- | 9:00 am

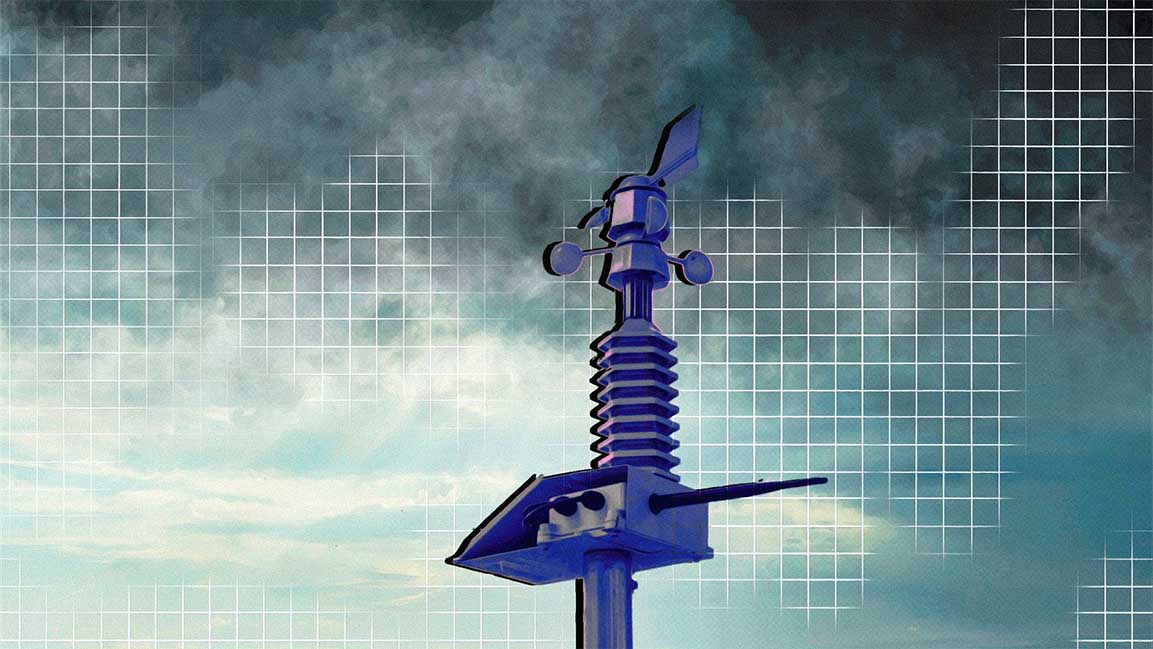

Are companies in the Middle East relying on old climate data to manage risk?

With interconnected risks from climate change, it has become important for businesses to assess how extreme weather events will impact their operations

We’re seeing unprecedented changes in the environment. Three years ago, the pandemic surprised us and shut down the global supply chain. But that could be just the beginning of what could happen because of the convergence of multiple interrelated environmental crises.

To avoid big shocks, especially with extreme rainfall and heatwaves becoming more frequent across most of the Middle East and Africa (MEA), businesses must integrate these risks into the operational, supply chain, and people strategies.

For that, they require up-to-date data and real-time insights to anticipate better and mitigate extreme weather events.

Sadly, every year, businesses lose billions of dollars because they use outdated climate data and reports. Many reports are based on backward-looking data going as far as the 1960s and do not incorporate the effects of global warming into their model, leaving businesses without up-to-date insights and ill-prepared for what lies ahead.

Floods and extreme heat waves can shut down business operations, cut transportation, and impact employees, suppliers, and customers.

DATA IS CRITICAL

Experts say the vast majority haven’t considered environmental data material to value creation other than from a resource exploitation perspective.

“We’re increasingly expecting companies to quantify and price in the externalities of their operations, so this kind of data is becoming critical,” says K D Adamson, futurist and ecocentrist.

“Unfortunately, virtually no one has established data supply chains to provide it, which leaves them significantly exposed. Whether we’re talking about liability risk, transition risk, or physical risk, we urgently need better volume, variety, and veracity of data, and we need it in real-time rather than retrospectively,” she adds.

