- | 2:30 pm

What’s the future of payments? It’s a balancing act between convenience and security

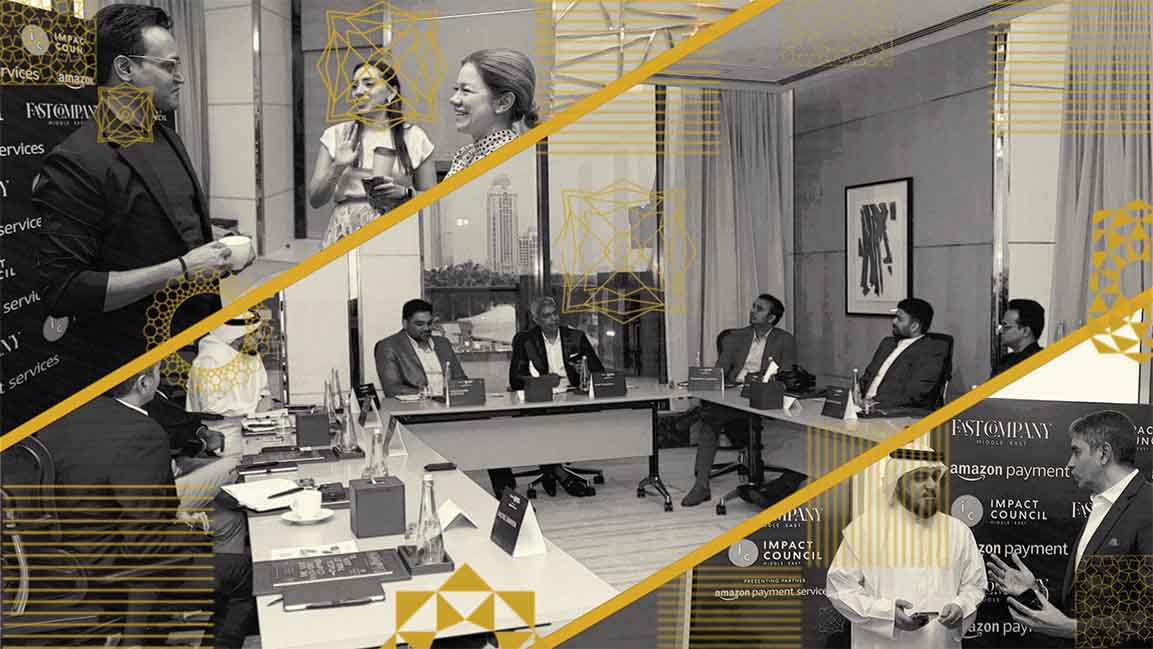

Top leaders discussed the paradigm shift in the financial payment industry at the Impact Council sub-committee meeting

As technology advances at an unprecedented scale, innovations are shaping the payments industry while encouraging regulators, innovators, and providers to focus on speed, convenience, and data security.

And as the industry evolves with disruptive business models being brought about by innovative technology, supportive regulation, and customer demand, the Fast Company Impact Council—an invitation-only collective of innovative leaders -– deliberated current challenges and emerging trends that will shape the payments landscape in the next decade.

Led by Ravi Raman, Publisher of Fast Company Middle East, the Future of Payments sub-committee, in collaboration with Amazon Payment Services, had industry leaders shedding light on the path ahead, including risk management, fraud prevention, the seismic shift in the space, which is evident from the rising digital payments in the Middle East.

The experts agreed that as payment technologies are poised for growth and transformation in the region, consumers expect more frictionless, personalized experiences.

CUSTOMER CENTRICITY AND SAFETY

“The future of payments is defined by customers in the driver’s seat, reflecting Amazon’s customer-obsessed philosophy,” said Mohamed Imtiyaz, Head of Business Development at Amazon Payment Services.

The emergence of tech-savvy consumers has led to a paradigm shift in expectations, emphasizing the importance of simplicity, convenience, and value. Meanwhile, diverse innovators, extending beyond the boundaries of the financial services sector, are disrupting traditional norms and introducing groundbreaking business models. These developments are poised to challenge the long-standing debit and credit card economics upheld by legacy banking.

The retail industry’s future of payments will be customer-centric, incorporating new wallets, payment methods, and fraud detection activities, noted Alfred James, Deputy General Manager of eCommerce at LuLu Group International.

Highlighting the importance of speed, accuracy, and security in the payments industry, Praveen Vijayan, Deputy Vice President – Digital Sales, eCommerce, and Marketing at Gargash Insurance, said, “Every player has a crucial role to play, and collaboration will benefit us in the long run.”

STRIKING THE RIGHT BALANCE

“As we progress, the boundaries between the physical and virtual realms are becoming increasingly blurred, making it crucial for merchants to build an outstanding customer experience across all channels,” said Imtiyaz.

The key challenge shaping future growth, added Gomes, will be effectively catering to the ever-evolving demands of Gen-Z and new-age customers who seek seamless and secure payments as this demographic moves into the workforce and their spending power increases.

The role of merchants in driving the payment ecosystem’s future is also crucial. “The future of the payment ecosystem is driven by two facts, said Sachin Kumar, Head of e-commerce at Al-Futtaim. “The willingness of merchants to accept new technologies and how it affects their profit statements.”

The discussion also shed light on the dynamics of customer-centricity, collaboration, security, and seamless experiences.

Khalid Almqeemi, Director of the Internal Audit & Risk Management Division at the Department of Transport, said by fostering partnerships with innovative players, regulators can leverage their expertise and capabilities to accelerate the advancement of digital transformation in the financial sector.

Balancing a seamless consumer experience with the right payment methods at the right time and place is key. Mohamed Abdul Qadir, Head of e-commerce- Nike at GMG, stressed the significance of leveraging the best technology available to address security and fraud concerns.

EMBRACING FUTURE-FORWARD TECHNOLOGY

By embracing technological advancements and strategic partnerships, businesses can navigate the evolving payments landscape and drive positive change in their respective industries.

Citing an example in the automotive industry, Bhaskar Kumar, Director of Finance at SellAnyCar.com., said one significant challenge revolves around the buying and selling of cars. Typically, when a person sells a car, they expect to receive payment instantly. “Even after the title transfer, we strive to complete the transaction within 48 hours. However, if we can expedite this process to just 24 hours, it would result in a remarkable 50% reduction in turnaround time. Achieving this level of efficiency would undoubtedly be a game-changer for businesses operating in the auto industry.”

Stressing the importance of giving customers a seamless experience without compromising speed and security, Dharmendra Mohanani, GM Operations and Head of Q Commerce at West Zone, said, “Refunds and exchanges for online and offline exchanges are critical, data-driven decisions to acquire customers is equally crucial to augment growth in payment gateways.”

The sub-committee discussion closed with industry experts stressing the greater need for collaboration in light of the convergence of cutting-edge technologies and customer-centric solutions, ushering in a new era of efficiency, accessibility, and financial inclusion.