- | 12:00 pm

Are homegrown brands in Gaza giving global soft-drink giants a run for their fizz?

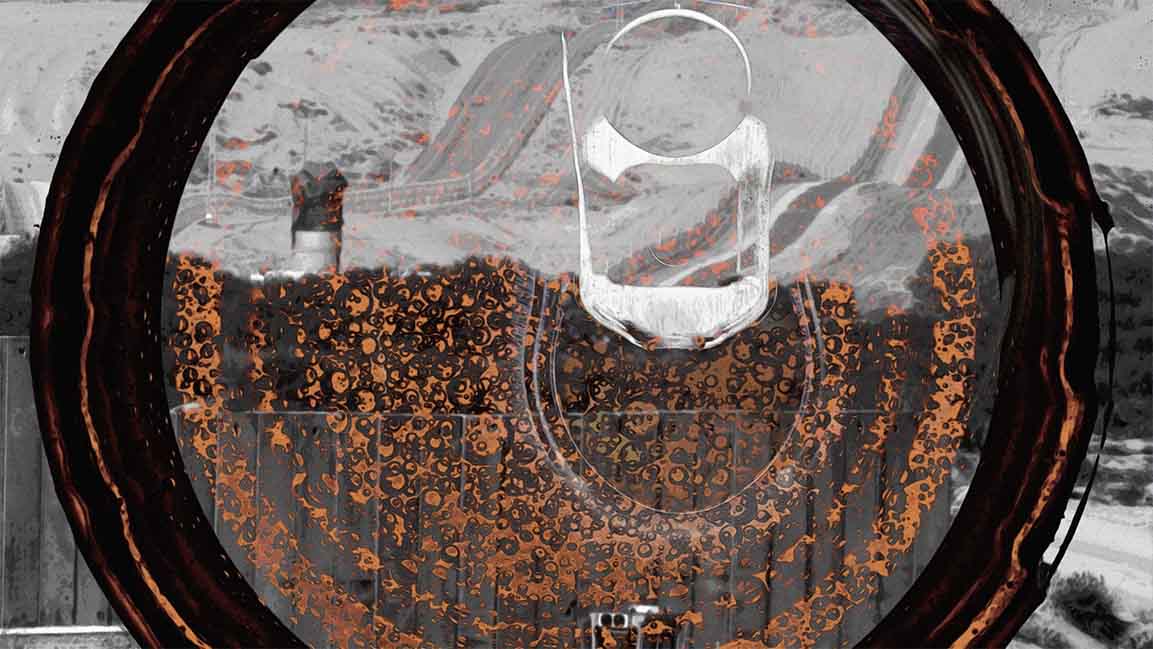

With crippling border restrictions, local brands are meeting soft drinks demands in the Gaza Strip

Stores in Gaza seem to have many local soft drink brands jostling for space with global ones.

Interestingly, these small, local brands are quietly stealing the thunder even as the global soft-drink giants introduced more fruit-based and healthier products to reduce their reliance on sugary sodas.

Local brands like Ventana and Gaza Cola are fast taking control of several pockets in the market.

Recently, a shortage of carbon dioxide caused Gaza drink manufacturers to cut production. Gas is an essential raw material for beverage companies because it adds fizz to carbonated drinks and fills empty bottles, kegs, and tanks without it foaming or suffering taste effects through contact with air.

Easing of the supply of carbon dioxide to the food and drinks industry left many drink makers breathing a sigh of relief.

GROWTH OF LOCAL BRANDS

“The factory needs three tons of gas per day, and about 450 workers work inside it, in four production lines, the number of which will increase if Israel continues to allow the import of CO2,” says Hammam Al Yazegi of the Yazegi Group, a soft-drink maker in Gaza, which started with manufacturing Opera and Gaza Cola drinks in the 50s and gradually acquired the franchises for Pepsi, 7Up, and Mirinda.

Although Pepsi and Coca-Cola have been in Arab markets for decades – Coca-Cola opened a $20 million bottling factory in the Gaza Strip in 2016 – local soft drink makers like the Yazegi Group are experiencing noteworthy growth.

Akram Al-Faluji, the owner of the soft drink brand Al-Faluji says there’s increasing demand for soft drinks. “Since imports are unreliable due to delay, costs, and border issues, homegrown drinks are in great demand. We are doubling production this summer to meet the market demand.”

He is hiring more workers to fill and sort bottles and distribute them.

The Gaza Strip annually imports 13,000 tons of soft drinks from several countries, most notably Turkey, China, Jordan, Saudi Arabia, and the UAE.

With Gazans facing high inflation and financial hardship, the popular local soft drink brand Ventana has a competitive pricing strategy while not compromising on quality, which allows them to remain profitable at a low price.

“High demand for our products makes us think about developing new products. We are also planning to export and scale manufacturing capabilities – from 5000 bottles a day to 50,000 thousand,” says Musa Al-Zabot, director of Al-Madina Company that produces Ventana.

“Success starts from the local market, encouraging us to expand to juices. We started that last year and are keeping the wheel of production going.”

CONSUMPTION OF SOFT DRINKS

Consumption of local and imported soft drinks is estimated at 110,000 tons annually in the Gaza Strip, which has about five soft drinks makers – one closed after it was bombed in 2014, and two have limited production capacity.

Hani Al-Barawi, head of the Food Industries Department at the Ministry of National Economy, said, in a recent interview, there’s intense competition among the local brands to sell quality products cheaper.

Industry experts attribute the rising popularity of local brands to their deep penetration into the hinterland plus their low pricing due to low marketing spending as they deal directly with retailers.

However, these small, local brands face challenges. Some have said there’s a decline in their share in the local market due to their inability to update the distribution fleet, electricity crisis, and the competition with businesses importing soft drinks.

Another worry for the few soft drink makers and other Gaza merchants is the deadly conflict, as the territory is often slapped with an economic blockade.

While the Ministry of Economy, Al-Barawi said, aims to move the economy’s wheel, which was stopped by the Israeli blockade, these homegrown businesses have been playing a vital role in generating employment – the unemployment rate in the coastal territory is over 40%, with close to two-thirds of young people out of work.

“We don’t have the wherewithals for large production. But we have enough to meet the local demand,” says Al-Faluji.