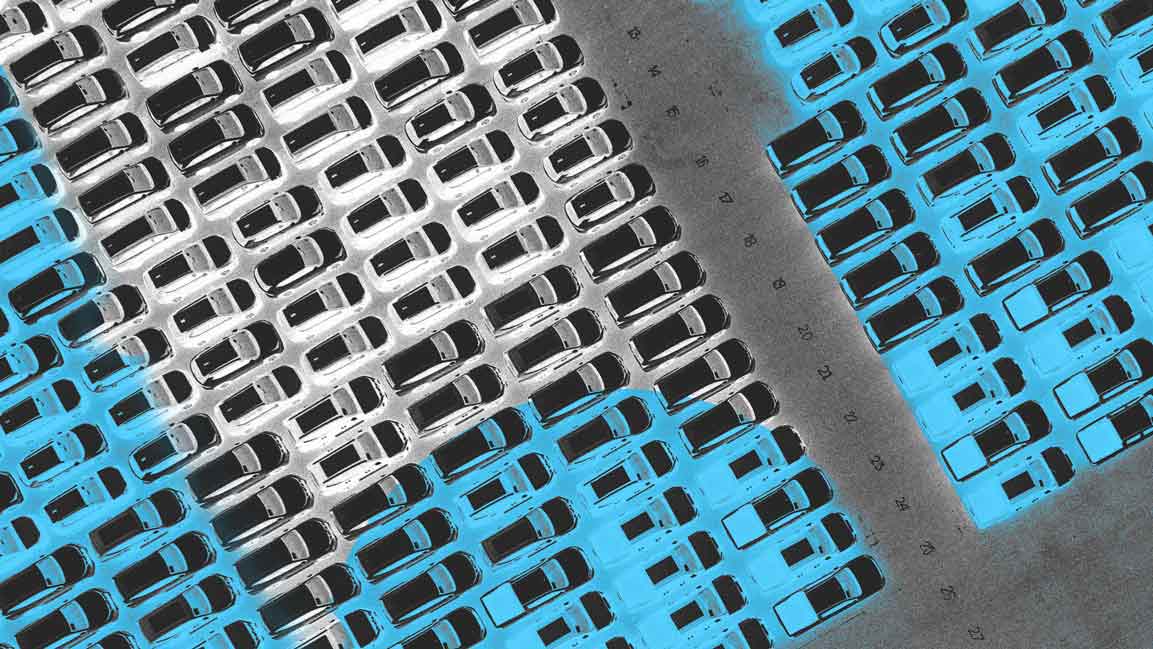

Once a niche market, electric vehicles (EVs) are now becoming increasingly accessible, not just through shiny new models, but via the growing second-hand market. In the UAE, more drivers are turning to pre-owned EVs as a cost-effective, sustainable alternative.

Lower prices, expanding charging infrastructure, and government incentives make pre-owned EVs a compelling choice, and the resale market is beginning to reflect that shift.

What’s driving the recent surge in second-hand EV sales?

“A combination of increased supply, rising consumer confidence, and improved affordability is reshaping the second-hand EV landscape,” says Christopher Milbourne, Social Media & Content Manager at dubizzle.

“As the market matures, the availability of used EVs has expanded significantly, offering buyers a broader selection across various price points.” He adds that introducing more electric models by manufacturers has “added further diversity to the second-hand inventory, making it easier for consumers to find vehicles that suit their needs.”

According to Milbourne, trust in EVs is growing due to “enhanced charging infrastructure, improved understanding of EV technology, and the appeal of lower running costs.”

“These market dynamics are reflected on dubizzle Cars, where we’ve seen a steady rise in searches and listings for pre-owned EVs.”

Sebastian Fuchs, Managing Director of AutoData Middle East, agrees that the surge in second-hand EV sales is driven by consumer confidence and increased availability.

“The electric vehicle market is expanding rapidly, with a wider range of models from entry-level to luxury, making EVs a more common sight on UAE roads,” says Fuchs. He notes that the growing presence of reliable and accessible charging infrastructure reinforces consumer confidence, “removing one of the biggest barriers to adoption.”

Surely, this momentum is beginning to benefit the used car market. “Many of the first-generation premium EVs are now re-entering the market, and due to natural depreciation, they are being offered at significantly reduced prices,” Fuchs says. “This presents an attractive opportunity for cost-conscious buyers to experience electric mobility without the premium price tag.”

RESALE VALUE AND BUYER DECISIONS

As the second-hand EV market gains traction, buyers face new considerations that differ from traditional petrol-powered vehicles. From battery health and warranty coverage to charging compatibility and software updates, understanding what to look for can help ensure a smarter, more confident purchase.

One of the most important considerations in the used EV market is battery health.

“Buyers are paying close attention to the remaining range, battery servicing history, and warranty coverage. A vehicle with 80–90% of its original battery capacity tends to hold its value well and reassures buyers about long-term performance,” says Milbourne.

While battery health is a key consideration, it’s not yet a major concern for most buyers as almost all OEMs offer strong warranties on EV batteries, Fuchs says.

“This usually only becomes an issue with vehicles 10 years and older.”

Still, as the second-hand EV market grows, experts say new tools for battery health testing and certification solutions will increase buyer confidence and ensure greater transparency.

USED EV MARKET TRENDS

Buyers are no longer limited to just a few models but are exploring a diverse range of options that blend luxury, performance, and affordability. “In the Middle East, the Porsche Taycan stands out as the leader in EV resale performance, with all trim lines retaining between 80% and 82% of their value after three years,” Fuchs says.

Following closely, he adds, is the Lotus Eletre R, a high-performance electric SUV that holds approximately 79% of its value after three years.

Tesla, particularly the Model X, shows solid residual values with a three-year retention rate of 72% to 75%, supported by strong brand recognition and continued demand for tech-driven vehicles.

Echoing these trends, Milbourne points to viewership data from Q1 2025 that reveals Tesla’s continued dominance in the second-hand EV market. “The Model 3 and Model Y generated 442,000 and 194,000 views, respectively, reflecting strong brand recognition, tech-forward features, and sustained resale demand,” he says.

Premium models also captured significant attention. “The Porsche Taycan drew 117,000 views, followed by the Rolls-Royce Spectre at 105,000 and the BMW iX at 101,000, highlighting ongoing interest in luxury EVs known for their design and innovation.”

Beyond these established brands, there’s a rising interest in newer, value-driven models such as Kia EV9, Hyundai Kona, MG Cyberster, the BMW i4, and the BYD e2.

This expanding variety in consumer preferences reflects a maturing second-hand EV market where both prestige and practical, value-driven options attract buyers.

DEBUNKING MYTHS AND MISCONCEPTIONS

While interest in second-hand EVs is growing, many potential buyers hesitate due to concerns about battery lifespan, doubts over maintenance, and resale value.

“We see a lot of practical concerns around battery degradation, charging accessibility, and potential maintenance costs,” Milbourne says, adding that dubizzle Cars ensures every EV listing undergoes a comprehensive inspection, including battery performance, charging systems, and other critical components.

Meanwhile, Fuchs says that range anxiety remains the top concern among second-hand EV buyers, along with questions about the overall environmental impact of EVs.

As inventory grows and public awareness improves, Milbourne adds that the second-hand EV market in the UAE is on track for continued expansion. “From premium models to budget-friendly options, buyers now have more choice—and more importantly, confidence.”