- | 8:30 am

We buy too many clothes. Can fashion’s secondhand boom change that?

Patagonia, ThredUp, and J.Crew are killing it at resale, but it’s still not curbing people’s voracious shopping habit.

For 40 years, J.Crew has been producing classic American garments, from sharp blazers to crisp Oxford shirts to cozy cashmere sweaters. So, if you’re a sustainably minded person with a preppy style, it makes sense for you to buy your J.Crew second-hand.

J.Crew agrees. If you stop by the brand’s Fifth Avenue and Bowery stores, you’ll find a rack of curated vintage J.Crew pieces from the ’80s and ’90s. And you can now shop a “resale” section of J.Crew’s website.

The online site is powered by ThredUp, a company that has helped revolutionize resale and de-stigmatize shopping secondhand. Over the past 14 years, ThredUp has built four enormous warehouses that process the millions of secondhand garments that customers send in daily. It now now has 1.7 million active users. Besides selling through its own website, ThredUp also makes its platform available to other brands, so they can launch their own branded resale sites. Tommy Hilfiger, Cuyana, Gap, Hot Topic, and Abercrombie are among its 40 partners.

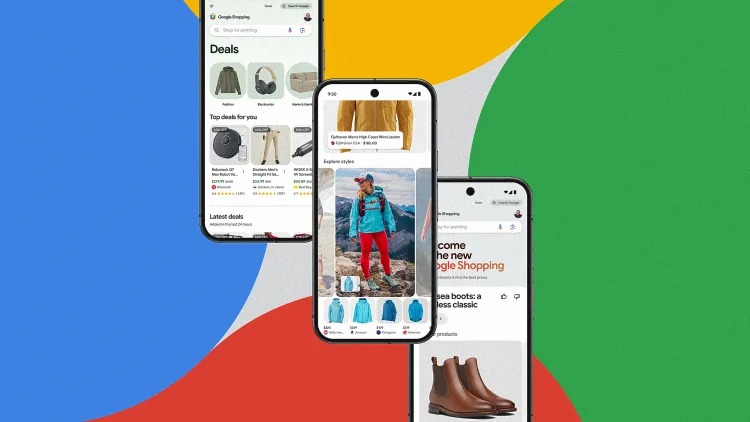

ThredUp is the largest player in the rapidly growing resale market. Many other brands, from Patagonia to Outerknown, have their own resale sites, powered by platforms like Trove and Recurate. And there’s a growing list of resale marketplaces, including Depop, which is beloved by Gen Z; Vestaire Collective, which received investment from the luxury group Kering; and high-end luxury specialist Rebag. By 2026, the industry is expected to double in size to $218 billion.

And yet, for all this interest in resale, the fashion industry’s overproduction hasn’t waned. The $2.5 trillion new clothing sector churns out an estimated 150 billion garments annually, exacting a terrible cost on the planet, including spewing more carbon emissions than international flights and shipping combined. And yet, new clothing sales continue to grow every year, spiking by 21% between 2021 and 2022.

Resale companies argue that buying secondhand is better for the planet because it keeps clothes out of landfills and allows them to circulate in the economy longer. So it’s worth asking why the boom in resale isn’t putting a dent in new clothing sales—and what it will take to decrease the quantity of clothes the fashion industry churns out every year.

A LOGISTICAL FEAT

The fashion industry has spent a century creating a linear system in which it manufactures clothes and delivers them to consumers. But collecting clothes back from customers and then reselling them is an entirely different endeavor, one that brands are not equipped to manage. “Brands are really good at creating what the market needs and delivering it to your doorstep after you’ve ordered it,” says Asha Agrawal, head of corporate development at Patagonia. “But reverse logistics are very different, and our systems aren’t built for them. No brand systems are.”

Reverse logistics are, in fact, a mind-boggling challenge. Brands are set up to efficiently sell and ship hundreds or thousands of the same item, say a blue button up shirt. By contrast, to sell secondhand goods, brands need to process each used item individually because they’ll be getting a hodgepodge of products from previous years. This is something that James Reinhart, founder and CEO of ThredUp, realized when he launched the business in 2009. His first move was to create an engineering team to build moving racks, computer vision, and AI that inspects, prices, and photographs each garment before uploading it to a website for customers to purchase.

Sellers can send in bags of old clothes to ThredUp on consignment. The company will inspect the items for blemishes or signs of wear, ultimately accepting only 63% of goods. (Customers can pay to ship unaccepted clothes back or let ThredUp recycle them.) The seller receives a payout for every item sold, ranging from $2 for inexpensive T-shirts to hundreds of dollars for luxury brands; ThredUp generates revenue from taking a cut from each sale.

It took a lot of investment to build this system. The company received more than $300 million in venture funding in its first 12 years, then went public in 2021. It currently has a market capitalization of $182.46 million. While it is not yet profitable, its 2022 revenue is expected to be between $279 million to $281 million. In other words, it now operates at a very large scale.