According to the ESG data conundrum study conducted by the IBM Institute for Business Value in the Middle East and Africa (MEA) region, only 36% have made progress towards their sustainability goals, with 67% needing help managing an overload of manual data.

This lag in indicators can be highly risky for businesses as it hinders their ability to make informed decisions and take proactive measures to achieve their sustainability goals.

“Without accurate data, businesses may fail to identify emerging risks, resulting in potential reputational damage, regulatory non-compliance, or missed opportunities for sustainable innovation,” says Hande Akdede Erbay, Sustainability Software Market Leader, MEA and Turkey at IBM.

While tech giants like IBM help companies infuse AI into their core business functions, enabling them to make data-driven decisions and align their strategies with climate realities, many big and small businesses rely on reports that must catch up with the change occurring.

If not, that could lead to big failures.

RISK MANAGEMENT STRATEGIES

Today’s mainstream environmental information is simply not actionable. It takes too long to generate reports on the impacts of environmental change. For example, a 100-year flood event means that based on past statistical data, there is a 1 in 100 chance that such an event will happen in a given year. Yet, the region had a few 100-year flood events in 2022-23.

Events like these show that probability statistics for hazardous events must be updated, which means risk management strategies that rely on these statistics must be better informed.

“By proactively considering climate-related factors in strategic planning, companies can better anticipate and mitigate risks such as extreme weather events, supply chain disruptions, and regulatory changes,” says Erbay.

“Additionally, identifying opportunities related to clean technologies, energy efficiency, and sustainable products or services can drive innovation, enhance competitiveness, and unlock new revenue streams.”

Adamson says it’s helpful to contextualize climate-related risks as part of wider ESG considerations because although all companies have obligations, they have to understand, evaluate and prioritize them regarding their materiality to their stakeholders.

“Too many people see ESG as an inconvenient piece of decarbonization reporting, but in reality, it is central to creating targeted strategies for new value creation. ESG is a window to the future and, if approached correctly, can be a catalyst for dynamic, customer-centric value creation and enterprise risk mitigation that can be a game-changer for business.”

INSIGHTS MUST BE SHARED WIDELY

According to experts, businesses need to get good data and analyses of their exposure and vulnerabilities to environmental risks, which then should be integrated into risk management and business strategies. To address the risks, these data and insights must be shared widely within the company – CEOs, risk management directors, chief sustainability officers, and supply chain managers.

With more companies outsourcing production and expanding operations—manufacturing plants or call centers— it makes sense to ascertain if the areas are predicted to suffer heat waves, floods, and water shortages.

Erbay says businesses are increasingly considering climate factors to avoid locating in areas predicted to suffer from climate-related risks. “By considering climate projections and environmental data, companies can make informed decisions about the suitability and long-term viability of specific locations.”

While pointing out that while these are increasingly becoming considerations, Adamson says, “When it comes to expanding or relocating facilities, businesses also have responsibilities to stakeholders in the local communities in which they currently operate – if an area is likely to be impacted by climate change then a major local business pulling back would remove local jobs and livelihoods and exacerbate the problem.”

With complex and interconnected risks from climate change – biodiversity loss, water scarcity, and food insecurity – it has become more and more important for businesses to assess how extreme weather events will impact their operations, get their up-to-date climate and environmental risk data as well as the expertise required to apply it to prepare for what’s to come and plan for unforeseen disruptions.

And companies that act now can be more competitive and resilient in the long run.

“Companies tend to suddenly realize how important up-to-date climate data is when it impacts their value chain. Many insurers refuse to cover California because of wildfire risk, causing major problems for business expansion or future viability. Banks and insurers have worked hard on this analysis, and we’re seeing that now translating into real-world decisions about what they will fund and insure and where,” says Adamson.

“At a minimum, businesses need to understand what key stakeholders like these believe the risks are now, but the smart money will then leverage a strong ESG stance to turn that into an understanding of future risk.”