But Reinhart believes that, for the resale sector to grow and reduce the quantity of new products on the market, brands need to take an active role in the resale process. That’s why ThredUp has been partnering with brands to offer branded microsites that only feature their own secondhand products. There was a time when brands weren’t keen to engage in resale precisely because they were worried it would impinge on their sale of new goods, but Reinhart says they’re beginning to change their tune.

“We’re still early in the conversation with brands,” he says. “The armor is starting to come off. Brands are shifting from believing this is bad for business to realizing this is part of the future. What keeps bringing them to the table is that all the data and surveys suggest that this is where the customer is headed.” According to ThredUp’s research, collected with GlobalData, between 2017 and 2022, the percentage of consumers who had shopped, or were willing to shop, secondhand went up from 52% to 93%.

MAKE LESS, BUY LESS

Many experts argue that the most sustainable approach to clothing is to keep garments in circulation for as long as possible instead of buying new clothes. “It’s very simple,” says Laura Balmond, fashion lead at the Ellen MacArthur Foundation, which is focused on sustainability. “It takes raw materials and carbon emissions to create a new garment. By wearing something you already own or that is already in circulation in the economy vastly reduces the impact of clothing.”

But this only works if the consumer stops buying as many clothes, and if brands stop making so many new clothes. This is not happening. While resale might be catching on, worldwide clothing production is also going up. Part of the problem is that most brands don’t have a strategy for reducing the amount of clothes they produce while continuing to grow financially. “The goal of the circular economy is to decouple revenue from production,” says Balmond. “But we absolutely haven’t yet cracked it. We haven’t yet achieved the point where we’re using less resources to make more money.”

Right now, most resale platforms don’t generate revenue for brands, including ThredUp and Recurate, which helped launch resale sites for Mara Hoffman, Steve Madden, and Outerknown. Indeed, the brands pay a fee for the reseller to launch and run the program. “We weren’t looking at this partnership from a profitability perspective,” says Liz Hershfield, head of sustainability at J.Crew, who helped launch the resale site. “We’re looking to break even financially. We do this to ensure we’re meeting our sustainability goals.”

Patagonia, however, stands out. It has already managed to transform resale into a revenue generating stream for itself. Seven years ago, the brand partnered with resale platform Trove to launch a little resale shop, where customers could trade used Patagonia goods. But the program has now evolved into a larger scale enterprise called Worn Wear in which Patagonia buys back old goods, refurbishes it, then sells it.

Agrawal, who helped create Worn Wear, says that it was crucial for Patagonia to ensure that its resale platform makes money because this is will allow the company to reduce the amount of new product it produces while still remaining a thriving business. “[Worn Wear is] already a profitable business for us,” says Agrawal, who manages the company’s resale operations. “So now, it’s just about scaling this business proposition, which will allow us to cut back on our net new production.”

Right now, Agrawal says Patagonia isn’t at a place where the revenue from resale can displace the sale of new clothing. That’s partly because there simply isn’t enough secondhand product on the market. Patagonia needs to work hard to entice consumers to both sell their used goods and also buy used instead of new. “The challenge is that resale is inherently a two-sided marketplace,” she says. “We need to incentivize both sides. We’re working on the messaging to help change consumer behavior, by arguing that its a better choice for you to buy used than new.”

But Agrawal says that it is part of Patagonia’s business plan to reduce its production of new goods. Getting to that point could take several years, but the brand is on track to get there. Other brands, however, don’t have a clear path towards reducing their clothing production while remaining profitable. When I ask J.Crew’s Hershfield about whether the brand plans to stop making as many clothes, she says: “The customer needs to take us there.”

THE FUTURE OF RESALE

Reinhart, who has seen the resale industry explode over the last 14 years, believes that it will take time for brands to change their practices. Right now, there is positive change happening at the margins, with consumers buying more secondhand clothing and brands using more recycled fabrics in their collections. “If you take a step back, this is an industry in transition,” he says.

Reducing the production of new clothes would be radical change, one that would go against the capitalist imperative that dictates that companies must sell more products to make more money. For a more realistic timeframe, Reinhart looks to the car industry. “We’re 25 years into the electric car revolution and we’re still making a lot of gas guzzling cars,” Reinhart says. “But those cars are more efficient and every manufacturer is now making hybrids and moving towards electric.”

In other words, change may be frustratingly slow to come. But Balmond, of the Ellen MacArthur Foundation, believes that there is reason to be hopeful given how quickly the industry has already changed. “There used to be a stigma around secondhand clothing,” she says. “There’s been a real shift thanks to great marketing by companies like ThredUp. And resale is just one piece of the overall puzzle, which includes things like recycling and regulation. The unlock is going to happen much more quickly when these things align and come together.”